DeFi, an emerging financial technology that is short for decentralised finance, has lost 45% of its value since the end of April in a development linked to the rapid collapse of the algorithmic stablecoin project Terra and its associated cryptocurrency Luna.

According to the Blockchain Industry Report for May 2022 by DappRadar, an app store for decentralized applications, Bitcoin and Ethereum have lost 25% and 40% of their value since the collapse of Terra.

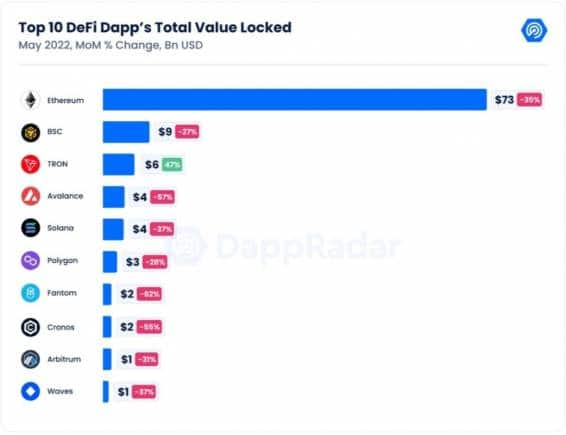

Total value locked (TVL), a metric used to measure the value of assets deposited in DeFi protocols and denote the overall health of the industry, is currently estimated at $117 billion, a fall of 45% since the end of April, the report said.

Yet, DeFi, a technology based on secure distributed ledgers similar to those used by cryptocurrencies and which removes the control banks and institutions have on money, financial products, and financial services, has gained 11% in TVL since May 2021.

Justin Sun's Tron (TRX) was the only blockchain DappRadar tracks to experience growth in May, having increased its TVL by 47%.

The Non-Fungible Token (NFT) market generated $3.7 billion in May, 20% down from April nu value. However, the volumes measured in tokens showed a 6.5% decrease.

NFTs are digital assets that represent real objects like art, music and sports. They are bought and sold online like normal assets, but each is distinguished by a unique code that is recorded on blockchain, a digital ledger. This code helps in tracing back an NFT to its owner.

Overall, the NFT market volume fell 45% to $10 billion, down from $18 billion in April, primarily because blue-chip collections had a tumultuous month.

For instance, the Bored Ape Yacht Club (BAYC), a collection of 10,000 unique NFTs, saw its floor price plunge 38% in May, from 150 Ethereum to 93.

But the loss has been a boon for newer collections like Otherdeeds, land parcels for the BAYC metaverse game, and Goblintown, which has logged $31 million in trading volume since its launch.

According to the report, investments have kept piling up in Blockchain games, with the gaming category resisting the crypto crash with only a 5% fall in activity and 197% growth year-on-year.

In May, Dapper Labs announced a $725 million fund to accelerate growth in the Flow ecosystem along with Andreessen Horowitz’s massive $4.5 billion commitment to its Crypto Fund 4, which will focus on developing blockchain projects.

Overall, blockchain gaming kept adding more adepts with dApps like STEPN or Genopets embedding a gamification element to physical activities in the move-to-earn trend.

Also, Otherside, the play-to-earn BAYC metaverse project, generated $760 million in May, spurring virtual world NFTs to their best month with $850 million.

“The macroeconomic situation and the Terra event have accentuated the effects of the bear season, dragging crypto prices down along with a slight decrease in enthusiasm for the industry. Still, it is a positive signal that user adoption and the number of Web3 developers are rising,” DappRadar states.

“Likewise, it is encouraging to see that the dApp industry has matured into a multi-chain ecosystem able to resist an adverse event of the magnitude of Terra,” it added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.