Sales maximization has been the key force behind earnings growth of Prataap Snacks. Earlier this year, to meet the capacity constraints, company activated contracts for third party manufacturing at Ahmedabad, Bengaluru and Kolkata for producing chips.

Now with the acquisition of Avadh Snacks (13.5 percent of Prataap Snacks sales), company has suddenly ramped up their presence in the snacks industry of Gujarat without additional debt on its balance sheet.

This EPS (earnings per share) accretive deal is positive for the company as it helps in further expanding its product portfolio range, makes it improve its competitive position (4th player in the region) and brings in operational synergy.

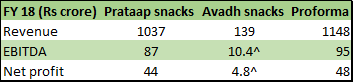

Deal details: Similar margins, strong growth while valuation appears attractivePrataap Snacks is acquiring 80 percent stake in Avadh Snacks for Rs 148 crore valuing it at 1.33x FY18 sales. The acquisition would be funded through internal accruals (Rs 140 crore cash in books). It translates to enterprise value (EV) multiple of 17.8x FY18 EBITDA which is at a discount to EV multiple (26.5x) prevailing for Prataap Snacks before the announcement.

Sales growth of the target company has been phenomenal - increased 42 percent in last fiscal year and grown 5 time in last two years. Margin profile is broadly in the same range as that of parent company – EBITDA margin is at 7.5 percent to 8.5 percent and net profit margin at 3.5 percent to 4.5 percent.

As per Frost and Sullivan, Western India along with North India, constitute more than 60 percent of demand in Indian snacks industry. With this transaction, Prataap snacks own sales exposure to West India increases from 30 percent to more than 40 percent of net sales. However, within West India, Prataap snacks is mainly located in MP, Maharastra and Rajasthan. Sales exposure to Gujarat is to the tune of Rs 25 crore which is minuscule given the market size (~ Rs 2,500 crore) and the dominant presence of regional majors like Balaji Wafers. As per Euromonitor’s market share estimate, and given the high presence in Gujarat, Balaji Wafers sales in Gujarat could be higher than Rs 700 crore.

With this acquisition, Prataap Snacks could clock sales higher than Rs 150 crore to start with and would be placed amongst the first four players in the biggest regional snacks industry of India.

Other than the easy access to the Gujarat market, the deal also brings a few more benefits. Firstly, it expands the product portfolio range, which in case of Avadh Snacks is more localized in nature. Additionally, it adds to the distribution network. While the margin profile of Avadh Snacks is similar, Prataap Snacks expects synergy benefit out of economies of scale, rationalization of operational and distribution cost for the Gujarat region.

Prataap Snacks Q1 FY19: Steady growth for topline impacted by raw material costIn the recent quarterly reporting, Prataap Snacks maintained its sales growth momentum by posting a growth of 19 percent YoY (Year on year) on the back of improved distribution reach and new product launches. Gross margins contracted by 130 bps YoY on account of higher key raw material cost. EBITDA margins were also impacted by higher other expenses and employee cost, partially offset by rationalization of trade margins and change in grammage.

OutlookOver the years, key concerns for the company related to higher logistic cost and limited geographical reach have abated due to decentralized manufacturing through contracts and now with the inorganic growth. Strategic steps like these have helped Prataap snacks to remain ahead of few of its peers like Balaji wafers and DFM Foods which have been struggling to move beyond their regional strength area.

Raw material costs in terms of packaging cost (17 percent of sales), vegetable oil/palm oil (~10 percent of raw material cost) and potatoes remain the key monitorables. Company’s EBITDA margin is expected to remain in the range of 7.5-8.5 percent till the time high margin product launches like Yum Pie and Nachos make significant contribution to sales.

Currently, the stock is trading at 32x FY20e proforma earnings for the consolidated numbers. Valuation remain fair. However, given the volume led earnings growth expectation of 18-20 percent CAGR (FY18-20e), long term investors can consider it for accumulation.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.