Madhuchanda Dey

Moneycontrol Research

At a time when the competitive advantage appears to be decisively shifting in favour of private banks, with weak competition from PSU Banks as well as NFBCs, Yes Bank could have reaped the benefits if had the capital.

Today, the opportunities in the marketplace are plenty, but Yes Bank has to preserve capital (as its core equity is low) because unless the succession issue is resolved and the lender gets a clean chit from RBI on its FY18 numbers, raising capital will not be possible. So investors should be prepared for slower growth in the quarters ahead.

We would wait for RBI's audit report and for some stability in the senior leadership team before turning positive on the stock, despite it having corrected significantly in recent times.

While business growth was encouraging even in Q2 FY19, there were several pressure points in the numbers that were not typical of earlier quarters.

Investment provision mars the headline numbers

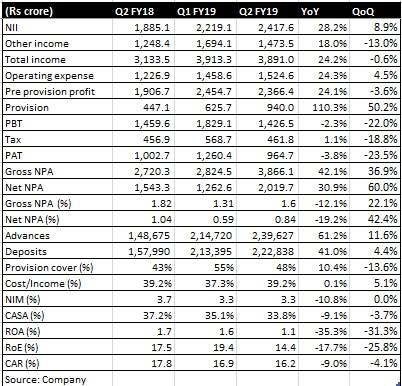

The bank's profit after tax (PAT) fell 3.8 percent on year, although its pre-provisioning profit grew 24 percent. The 28 percent growth in its net interest income (difference between interest income and interest expenses) was primarily due to robust growth in advances, which rose 61 percent, and a 40 basis points moderation in margin to 3.3 percent.

Non-interest income grew 18.0 percent, with fee-based income growing by 38.5 percent.

What marred the headline performance was the 110 percent spike in provisions to Rs 940 crore. Of this, Rs 409.2 crore was to provide for non-performing assets (NPAs) and the bank's provision cover has fallen to 48 percent. But a sizeable Rs 344.9 crore was towards investment provisioning -- Rs 252.2 crore to mark to market its corporate bond holdings, and Rs 92.7 crore for amortisation under RBI dispensation. On this count, it still has to provide Rs 185 crore in the second half of the fiscal.

Business still showing strong traction

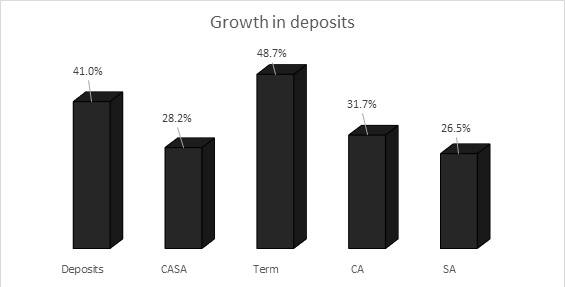

The bank has been aggressive in capturing market share so far. Advances rose 61 percent and deposits 41 percent year on year in September. The bank's advances market share and deposits market share stood at 2.7 percent and 1.9 percent, respectively, at the end of the quarter under review. However, Yes Bank's incremental market share in deposits and advances rose to 7.4 percent and 9.1 percent, respectively.

The bank's asset growth in the quarter was driven by corporate banking as well as retail, with the share of latter now at 14 percent.

CASA disappoints

Source: Company

While the bank's focus has been on garnering more granular deposits, it appears to be facing challenges. While overall deposits grew 41 percent, the low-cost CASA (current and savings accounts) grew 28 percent and consequently, the share of CASA fell sequentially from 35.1 percent to 33.8 percent. This is surprising since the bank offers a differentiated rate on its savings balance compared to peers.

Slippage surprises negatively

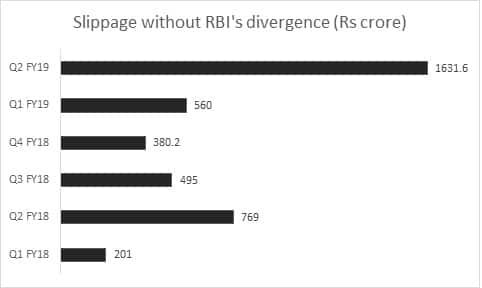

Yes Bank's slippage figure took us by surprise. Of the gross slippage of Rs 1,631.6 crore, the bank expects repayment from an account of Rs 631.2 crore and an upgrade in Q3 FY19 for it.

The bank sold assets worth Rs 445.8 crore to asset reconstruction companies during the reporting quarter. It also disclosed its gross outstanding exposure of Rs 2,620.7 crore to IL&FS' group companies. The entire exposure is still a standard asset in the bank's books as most of it is in asset-rich subsidiaries of the infrastructure lender, the management said. This too warrants close monitoring, going forward.

However, the overall reported stress, at 1.77 percent (including NPA, security receipts and restructured assets) has not shown market deterioration over the previous quarter's level of 1.53 percent.

Source: Company

Yes Bank reported a stable rating profile for its corporate book and the ratio of its risk-weighted assets as a percentage of total assets is also hovering around the same level as the last quarter.

The bank had a credit cost of 18 basis points in Q2 FY19 and 34 basis points for the first half and is sticking to its guidance of 50 basis points for FY19.

However, what could add incremental comfort on the asset quality front for investors is a clean chit from RBI for the FY18 audit.

Capital to constrain growth

While Yes Bank's capital adequacy ratio is at 17.0 percent, its tier-I ratio has fallen to 11.9 percent and its CET-I is at 9.0 percent. The plan to raise capital has to wait till the senior management team stabilises after Rana Kapoor's successor is identified.

While the bank plans to conserve capital in the interim and is open to the idea of selling assets as well, we see the capital constraint standing in the way of the scorching pace of growth that we have witnessed in the past. This, coupled with the overhang of the management change, RBI's audit report and its stance on the concerns it had about extending Rana Kapoor's term, makes us cautious, despite the stock's seemingly attractive current valuation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.