For JHS Svendgaard Laboratories, a small Delhi-based FMCG contract manufacturer, FY10 was a breakthrough year.

The company's sales had more than doubled that year to Rs 68.5 crore and most importantly, it had won a huge contract from global FMCG major P&G to manufacture toothbrushes, toothpastes and detergent under its brands Oral B and Tide. It was expecting the deal to start contributing nearly half of its overall revenue.

To meet P&G's demands, JHS Svendgaard went ahead with capital expenditure of over Rs 100 crore in Himachal Pradesh to start making Tide detergent. Much of the capex was financed through debt.

The contract with P&G restricted the company from signing contracts with any of the global powerhouse's competitors.

All this made sense for JHS Svendgaard at the time, as P&G was investing aggressively to take on Colgate Palmolive and HUL in the oral care and detergent segments. Any success that P&G tasted would have percolated down to JHS Svendgaard in the form of more volumes and more revenue.

But that didn't pan out exactly as planned.

Success proved elusive for P&G. With the exception of toothbrushes, neither Oral-B nor Tide made any significant dent in the market share of its rivals. Within a few years of launch, P&G pulled out its toothpaste in 2016.

These failures took a toll on JHS Svendgaard too. The company alleged that due to conditions imposed by P&G and the latter not placing enough orders as promised, it had to keep its plant idle and incur losses.

"The were trying to wriggle out of the contract," Nikhil Nanda, Managing Director at JHS Svendgaard told Moneycontrol.

By 2013-14, the company was in deep trouble. It had already slipped into the red and was now reporting a loss for the third year in a row. Its loss for FY14 had risen to Rs 28 crore.

P&G finally terminated the contract, much before it was due to expire in 2016. Given the fact that Svendgaard was relying heavily on P&G, the loss of contract put the company in an existential crisis, as it defaulted on loans and was unable to pay wages to employees.

In FY16, the company sold the detergent manufacturing facility for Rs 16.25 crore and further settled the litigation with P&G in 2016 for Rs 30 crore as compensation. The proceeds of the sale and the settlement were used to pare its debt.

The compensation helped Nanda to tide over the crisis. But what about the future?

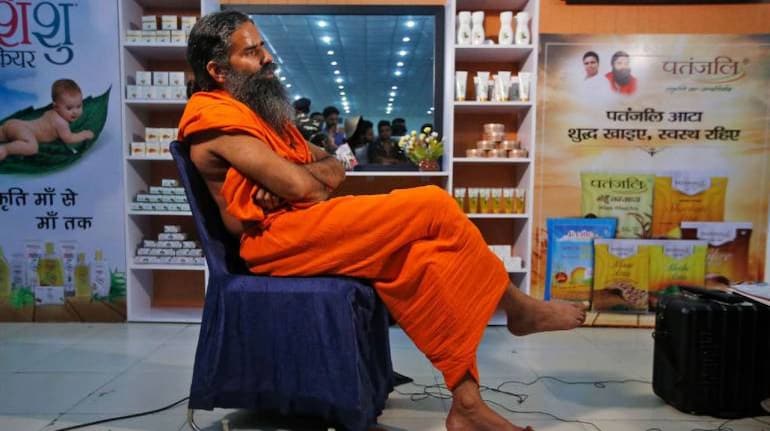

Enter Patanjali's Dant Kanti

As JHS Svendgaard was trying to claw its way back, it got a huge boost in the form of Patanjali's Ayurvedic toothpaste Dant Kanti.

"We were manufacturing tooth brushes for Patanjali, when we told them that we also make tooth paste and have built good capacity, they were excited, as they too were looking for a manufacturing partner for Dant Kanti," Nanda said.

Soon, in 2016, JHS Svendgaard was contracted to manufacture Dant Kanti. The Ayurvedic toothpaste, which is muddy-brown in colour and leaves a tingling taste, has shaken up the Rs 10,000 crore Indian toothpaste market like never before.

Multinational consumer goods companies such as Colgate Palmolive and HUL, which dominated the toothpaste segment earlier, were outsmarted by Yoga guru Baba Ramdev, who brought vigor to the Rs 200 crore Ayurveda and herbal toothpaste market with Dant Kanti by promoting it as a wellness and swadeshi brands and pricing it aggressively.

The Ayurveda and herbal toothpaste sub-segment is now worth Rs 2000 crore, and is growing at 20 percent. Dant Kanti has a share of around 8 percent in the toothpaste market, while Dabur has a share of 10-11 percent, again thanks to Patanjali's Ayurveda push.

Market leader Colgate, which saw its market share dropping from 58 percent to 53 percent over the last two financial years, was forced to venture into the natural toothpaste sub-segment by launching the Vedshakti brand.

Now, around 30 percent of JHS Svendgaard revenue comes from Patanjali. The company is also a major contract manufacturer for Dabur as well. The changes have worked for it. Even as its topline increased from Rs 98 crore in FY16 to Rs 138 crore in FY18, JHS Svendgaard's bottomline to was back in the black. In FY17, it reported a net profit of Rs 21.9 crore, which increased to Rs 28 crore the next year.

Proprietary products

While JHS Svendgaard gets the lion's share of its revenues from contract manufacturing, it is also trying to break into the high-margin branded segment with its own portfolio of proprietary brands of toothpastes and toothbrushes under the brand name Aquawhite.

Even under its own label, the company has narrowed its focus on children's oral care, in which the competition is relatively less.

But Nanda continues to believe that the decade 2020-2030 is going to belong to the contracting business. He expects the contract business to grow 20 percent every year.

"The way MNCs and India companies are thinking now a days , they are going to move out of manufacturing completely and focus on enhancing brand value. So there is huge potential in the years to come," he said.

The company plans to triple its sales by FY21.

JHS Svendgaard is also widening its relationship with Patanjali. It has tied up with Baba Ramdev-promoted company to set up retail stores to exclusively sell the latter's products at various airports across the country.

The company opened its first store in Delhi, and is planning to launch another one at Raipur airport.

"The target is to have 10 stores by end of FY20," Nanda said.

Nanda, who calls Baba Ramdev 'Swamiji', credits Patanjali for aiding the company's turnaround.

He said the opportunity provided by Patanjali would never have come up if Svendgaard had given up on staying in business.

"You are not lost until you give up," he quipped.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.