Corporate bond issuances jumped sharply in November as most companies and banks tapped the market to refinance their high-cost borrowings after rates on these instruments eased, dealers said.

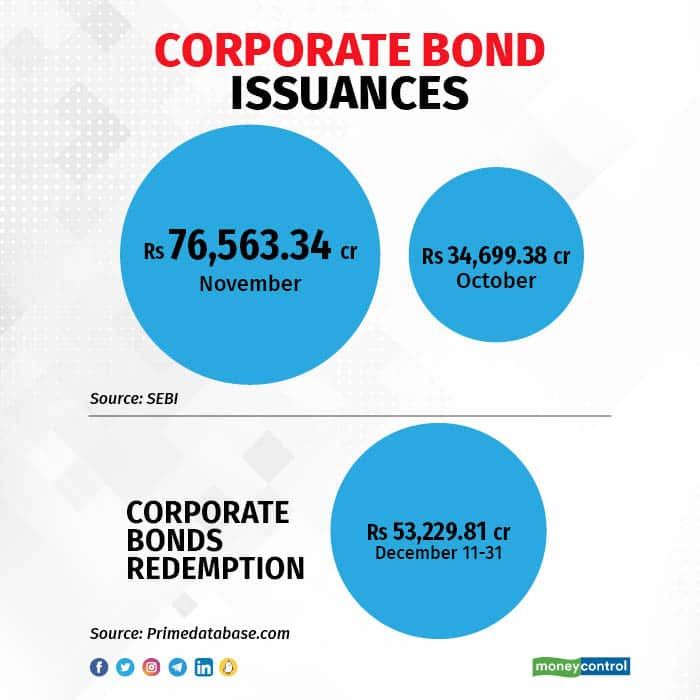

According to Securities and Exchange Board of India (SEBI) data, Indian corporates and lenders raised Rs 76,563.34 crore by placing 140 bonds in November compared to Rs 34,699.38 crore in October. Of these, Rs 26,066.34 crore of bonds were listed only on the National Stock Exchange of India (NSE) and Rs 25,154.15 crore on the BSE.

Mahanagar Telephone Nigam Ltd, Housing Development Finance Corporation (HDFC), Bharti Telecom, Power Finance Corporation and Small Industries Development Bank of India (SIDBI) were among the major issuers in November.

“With term loan pricing increasing consistently with every repo rate hike, issuers preferring to refinance their high-cost foreign currency borrowings with Indian bonds and banks raising tier-2 capital and infra bonds to meet the requirements of credit growth helped bond issuances increase,” said Venkatakrishnan Srinivasan, founder and managing partner at debt advisory firm Rockfort Fincap.

Money market dealers said housing finance companies and state-owned entities were major fundraisers in November. Some non-banking financial companies have also tapped the market to match the pick-up in credit growth.

Rate movement

Yields on the corporate bonds eased sharply in November by 10-22 basis points (bps) across tenures. This was after yields rose sharply after the Reserve Bank of India (RBI) started increasing its key repo rate to tame rising inflation. However, rates on the shorter end of the curve have increased very sharply compared to long-term bonds.

The easing yields trend was due to expectations of lower inflation and a consequent slower pace of rate hikes by central banks globally, and easing Brent crude oil prices, dealers said.

The yield on three-year bonds have eased 10-12 bps, five-year bonds by 15-17 bps and on 10-year bonds by 18-22 basis points. One basis point is one-hundredth of a percentage point.

Currently, yields were trading in the range of 7.40-7.70 percent across tenures.

“With outlook on inflation improving and expectations of a less hawkish stand in policy, yields have moved lower and as we see issuers have been tapping the market with improved appetite from investors,” said Ajay Manglunia, managing director and head of investment group at JM Financial.

With this easing, the spread between corporate bonds maturing in five years and government securities of similar maturity has widened to 33 bps from 26 bps in October. The spread on 10-year bonds has remained largely unchanged because long-tenure corporate bond yields eased in line with government securities’ yields.

The RBI has raised its policy rate by 225 bps since May and currently the repo rate stands at 6.25 percent. Last week, the monetary policy committee (MPC) hiked the key repo rate by 35 bps to 6.25 percent to contain inflation.

The headline retail inflation declined to an 11-month low in November to 5.88 percent from 6.77 percent in the previous month, but core inflation continued to remain high at over 6 percent.

Also read: Core inflation may average 6.2-6.3% in FY23 despite CPI fall in November, say experts

Redemptions

Money market dealers remained divided on their views on redemption and rollovers. Some said as issuances were higher, it meant most companies had rolled over their papers.

According to Prime database, redemptions worth Rs 53,229.81 crore is due between December 11 and December 31.

Srinivasan said that the possibility of issuing long-term bonds is bright considering attractive prices compared to term loans.

Most issuers generally plan their future redemptions either by internal cash accruals or with refinancing of earlier debt either with bonds or loans.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.