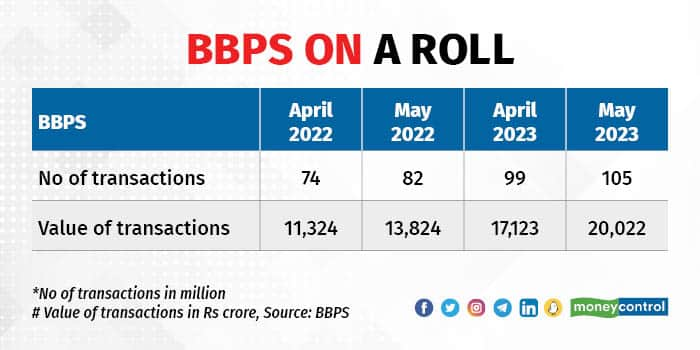

Digital utility bill payments through the National Payments Corporation of India (NPCI)-owned BBPS has grown by 50% over the last year. In May, the bill payment value stood at Rs 20,022 crore, compared to Rs 13,800 crore during the same month of last year.

Launched back in 2016, Bharat Bill Payment System (BBPS) has emerged as the one stop utility and other bill payment option for end-customers and billers alike. On the biller side, banks and payment gateway companies onboard utility payment companies online in the BBPS ecosystem, whereas UPI apps such as PhonePe, Google Pay, Paytm, and Amazon Pay digitalise more customer bill payments.

SurgeFrom around 35 million bill payments in March 2021, this has gone up to 105 million in May this year, with the BBPS platform registering a three-fold growth in two years. Similarly, the bill payment value has grown from Rs 5, 200 crore in March 2021 to Rs 20,000 crore in May this year, close to four-fold growth.

"The humongous growth has been achieved with the help of banks and payment gateways working on digitalising utility companies, and on the consumer end by UPI apps such as PhonePe, Paytm and Google Pay," Noopur Chaturvedi, CEO of BBPS, a wholly owned subsidiary of NPCI, tells Moneycontrol.

The company is also looking to enter the enterprise utility bill payment space this year by partnering with a couple of startups. While enterprise billing constitutes only 12-15% of the total bills paid, in terms of value this is close to 35%. Currently, the enterprise bills are mostly paid through RTGS, NEFT or through standing instructions within bank accounts. Adding these high-value payments to the BBPS platform could see the transaction value doubling in a couple of years.

"The enterprise segment is massive as the current system does not have real time acknowledgement or reconciliation. We need a good product to attract this segment," adds Chaturvedi.

BBPS has two divisions. First is the customer operating units (or Customer BBPOU) established through RBI licences by customer-end apps such as PhonePe and Paytm. On the utility end, banks and payment gateway run biller operating units (or Biller BBPOU).

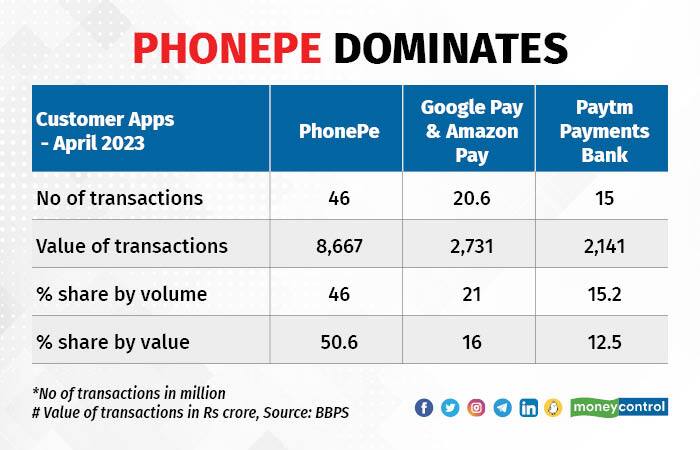

In the customer side, PhonePe leads the charts with around 46% market share by number of bills paid and more than 50% market share in the value of bill payments during April 2023, the month for which the latest data is available on the BBPS website.

Google Pay and Amazon Pay have partnered with BillDesk to run their customer BBPOU and these two players together have a 21% volume market share and 16% value market share.

Paytm Payments Bank was third with a 15% volume and 12.5% value market share during the same month.

"Since becoming an independent subsidiary, we have focussed on innovating and building relationships with partners. We are aggressively growing in the assisted bill payment segment through Spice Money in small towns and rural areas, thereby doing our role in digital inclusion. Adding new categories such as loan repayment and Fastag (highway toll payment recharge) have helped us grow the value faster in the last couple of years," says Chaturvedi, who joined BBPS in August 2021. She had previously worked at payment gateway firm PayU and Airtel Payments Bank.

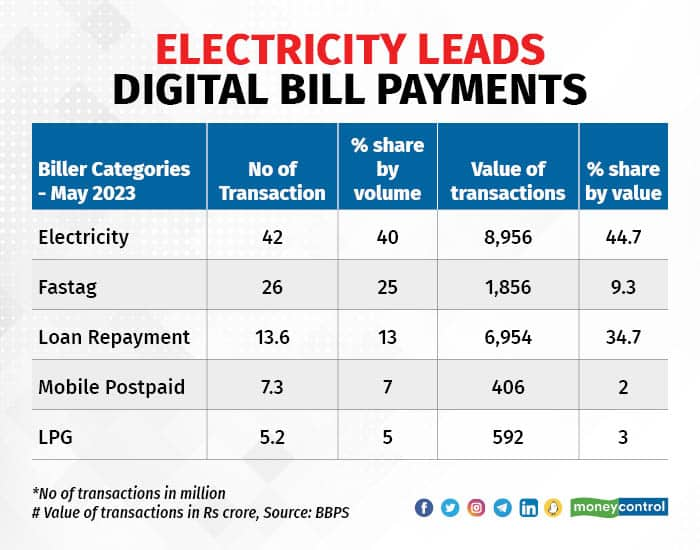

Electric performanceDuring the first few years, electricity bill payments had a big sway over the BBPS platform. However, in the last year, loan repayment, Fastag, and DTH have seen growth rates of 140%, 100%, and 200% growth, respectively. Even in May this year, electricity bill payments contributed to 40% of the volume and 45% of the value market share on BBPS.

"We are looking to add mutual funds and gift funds among other new categories. We are also adding more insurance and loan repayments apart from municipal taxes and school fees payments on the platform," says Chaturvedi.

Before BBPS was established by RBI and NPCI in 2016, only 20% of bill payments were happening digitally. Today, more than 70% of bill payments happen digitally. Earlier, the billers such as banks, payment gateways, and mobile apps such as Paytm, Mobikwik, and Freecharge used to onboard utility billers on their platform. Since BBPS came on the scene, all the billers are moving to the BBPS platform through the operator BBPOU.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.