Krishna Karwa Moneycontrol Research

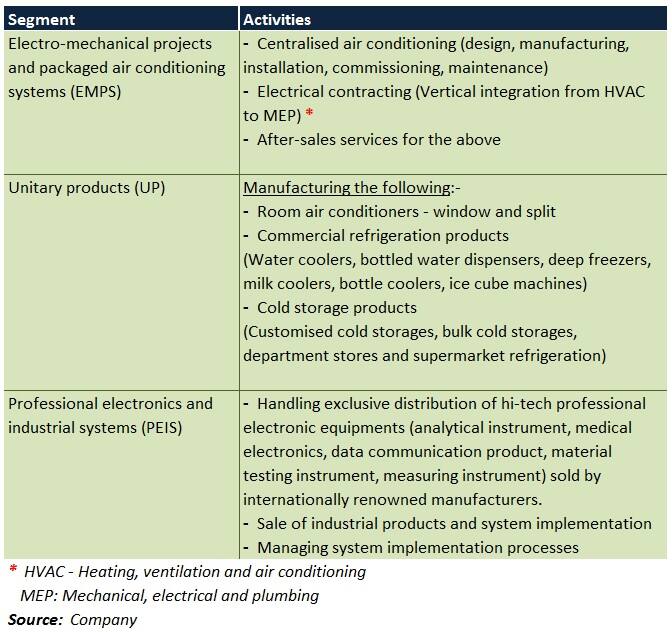

Blue Star is one of the leading players in the heating, ventilation, and air conditioning (HVAC), and room air conditioning (RAC) segments in India. The company's integrated business model, which includes manufacturing, after-sales services and contracts, allows it to offer end-to-end solutions to its customers.

Some of the factors going for the company from an investor’s point of view are traction in the commercial and residential air cooling segments, enhanced brand visibility, product launches, government projects, and client additions.

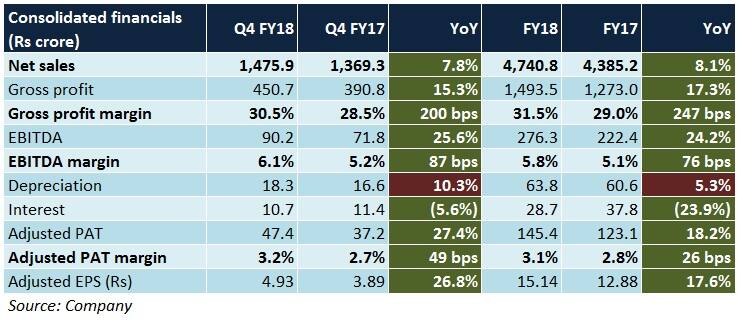

Performance review

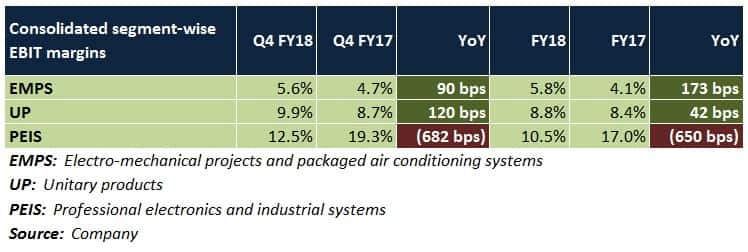

As on 31st March 2018, Blue Star’s carried forward order book, which stood at Rs 2,093.8 crore, was 19.8 percent higher than its order book at the end of March 2017. The company’s ‘EMPS’ and ‘UP’ segments reported healthy sales growth and margins, while the ‘PEIS’ segment’s performance was lacklustre.

Revenue stability in the ‘EMPS’ segment was on the back of orders received from clients across categories like offices, information technology, educational institutions, and automatic transfer switching (power backup through generators). Profitability was driven by higher scale and good margins in certain jobs.

The company’s growth in the commercial air conditioning market during Q4FY18 was largely led by product launches in Q2 and Q3. Retail businesses, industrial units, government enterprises, hotels and hospitals accounted for most of the revenue.

In the ‘UP’ segment, Blue Star managed to offset the pressures stemming from rising commodity prices by revising prices of its own products. However, the room air conditioning sub-segment faced headwinds in the form of unsold inventory (mainly because of a revision in efficiency norms) and a weak summer, particularly in southern and western India.

Residential and light commercial air conditioners were the top-performing products in this segment. During the quarter under review, the company’s largest orders were from tourism-related businesses, international schools, and manufacturers of dairy products. Water storage products and coolers, too, witnessed an uptick in orders from offices.

Within the ‘PEIS’ segment, the industrial systems sub-segment bore the brunt of weak demand and low product realisations. In contrast, revenues from the professional electronics sub-segment grew on account of more orders for data security systems and demand from healthcare businesses.

What lies ahead?

‘EMPS’ segment

Initiatives taken by the government to fund investments in capital-intensive projects such as metros, airports, infrastructure upgrades, and healthcare will provide Blue Star a good opportunity to bolster its existing ‘EMPS’ order book of Rs 1,472 crore.

Growing preference for vendors capable of providing multiple services could augur well for the company. Depreciation of the rupee vis-à-vis the dollar, coupled with reduced volatility in commodity prices, could rub-off positively on the company's export billing and margins.

Blue Star’s commercial air conditioning products and air cooling chillers should witness strong demand over the next couple of quarters. A new subsidiary will be incorporated in UAE to improve competitive position in mid-sized projects and services in the Middle East.

‘UP’ segment

For FY19, Blue Star’s strategy entails foraying into new geographies, deriving a higher chunk of revenue from government-run organisations, and targeting a higher wallet share from modern retail trade. The company will prioritise sales of energy-efficient 5-star air conditioners and inverter air conditioners.

Blue Star’s commercial refrigeration business is seen gathering momentum as well. With varying capacities across a series of product lines at various price points, the company is well-positioned to maintain a strong foothold in the markets it caters to. Some of the products in its commercial refrigeration portfolio are deep freezers, water coolers, and bottled water dispensers.

Blue Star is also scaling up its expansion activities to meet the growing demand for medical refrigeration products, modular cold rooms and water purifiers. In the case of water purifiers, brand building measures and the augmentation of its own network should help the company achieve a 10 percent market share and break even by FY21.

‘PEIS’ segment

Given the potential for growth in professional electronics, Blue Star will explore new business opportunities in the segment by expanding its product portfolio. Data security, in particular, is a promising sub-segment, with prospects in areas such as online payments, enterprise information, and record management at healthcare centres.

The challenges

In the ‘EMPS’ segment, trends pertaining to muted capital expenditure by the private sector and slow growth in real estate are probable headwinds. Markets of the Gulf Cooperation Council (GCC) countries and Africa are still under pressure. The ongoing sanctions on Qatar by the members of the GCC may have an adverse bearing on the Blue Star’s orders and cash flows.

The ‘UP’ segment, despite being a fast-growing one, is likely to face stiff competition in the inverter air conditioners space. Of late, the company’s peers are either maintaining or reducing prices, even though their input costs have gone up.

The industrial systems sub-segment, which comes under the ‘PEIS’ segment, continues to face challenges on account of a subdued private capital expenditure cycle and difficulties associated with finding assignments that are scalable and profitable.

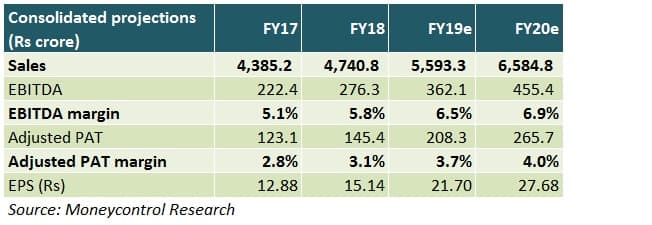

Is Blue Star investment worthy?

At 27.2 times its estimated earnings for FY20, Blue Star doesn't seem to be trading cheap. It has been range-bound for the past 6 months.

However, the stock is down 12 percent from its 52-week high of Rs 845, which it hit at the tail end of the January bull run. So, in our view, the downside risks appear fairly limited, and the stock will likely continue to perform in line with the pace at which its earnings are estimated to grow.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.