Ron Kahn has been thinking about AI since the last bubble burst on Wall Street.

It was 2007, twilight of the subprime era. Trading algorithms failed and a “quant quake” shook markets, presaging the broader financial crisis to come.

Kahn, a Princeton- and Harvard-trained physicist, figured there had to be a better way. It’s taken about 15 years, but he and his colleagues at BlackRock Inc. are now getting somewhere.

Kahn and teammates Jeff Shen and Raffaele Savi are leading a division inside BlackRock that’s increasingly applying machine learning and AI technologies to sort through 1,100 or more market signals and that uses a “thematic robot” to decide which stocks to buy, and which ones to short.

Over the past two years, their 200-person unit, known as systematic investing, has raked in at least $40 billion of new money. Led by Shen and Savi, and with research head Kahn, the team now manages $378 billion. The group launched a new ETF this week that’s focused on liquid alternatives.

While some industry leaders such as Citadel’s Ken Griffin have raised questions about AI’s potential to generate alpha for investment managers so far, BlackRock’s low-key band of computer-loving PhDs has become one of its most vocal Wall Street boosters. A big reason: BlackRock Systematic took in a record amount of revenue in 2024 at nearly $1 billion. This year, it’s on track to pull in a record amount of client money.

Kahn, an intellectual force behind the unit and its longest serving member, says the future of investing belongs to those who can pair savvy money managers with powerful new technologies.

“There are a few humans who have the ability to really see the future,” Kahn said of investors focused on market or company fundamentals.

“There’s always going to be a role for people like that,” Kahn said. “I just don’t think there are very many people like that.”

Harnessing the likes of AI and systematic investing will be crucial going forward.

“This just becomes more and more powerful,” he said.

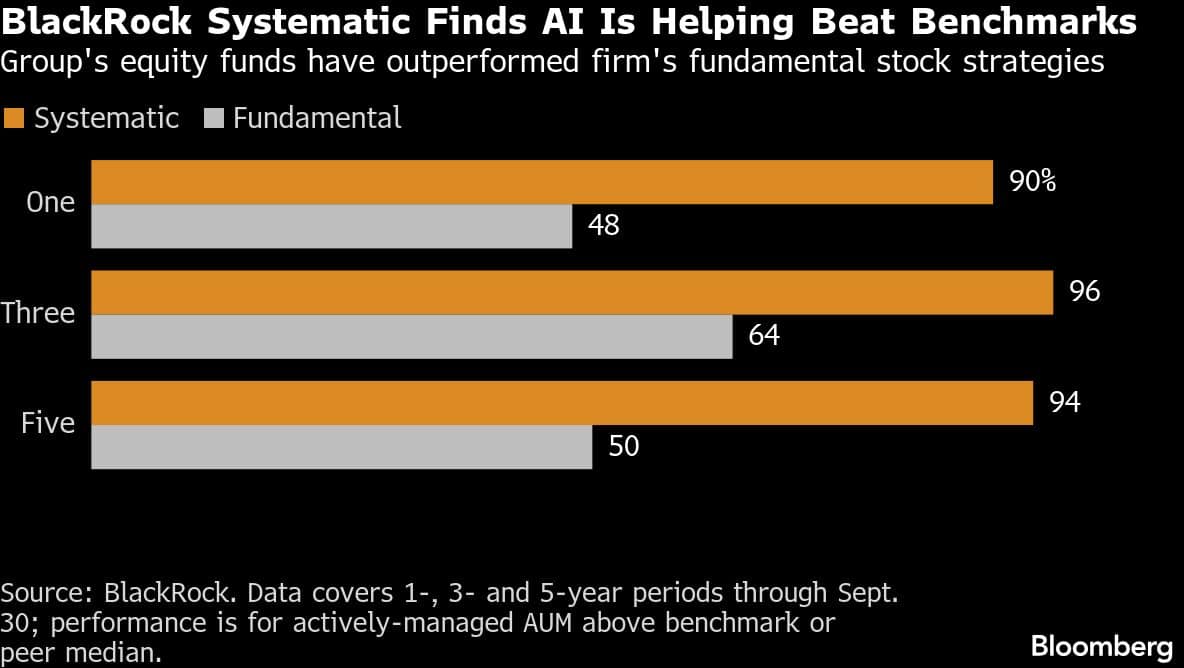

Lately, the BSYS formula has been working. Through September, BSYS equity funds have beaten their internal market benchmarks over a five-year period about 94% of the time. BlackRock’s conventional stock-pickers have beaten the market only half that time.

One big fan is BlackRock Chief Executive Officer Larry Fink. From his perch atop a world leader in ETFs and index investing that oversees about $13.5 trillion, Fink sees the unit as a model for how actively managed funds run by humans using AI can beat the market.

While BlackRock is one of the largest managers of low-fee index funds, its systematic group is touted by senior executives as part of the firm’s strategy to really transform the firm and pull in higher fees.

As the landscape shifts, BlackRock is shaking up one of its divisions that has historically relied more on human efforts. The so-called fundamental equities unit is also leaning more on AI, using its own proprietary research platform dubbed “Asimov.”

The changes have also entailed a shake-up at the group to rely more on BlackRock’s technology and scale to boost performance. In a memo to employees in November, BlackRock said several portfolio managers in the group, which oversees about $300 billion, are leaving the firm.

BSYS, as the systematic team is known inside BlackRock, goes way back. It was born in the mid-1980s as part of Wells Fargo & Co. and traces its roots to risk-modeling company BARRA. It then became part of Barclays Global Investors, the asset management company Fink bought in 2009.

While BlackRock is based in New York, BSYS has remained anchored in San Francisco, near Silicon Valley. Its influence is growing among BlackRock’s deep-pocketed institutional clients as well as for the firm’s mass-market funds and ETFs, BlackRock executives say.

“We’re really looking at every single step of our process and asking this very simple question like — why wouldn’t we think about AI or generative AI or machine learning in general to make it better and more productive and faster and more scalable,” said Shen, who has a PhD in finance from New York University.

Shen predicts the accuracy of AI models will improve at a “nonlinear” pace. Data, and the computing power to crunch it all, are expanding so rapidly that decision-making will become more consistent, accurate and profitable.

BSYS has trained its large language model with 20 years of financial data. According to BlackRock, the model has forecast stock returns more accurately than Sam Altman’s OpenAI and its popular ChatGPT chatbot.

Which, of course, is the point. If everyone uses the same chatbot, no one has an edge in the market.

“But if I can fine tune it, then I can really use it,” Shen said.

Success hasn’t come overnight. In the 1990s, before BlackRock acquired BGI, BSYS’s predecessors had to contend with comparatively creaky computers.

Then, in the 2000s, the quant quake – presumably caused by many traders using similar algos for similar trades – provided a painful reckoning. It took years for Wall Street quants to recover. Fink’s acquisition of BGI in 2009 transformed BlackRock into an ETF giant.

At the time, the quant group was almost an afterthought. In 2016, the group suffered another setback when it clocked some of its worst returns on record.

“There definitely have been plenty of bumps in the road,” Shen said.

Investing Reach

These days, the group includes 125 people with PhDs or post-grad degrees, including at least one actual rocket scientist who used to work at NASA.

The vibe is faculty-lounge-meets-Wall-Street. A house-built “thematic robot” blends human knowledge and questions with computing power and big data to pick winners and losers in the market. The system keeps a “human in the loop” to train and and fine-tune systems and to analyze the 1,100 potential market signals, according to a presentation to investors.

The group’s roughly $7.5 billion Global Equity Market Neutral fund and $11.5 billion Global Equity High Income fund have regularly beaten their composite indexes over the last decade, according to Bloomberg data. The group runs longstanding equity-market neutral hedge fund, 32 Capital fund, and started one of its biggest revenue generators, the Systematic Total Alpha hedge fund strategy, in 2022.

Referees are assigned to oversee proposals for new trading ideas and the group vets them for use. The group’s investing horizon is typically three or four months. That’s nowhere near as tight as high-frequency traders, whose computers can move in fractions of seconds, but it’s not exactly a buy-and-hold approach either.

The giant BlackRock doesn’t have the Wall Street mystique of quantitative hedge funds like DE Shaw & Co. and Two Sigma Investments. What it does have are its ETF platform and distribution scale, including executives who make big investment decisions for potentially tens of, if not hundreds of, billions of dollars in model portfolios that are followed by financial advisers and their clients across the US.

Those model portfolios are increasingly incorporating systematic strategies, meaning the group has considerably more money now to manage and clients are invested in funds influenced by AI and machine-learning technologies.

The clearest sign of that is the $30-billion US Equity Factor Rotation Active ETF, which is up almost 20% this year and has beat its benchmark. The company’s models have included that ETF known as DYNF, helping to attract $13 billion in new money into the fund this year alone.

Kahn says systems will generally outperform portfolio managers eight or nine years out of 10. Even so, he’s not ready to let the machines take over completely.

“You want the human portfolio managers there to think about what could go wrong or situations where the machine actually just doesn’t have any information,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.