On February 7, 2022, the Central Bureau of Investigation filed a first information report against ABG Shipyard, the flagship firm of the ABG Group, some of its top executives, unknown public servants and private persons, accusing them of abuse of official position, criminal conspiracy, cheating, and criminal breach of trust.

The FIR was based on a complaint filed by the State Bank of India, which alleged that the accused people had colluded and committed illegal activities including diversion of money borrowed from banks for purposes other than what was stated.

An investigation is under way. The company currently faces insolvency resolution in the National Company Law Tribunal.

What went wrong for ABG Shipyard?

Trouble for ABG Shipyard started during the economic slowdown that followed the global financial crisis of 2007-08, resulting in the collapse of the shipbuilding business. That led to the loss of orders, an inventory pile-up and finally, financial fraud. A forensic audit revealed that the company flouted rules and diverted money from stated end-uses.

Although banks had extended a helping hand to the failing business by offering to recast loans under the corporate debt restructuring mechanism, the writing was on the wall for ABG Shipyard.

At one time earlier, banks used to queue up to lend to ABG Shipyard. The company’s yards were located at Dahej and Surat in Gujarat, which were the nerve centres of India’s shipping industry.

The Surat yard had an 18,000 dead weight tonnage (DWT) capacity, while Dahej had 120,000 DWT. Over the past six years, ABG Shipyard constructed over 165 vessels including bulk carriers, interceptor boats, pusher tugs and flotilla. Business boomed with orders from Indian and foreign companies.

All that changed during and after the global financial crisis. Soon, the company faced a paucity of working capital and a significant increase in the operating cycle, aggravating its liquidity and financial problems. Adding to its woes was the absence of fresh defence orders in 2015.

All this led to defaults on loan payments. Lenders had restructured the company’s loan account in March 2014, but these efforts failed to revive ABG Shipyard. Loan restructuring typically involves reducing the interest payable on the loan or extending the loan repayment duration.

After the restructuring failed, the account was classified as a non-performing asset in July 2016, with retrospective effect from November 30, 2013.

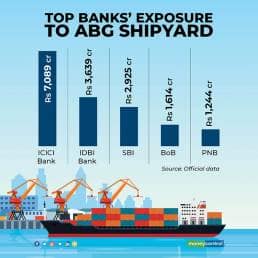

In total, ABG Shipyard owes Rs 22,842 crore to a group of 28 lenders including SBI, ICICI Bank, IDBI Bank, Bank of Baroda, Punjab National Bank, Bank of India, Life Insurance Corporation of India, IFCI and Yes Bank.

Findings of forensic report

A forensic report submitted by Ernst & Young to lenders on January 18, 2019, for the period April 2012 to July 2017 revealed evidence of fund diversion. The company had made pay-outs to related parties including Rs 603 crore to One Ocean Shipping and Rs 812 crore to ABG Engineering and Construction by passing a joint venture entry on March 31, 2016.

The transfer entries indicated that ABG Shipyard had transferred funds to both One Ocean Shipping and ABG Engineering and Construction in previous years.

The audit raised questions about investments through an overseas subsidiary and indicated that properties had been purchased by related parties with funds provided by ABG Shipyard. The assets purchased with these funds were not part of the fixed assets in the books of the company.

Impact on banks

Banks have already classified the account as bad and have made provisions for the ABG Shipyard account, which means any further impact on the balance sheet is unlikely.

“The damage is done and is already factored in. I don’t expect any further shocks from this episode for banks,” said a senior banker who is part of the lender consortium.

Banks are expected to forego about 92 percent of the amount due to them during the resolution process at the National Company Law Tribunal, according to CH Venkatachalam, general secretary of the All India Bank Employees’ Association.

“There will be very little to recover. This also shows how badly banks are hit in this deal,” said Venkatachalam.

How serious are the charges against ABG Shipyard?

The main charges against ABG Shipyard are diversion of bank funds to group companies and the purchase of assets by related parties using bank funds. These charges, if proved, amount to financial fraud and breach of trust.

However, according to bankers, companies diverting money from stated end-use is a common practice and only a few cases get caught when the loans turn bad. A loan becomes an NPA if neither the principal nor interest is paid for a period of 90 days.

SBI has denied allegations that there were attempts to delay the case against ABG Shipyard.

“The lenders’ forum diligently follows through with the CBI in all such cases,” the bank said in a statement on February 13.

A fraud is declared on the basis of the forensic audit report findings that are discussed thoroughly in joint lender meetings. Typically, when a fraud is declared, an initial complaint is filed with the CBI and based on their enquiries, further information is gathered.

In some cases, when substantial additional information is gathered, a second complaint incorporating full and complete details is filed and this forms the basis for the FIR, the bank said.

In the case of ABG Shipyard, the first complaint was filed in November 2019 and the second complaint in December 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.