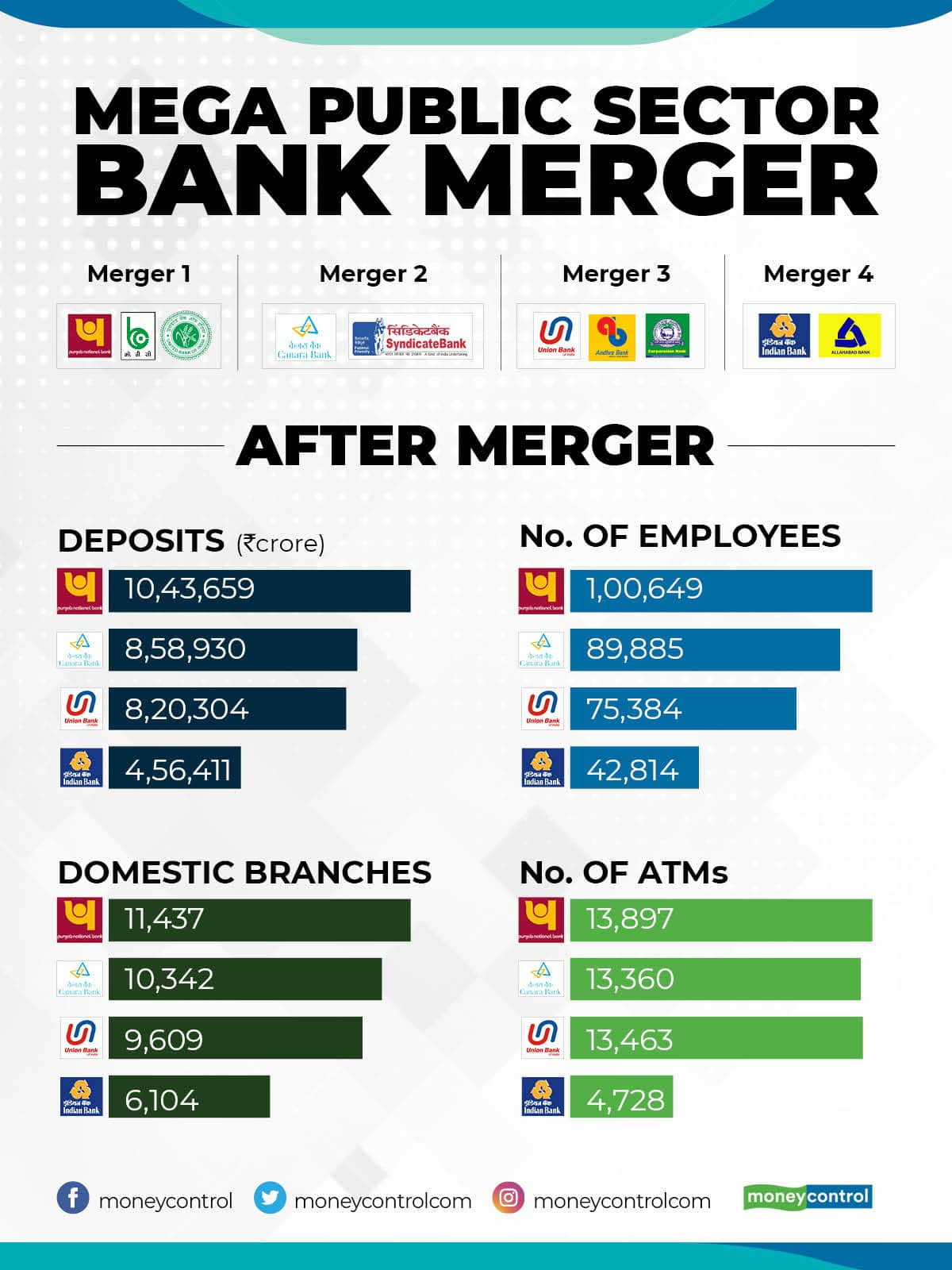

Union Finance Minister Nirmala Sitharaman, on August 30, announced the merger of Canara Bank with Syndicate Bank.

She also announced the merger of United Bank of India and Oriental Bank of Commerce with Punjab National Bank; Andhra Bank and Corporation Bank with Union Bank of India, and the merger of Allahabad Bank with Indian Bank so as to strengthen these public sector banks (PSBs) and help achieve the target of a $5 trillion economy.

After this announcement, the number of public sector banks will be 12, down from 27 in 2017. The government had merged Vijaya Bank and Dena Bank with Bank of Baroda last year.

Here is how the merged Canara Bank-Syndicate Bank will look like:-

1. This bank will become the fourth-largest public sector bank with a business of Rs 15.20 lakh crore, which will be roughly 1.5 times of Canara Bank.

2. It will have the third-largest branch network in India with 10, 342 branches, which will have a strong presence in South India.

3. It will have the potential to reduce huge cost due to network overlaps, a similar culture to enable smooth consolidation and cost-saving and income opportunities for joint ventures and subsidiaries.

4. There will be a quick realisation of gains as both banks operate on the iFlex Core Banking System.

5. The amalgamated bank will have a total business of Rs 1,520,295 crore with gross advances of Rs 6,61,365 crore.

6. The deposits of the bank will be Rs 858,930 crore and the current account saving account (CASA) ratio will be 30.21 percent.

7. The bank will have a Common Equity Tier 1 (CET1) of 8.62 percent and Capital to Risk (Weighted) Assets Ratio (CRAR) of 12.62 percent.

8. The merged bank will have an employee strength of 89,885.

9. The net NPA of the bank will be 5.62 percent after the merger.

10. The government will infuse Rs 6,500 crore through bank recapitalisation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.