Finance Minister Nirmala Sitharaman, while presenting the Union Budget on February 1, announced an increase in the “standard deduction” to Rs 52,500 a year from the current Rs 50,000.

Standard deduction is a base amount that is not subject to tax, in addition to the basic exemption limit, providing relief to every tax payer. Deduction is different from a rebate, which is kind of a partial refund from tax payable. Income tax deductions are allowed to be claimed from the income, whereas rebate is allowed to be claimed from the tax payable.

Catch all the LIVE updates on Budget 2023

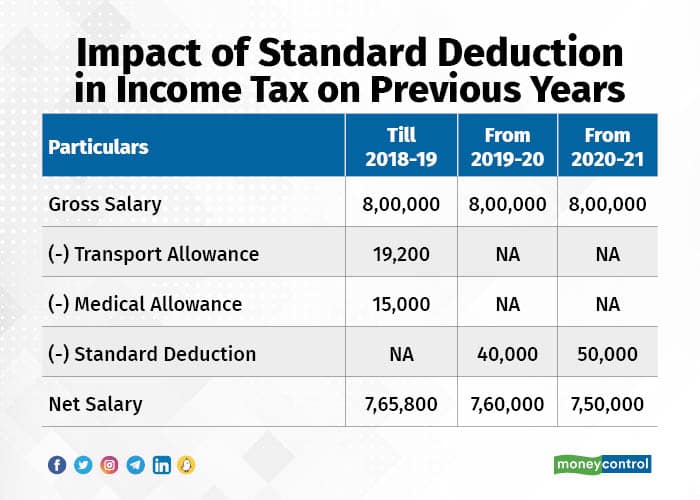

Former finance minister Arun Jaitley had brought back the “standard deduction” of Rs 40,000 in the budget for 2018 to replace the transport allowance of Rs 19,200 and medical expense of Rs 15,000v— thirteen years after it was removed in 2005-06.

The following year, standard deduction was raised to Rs 50,000 a year.

The increase in standard deduction, by Rs 2,500, comes at a time when household expenses have risen sharply due to inflation.

From electricity to medical expenses and more, taxpayers have seen a sharp jump in expenses. This is why taxpayers have demanded an increase in the standard deduction limit.

The overhaul will leave more money in the hands of everybody, from the lowest tax payer to the super-rich, and prompt households to spend more — both on essentials as well as aspirational purchases.

Accelerating household spending, which accounts for more than half of India’s gross domestic product (GDP), is critical to revive the slowdown in the broader economy caused by the COVID-19 pandemic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.