BUSINESS

Crude palm oil slips 1.9% to Rs 1,123.80 per 10 kg on profit booking

Though profit booking witnessed yesterday, sustaining above Rs 1,145 could see more upside moves targeting Rs 1,160-1,170 levels, says Geojit Financial Services.

BUSINESS

Natural gas futures steady at Rs 183.80 per mmBtu on positive global trend

In the futures market, natural gas for March delivery touched an intraday high of Rs 184.50 and an intraday low of Rs 182.20 per mmBtu on MCX.

BUSINESS

Copper futures slip nearly 1% to Rs 671.15 per kg on weak demand, firm dollar; further downside likely

The non-ferrous metal has been trading higher than 50, 100 and 200 days' moving averages but lower than 20 and 5 days’ moving average on the daily chart. The Relative Strength Index (RSI) is at 49.28 which indicates sideways momentum in prices.

BUSINESS

Gold rises to Rs 45,003/10 gm on weak rupee, silver falls by Rs 30

The broader range on COMEX could be between $1720- 1770 and on the domestic front, prices could hover in the range of Rs 44,550- 45,100, said Damani.

BUSINESS

Cotton futures weak at Rs 21,190 per bale on subdued demand

The soft commodity has been trading higher than 100 and 200 days' moving averages but lower than 50, 20 and 5 days’ moving average on the daily chart. The Relative Strength Index (RSI) is at 35.59 which indicates weak momentum in prices.

BUSINESS

Crude oil futures slump over 3% to Rs 4,332/barrel amid global sell-off

The black gold has been trading higher than 50, 100 and 200 days' moving averages but lower than the 20 and 5 days’ moving average on the daily chart. The momentum indicator Relative Strength Index (RSI) is at 41.62, indicating bearish momentum in prices.

BUSINESS

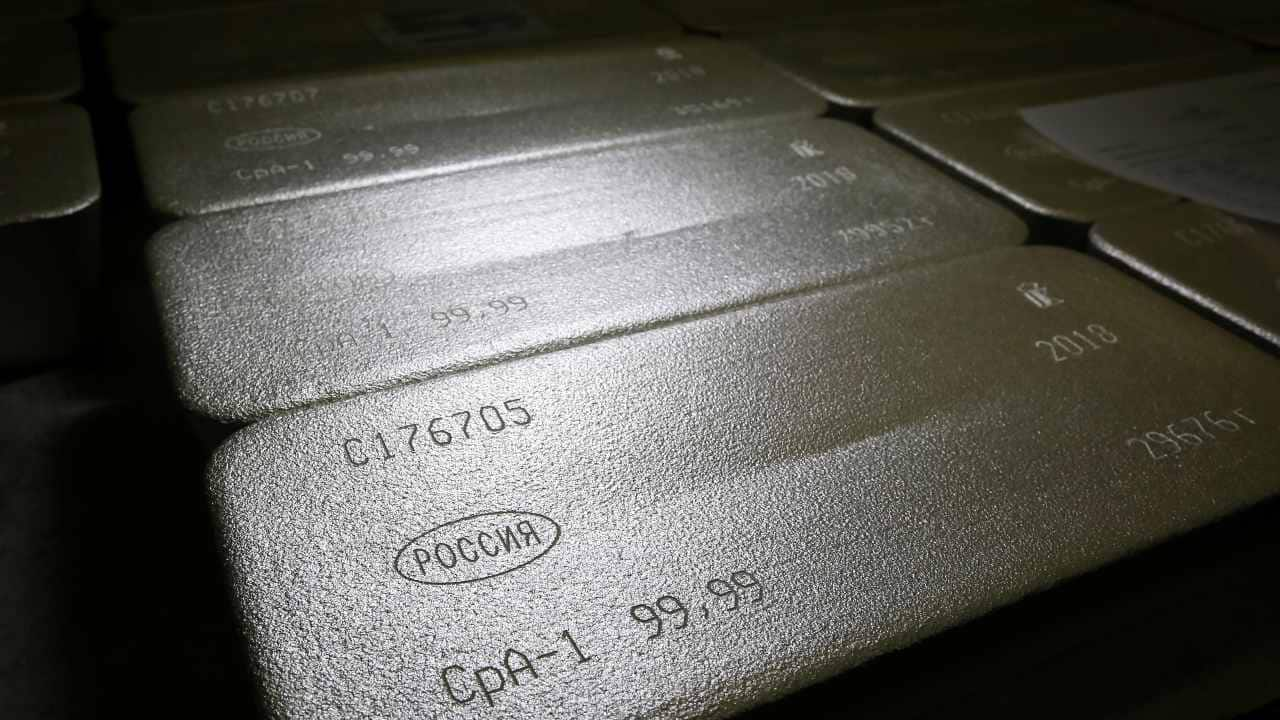

Silver prices down marginally to Rs 65,984 per kg on weak economic data, strong dollar

The spot gold/silver ratio currently stands at 68.16 to 1 indicating that gold has outperformed silver.

BUSINESS

Natural gas futures slip 0.32% to Rs 185.40 per mmBtu

The commodity has been trading higher than 5 and 200 days' moving averages but lower than the 20, 50 and 100 days’ moving average on a daily chart for the April contract.

BUSINESS

Zinc futures jump 0.73% to Rs 221.10 per kg on positive global trend

The non-ferrous metal has been trading higher than 5, 20, 50, 100 and 200 days' moving averages on the daily chart. The Relative Strength Index is at 52.09 which indicates positive momentum in prices.

BUSINESS

Copper futures drop 0.19% to Rs 674 per kg on higher inventory

Speculators cut their net long US copper positions by 6,651 contracts to 44,570 in the week to March 16, according to US CFTC data.

BUSINESS

Gold prices fall marginally to Rs 44,847/10 gm, silver tumbles by Rs 998 a kg

The CFTC data showed that money managers increased net long positions by 12,845 lots in the last week.

BUSINESS

Crude oil price steady at Rs 4,468/barrel after over 7% drop last week, Brent trades above $64/bbl

The CFTC data showed that money managers increased net long positions by 2331 lots in the last week.

BUSINESS

Silver futures crash 2.39% to Rs 65,916 per kg on ETF outflow and strong dollar

Speculators cut their net long silver futures and options by 1,763 contracts to 25,913 in the week to March 16, the US CFTC data showed.

BUSINESS

Natural gas futures edge 0.98% lower to Rs 182 per mmBtu; expert suggests sell-on-rise strategy

Speculators cut their net long natural gas futures and options positions by 72,401 contracts to 211,812 in the week to March 16, according to US CFTC data.

BUSINESS

Copper futures fall 0.28% to Rs 674 per kg on weak demand, firm dollar

The non-ferrous metal has been trading higher than 50, 100 and 200 days' moving averages but lower than the 20 and 5 days’ moving average on the daily chart.

BUSINESS

Gold prices steady at Rs 44,861/10 gm as US bond yields, dollar spike; silver gains Rs 395

The gold/silver ratio currently stands at 66.90 to 1, which means the number of silver ounces required to buy one ounce of gold.

BUSINESS

Silver futures firm at Rs 67,432 per kg, strong dollar caps upside

The semi-precious metal has been trading higher than 5, 20, 100 and 200 days’ moving averages but lower than 50-day moving averages on the daily chart.

BUSINESS

Crude oil futures flat at Rs 4,668/barrel on stronger dollar; Brent trades below $68 a barrel

The black gold has been trading higher than 20, 50, 100 and 200 days' moving averages but lower than the 5-day moving average on the daily chart.

BUSINESS

Cotton futures drop 0.64% to Rs 21,880 per bale on weak global cues

The soft commodity has been trading higher than 50, 100 and 200 days' moving averages but lower than 20 and 5 days’ moving average on the daily chart. The Relative Strength Index (RSI) is at 50.33 which indicates neutral momentum in prices.

BUSINESS

Natural gas futures down 0.70% to Rs 183.10 per mmBtu ahead of inventory report

The commodity has been trading lower than 5, 20, 50 and 100 days' moving averages but higher than the 200-day moving average on a daily chart.

BUSINESS

Gold prices steady at Rs 44,791/10 gm ahead of Fed decision, silver falls by Rs 286 a kg

The broader range on COMEX could be between $1715 - $1765 and on the domestic front, prices could hover in the range of Rs 44,700 - Rs 45,350, said Damani.

BUSINESS

Silver futures firm at Rs 67,162 per kg tracking gold price trend

The spot gold/silver ratio currently stands at 66.73 to 1 indicating that gold has outperformed silver.

BUSINESS

Crude oil futures trade flat at Rs 4,697/barrel, Brent above $68

The black gold has been trading higher than 20, 50, 100 and 200 days' moving averages but lower than the 5-day moving average on the daily chart.

BUSINESS

Natural gas futures firm at around Rs 185 per mmBtu in afternoon trade

The commodity has been trading lower than 5, 20, 50 and 100 days' moving averages but higher than the 200-day moving average on a daily chart. The Relative Strength Index (RSI) is at 37.39 which indicates weak momentum in prices.