Hareesh V Geojit Financial Services

The year 2018 ended with broad losses in commodities and emerging market currencies. The US-China trade spat, sanctions on Iran, and a strong dollar were the major factors driving markets throughout this year.

Since April, US started imposing multi-million dollar worth tariff on several goods being imported from China. China retaliated by levying tariffs on American products that raised concerns of a full-blown trade war between the world’s two leading economies. As a result, there were wide swings in commodity and currency markets.

Reversing previous year’s losses, the US greenback has so far risen more than 10 percent since the country started imposing tariffs on imports. Due to a strong US dollar, many of the emerging market currencies shed intensely. Indian rupee was one of the weakest performing Asian currency during October when it declined to an all-time low of 74.48 versus the dollar.

Though the Indian economy posted a faster growth rate among all other major economies, strong oil prices and weakness in emerging market currencies hit the overall market sentiments.

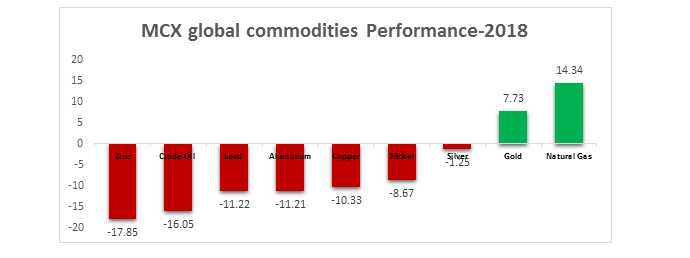

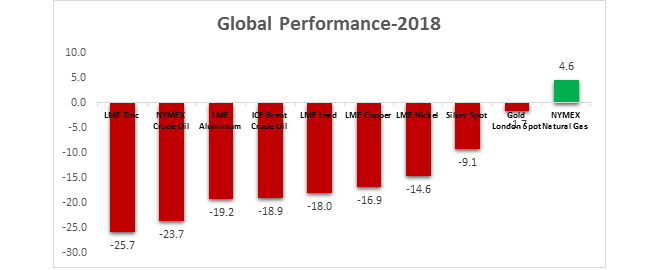

In the global market, gold lost about six percent in the year. A combination of geopolitical concerns like the US-China trade dispute and sanctions on Iran lifted gold’s safe-haven appeal in the initial months. However, a series of rate hike by the US Fed backed by strong labour market and rising inflation took dollar to multi-month highs, which hit non-interest yielding assets like gold.

However, domestic gold prices rallied to a two-year high due to an all-time weak Indian currency. Gold prices in India have been on the upward trajectory since the start of the year and have returned about 7 percent so far this year.

At the same time, silver in the overseas market lost about 14 percent and so far in domestic futures prices, it lost about 5 percent.

Oil prices in the benchmark NMMEX platform closed the year losing more than 20 percent despite testing a four-year high in October. Concerns of supply crunch amid prospect of tough sanctions on Iran and healthy demand from top oil consumers kept oil prices at multi-year highs early this year. However, the overall supply drop in the market has not materialised.

The US unexpectedly gave broad exemptions for importing Iranian oil and record level output from the US supplemented the trend. Now, oil market faces a threat of supply glut amid higher production and forecast of lesser demand, which pushed down prices to one-year low.

In comparison with the overseas market, a decline in Indian prices was limited due to an all-time weak domestic currency.

Meanwhile, wide swings were seen in the natural gas market and now the market seems to have stabilised and has closed the year with a gain about 20 percent.

The US-China trade tensions and reports of weak economic growth in the world’s top base metal consumer China shaped the trend in the base metal market.

During the first half of the year, most of the base metals surged to a multi-year high, but later showed a swift turnaround on reports of rising inventories in warehouses and forecast of feeble global economic growth.

On the LME, zinc and lead posted a decline of more than 20 percent, while copper, nickel and aluminium are so far down 17, 13 and 16 percent respectively. Steel prices too trended lower in the key benchmark Shanghai Futures Exchange.

The author is Head - Commodity Research, Geojit Financial ServicesDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.