We had initiated coverage on Lumax Industries (Lumax), a lighting solutions provider to automobiles, catering to all major segments. The company posted a strong set of numbers for the September quarter. Market leadership, marquee clients in its kitty, its focus on developing technologically advanced products and adoption of LED-based products provide an improved earnings visibility for the company and therefore merits investors’ attention.

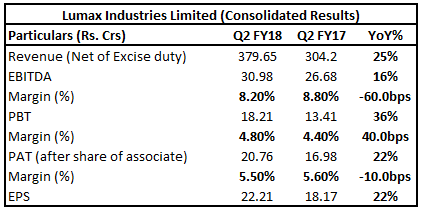

Quarter in a snapshot  The company’s revenues grew 25 percent (YoY), led by a volume growth of 16 percent. More importantly, the product mix was skewed towards expensive LED products. EBITDA margin witnessed a small blip of 60bps on the back of realization of price hike pending from the customers.

The company’s revenues grew 25 percent (YoY), led by a volume growth of 16 percent. More importantly, the product mix was skewed towards expensive LED products. EBITDA margin witnessed a small blip of 60bps on the back of realization of price hike pending from the customers.

Lumax generated most of its revenues from front lighting (69 percent of total) and from passenger vehicle segment (68 percent of total). After the GST hangover, passenger vehicle segment is posting healthy numbers, which is expected to get reflected in the coming quarters’ results.

Strong clientele In terms of percentage of total revenues, Maruti Suzuki is the largest client with 32 percent share followed by Honda Motorcycle and Scooter India (HMSI) and Mahindra and Mahindra with 11 percent share each. The top 5 customers generate around 73 percent of the total revenues.

Ahead of competition Lumax has a strong financial and technical collaboration with Stanley Electric Company (Stanley), Japan, which is a world leader in vehicle lighting and illumination products for automobiles. Lumax gets strong cutting-edge technology from its foreign partner that keeps it ahead of competition. Apart from that, the company also has in-house research and development facilities and design studio that helps it in working on innovative products.

Industry tailwinds, unaffected by the move towards EV Auto companies had a bumpy ride in FY17, as demonetization and BS-IV implementation impacted sales. This was followed by GST-led de-stocking, hurting auto companies across the board. Normalcy is returning and stocking has resumed as was evident from the monthly auto sales for the last three months. This augurs well for Lumax, as it the largest player in the auto-lighting space.

Moreover, Lumax is unaffected by the electric vehicle disruption, going forward, as the products it makes are immune to EV adoption.

LED – a game changer The management continues to be very positive on the adoption of LED lamps and indicated that the adoption is faster than they expected. They also indicated that LEDs are high margin products for the company and the wider adoption of LEDs would unlock huge potential both in terms of sales growth and margin expansion.

Moreover, the government’s decision to make ‘automatic headlamp on (AHO)’ mandatory in two-wheelers from 2017 has started to provide an additional kicker to growth. Additionally, BS-VI norms to be implemented by 2020 would require the vehicles to be more energy efficient, which would lead to the adoption of LEDs.

The management also mentioned that they are aggressively focusing on LED products and they had around 25 percent of revenues coming from LEDs in the September quarter, up from 5 percent at the end of FY17. The management believes the share of LED-based products can be raised to 40-50 percent of total revenues by 2020.

New facility commissioned – to meet additional demand Lumax has commissioned a new facility in Sanand, Gujarat, with a capacity of 300,000 lamps annually. This facility would supply primarily to Maruti and Tata Motors in the passenger vehicle segment and Honda and Hero in the two-wheeler segment. The peak revenue from this facility is expected to be Rs 275-300 crore. The management believes that they can get 100 percent utilization from this facility by FY20.

Valuation The share price has risen over 28 percent since our initiation which has put the valuations on the higher side. The company is trading at valuations of 22.2 and 18.8 times FY18 and FY19 projected earnings. We advise investors to accumulate shares for long-term benefits.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.