It is pouring new fund offers (NFO) of target maturity funds (TMF) on mutual fund (MF) street. As many as 10 NFOs are on at the moment, as per data available with Value Research, that would mature as distant as in the year 2033. It appears that the year’s first monetary policy review by the Reserve Bank of India (RBI) on February 8 has not tempted fund houses to hold on for a little longer.

That’s both, good and bad news for investors. The good part is: you are spoilt for choice. The not-so-good news is that with all these funds being passively-managed, all you have to choose is the tenure for which you need to stay invested. Your scheme’s portfolio composition is the next deciding factor.

But the question is: Should you wait for the RBI policy to pass and then perhaps wait for a few more days to see where bond yields are headed?

Can Feb 8 RBI policy make any difference?

As interest rates are nearing their peak, it could be the right time to lock in yields. A Balasubramanian, Managing Director & CEO, Aditya Birla Sun Life AMC, expects a 25-basis- point (bps) rate hike in the upcoming monetary policy review. “As the risks from the external front and inflation have subsided recently, RBI can shift its focus back on “growth”. Beyond rate hikes, liquidity will be used as an active policy tool for 2023, and will be a larger driver of broad interest rate movement incrementally,” he said. A 25-bps increase will push the repo rate to 6.5 percent, which should be the terminal rate for the current rate cycle. “RBI should pause thereafter,” he added.

For the past year or so, TMFs have caught the attention of both, investors and advisors. After Edelweiss Asset Management, India’s 13th largest fund house, launched the Bharat Bond Exchange-Traded Fund (ETF) in December 2019, India’s first TMF, several other fund houses followed with TMFs, albeit with a slight difference. But they do the same thing essentially.

A TMF locks your money at the current yield prevailing in the bond market. The idea is to buy bonds at current prices with current (high) yields and then stay invested in them till maturity. These schemes generally invest in high credit quality bonds. The fund manager chooses an index that comprises bonds maturing around the same time. The scheme maturity is matched with the index maturity. The idea is to offer a high-quality portfolio with a clearly defined maturity date that ensures that an investor holding his investment takes home returns close to the portfolio yield minus the expense of the scheme. This return visibility is a big draw for many investors.

Balasubramanian is not alone in his recommendation. Joydeep Sen, Corporate Trainer-Debt, also expects a 25-bps hike in repo rate on February 8. “Markets have already priced in that rate hike and bond yields have accordingly moved. What matters now is will RBI change its stance from withdrawal of accommodation to neutral,” he says.

Put simply, a change of stance to neutral means RBI will hike (or cut) the repo rates if there is a compelling reason to do so. That paves the way for cut in rate in future, though that may take some time. Irrespective of that, Sen and Balasubramanian argue that India has reached close to peak interest rates, and therefore, the current crop of TMFs are good enough.

TMF - options galore

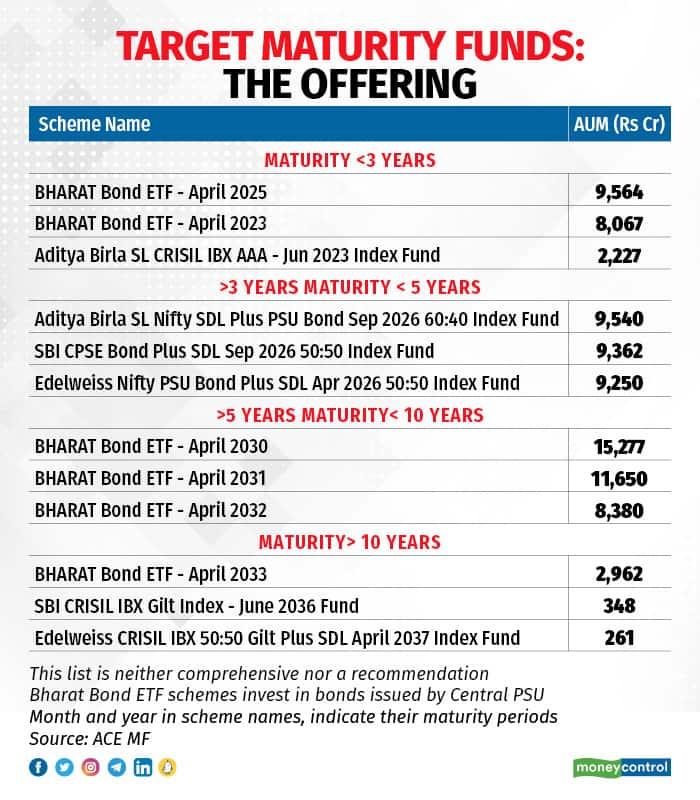

There are 82 TMFs on offer including the various series of Bharat Bond ETF maturing at various points in time. Some of these have residual maturity of a few months and some mature as late as in CY2037. In the most ideal situation, investors should pick one that suits their holding timeframe. This ensures that the investor gets an idea of the expected returns and does away with interest rate risk, provided the investor holds it till maturity.

But not all investors have an idea when they will need money. Rather, they have a corpus which needs to be deployed without any specific financial goal. This is especially true about those who may have sizeable regular income and a decent investible surplus.

Picking the attractive spot

Such investors keep looking at relatively attractive bets from the risk-reward point of view.

Nitin Rao, CEO, InCred Wealth, recommends investing in TMFs maturing over four to five years, given the attractive yields. “Yields available on bonds maturing over five years and more are not as attractive. Also, most investors are comfortable holding it for three to five years to earn tax-efficient returns,” he adds.

Vinay Joseph, Chief Investment Strategist, Standard Chartered Wealth India, likes TMFs of medium duration that are likely to benefit from higher carry, lower interest rate risk, and falling residual maturity.

If you are willing to look beyond this medium-duration space, then there are options. But do not look at far longer-term maturities, say experts.

“Since interest rates have almost reached their peak, we recommend investments in target maturity fund with a maturity basket of four to 10 years as the yields are attractive. The yield curve is flat and yields above 10 years till 40 years are not attractive,” said Deepak Panjwani, Head-Debt Markets, GEPL Capital.

Exposure to medium-duration funds can help you ride out a possible fall in interest rates. In such a case, you may see capital appreciation. However, booking profits before three years means attracting short-term capital gains (STCG) tax at the slab rate, which may not be an attractive proposition for many investors in the high-income tax slabs.

However, Balasubramanian has a different take with focus on relatively shorter holding period.

ALSO READ: Seniors may earn risk-free income on investing up to Rs 1.1 crore. Here's how

“We expect the yield curve to remain elevated due to limited space of policy easing and tighter liquidity conditions incrementally. Thus, from the risk-rewards perspective, we would recommend to look for TMFs up to three years of maturity for long-term investors,” he said. Investors looking for tactical exposure should look at March 2024 AAA TMF as an optimal opportunity, he added.

What should you do?

Though many fixed income experts are gung-ho about central banks world-over, including RBI to support growth and in that process the interest rates to come down, do not jump and invest in TMFs maturing too far in the long term just because the NFOs are on. It is better to be prepared to hold on till maturity. Geo-political risks, and commodity inflation are not going away soon, and adverse developments on these fronts may push up yields.

ALSO READ: Beware! Insurance agents pushing high-premium policies before March 31 to escape tax

Sen advises investors to look at the portfolio composition of funds and the expense ratio as well.

Schemes that allocate money to PSU bonds may offer a tad more than those that invest only in government securities (G-Secs). Large assets under management (AUM) should keep the expenses charged to the scheme under check. Investors can also choose to stagger their investments over the next three to six months, if they want more clarity on how interest rates pan out.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.