The Monetary Policy Committee avoided the use of “accommodative stance” in its policy document on June 8 and instead emphasised the “withdrawal of accommodation” to tame inflation. The change in stance is good because the MPC’s language is now more in sync with ground realities.

Also, projecting inflation at 6.7 percent in FY23 appears more convincing. There had been a disconnect between what the MPC said about its stance in earlier statements and what it actually did with interest rates. The fact is accelerating inflation has emerged as the single biggest challenge for policy makers, holding well above the central bank’s Parliament-set mandate of 2-6 percent.

There is a view among some economists that the central bank has clearly failed to read inflation’s trajectory. Price increases have been sharper than the MPC’s estimates and what it is doing now is playing catch-up. This time, hiking the key interest rate by 50 basis points (bps) to 4.90 percent itself was not a surprise.

This was simply a continuation of the surprise announcement on May 4, when the Reserve Bank of India increased the policy rate by 40 bps and the cash reserve ratio. We will, in all likelihood, see another 25 bps-35 bps rate hike in August.

One bps is one-hundredth of a percentage point.

The question is what can the RBI do to tame inflation even after these rate hikes?

External factors

The MPC expects its actions to help curb the pace of inflation. Between February and April, headline inflation increased by about 170 bps. The Consumer Price Index headline inflation was 7.8 percent in April, touching or staying above the upper tolerance level of 6 percent the fourth consecutive month.

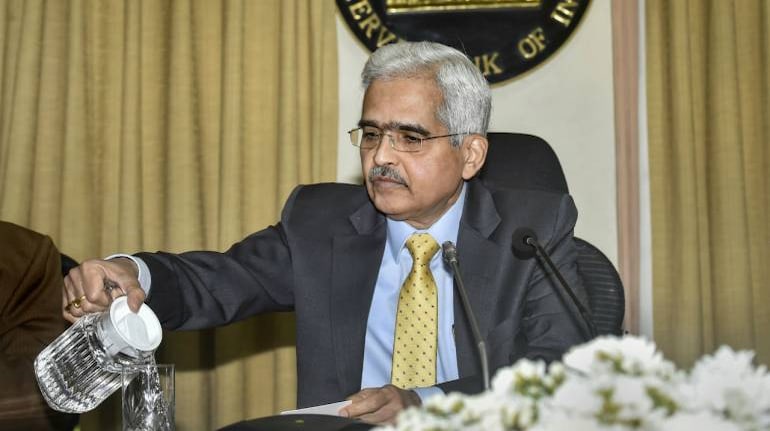

In his speech, RBI governor Shaktikanta Das admitted that inflationary pressures had become more deep-rooted and more entrenched in the economy than what the central bank had expected.

The problem is that a significant part of inflation is also due to external factors that are beyond the control of the central bank such as global commodity shocks, geopolitical tensions, US Federal Reserve decisions, and a depreciating rupee.

Beyond hiking rates to say, pre-pandemic levels or a few bps higher, what else can the central bank do? Rate hikes come at a cost because they can act against the nascent growth recovery. Demand for credit and goods can stall if borrowing costs keep rising.

Also, the RBI clearly cannot tighten liquidity beyond a point because surplus liquidity in the banking system declined sharply after the last round of action, with net excess liquidity parked under the liquidity adjustment facility window now about Rs 3 lakh crore. The central bank may not want to tighten liquidity further at this point.

It's fairly certain that there is a big dilemma for Das and his team. Inflation exceeding the mandate can put the panel in an embarrassing situation. It will have to publicly admit failure if inflation averages above 6 percent for three quarters.

Most economists now agree that the central bank clearly failed to act early against the menace of rising prices.

The worrying question is whether the central bank and the MPC have already lost the inflation battle and whether the tools in their kitty are enough to fight a mighty enemy. Only time will tell.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.