The Economic Survey 2023 has said startups are exploring "reverse-flipping", or shifting their domicile back to India, a month after it emerged that such a shift by fintech unicorn PhonePe cost its investors around Rs 8,000 crore.

The survey also suggested measures like simplification of employee stock option (ESOP) taxes, capital gains tax regimes like those of Singapore, UAE and the Netherlands, and capital flow procedures akin to geographies like the US and Singapore to accelerate reverse-flipping.

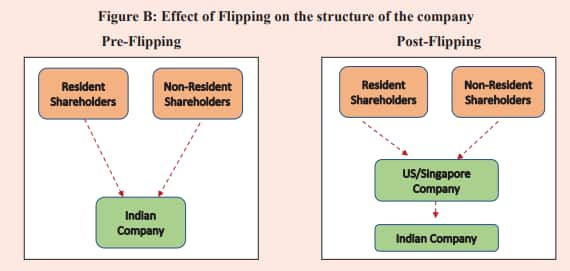

Typically, “flipping” happens at the early stage of the startups, driven by commercial, taxation and personal preferences of founders and investors. Some companies decide to “flip” because the major market of their product is offshore.

Sometimes investor preferences like access to incubators drive the companies to “flip” as they insist on a particular domicile. Some companies prefer to domicile in countries where they are likely to access the capital market later for better valuations and ticket size.

Better protection and enforcement of intellectual property (IP) and tax treatment of licensing revenue from IP, residential status of founders and agile corporate structures have been the reasons for “flipping” in the past, the survey said.

In popular holding company jurisdictions like Singapore, dividends received from a Singaporean company or subsidiary are not taxed at the holding level. There are no withholding taxes when distributing dividends to residents or non-resident shareholders. This is a critical component since the dividend is one of the most popular repatriation tools.

“There are no withholding taxes in the United Arab Emirates (UAE) under current legislation. These jurisdictions have tailor-made their policies and tax and incentive structures to incentivise companies to store IPs and create Holding companies as Regional Headquarters,” the survey said.

European jurisdictions, such as the Netherlands, provide for participation exemptions on dividends and capital gains (based on certain shareholding thresholds, i.e., 5 percent and other tests).

These exemptions are unavailable in India and any migration of existing structures to India triggers capital gains tax.

The Economic Survey said that the number of recognised startups in the country has increased from 452 in 2016 to 84,012 in 2022. About 48 percent of our startups are from tier 2 & 3 cities, a testimony of grassroots’ tremendous potential.

“India ranks amongst the largest startup ecosystems in the world. An impressive 9 lakh+ direct jobs have been created by the DPIIT recognised startups (self-reported), with a notable 64 per cent increase in 2022 over the average number of new jobs created in the last three years,” it said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.