BUSINESS

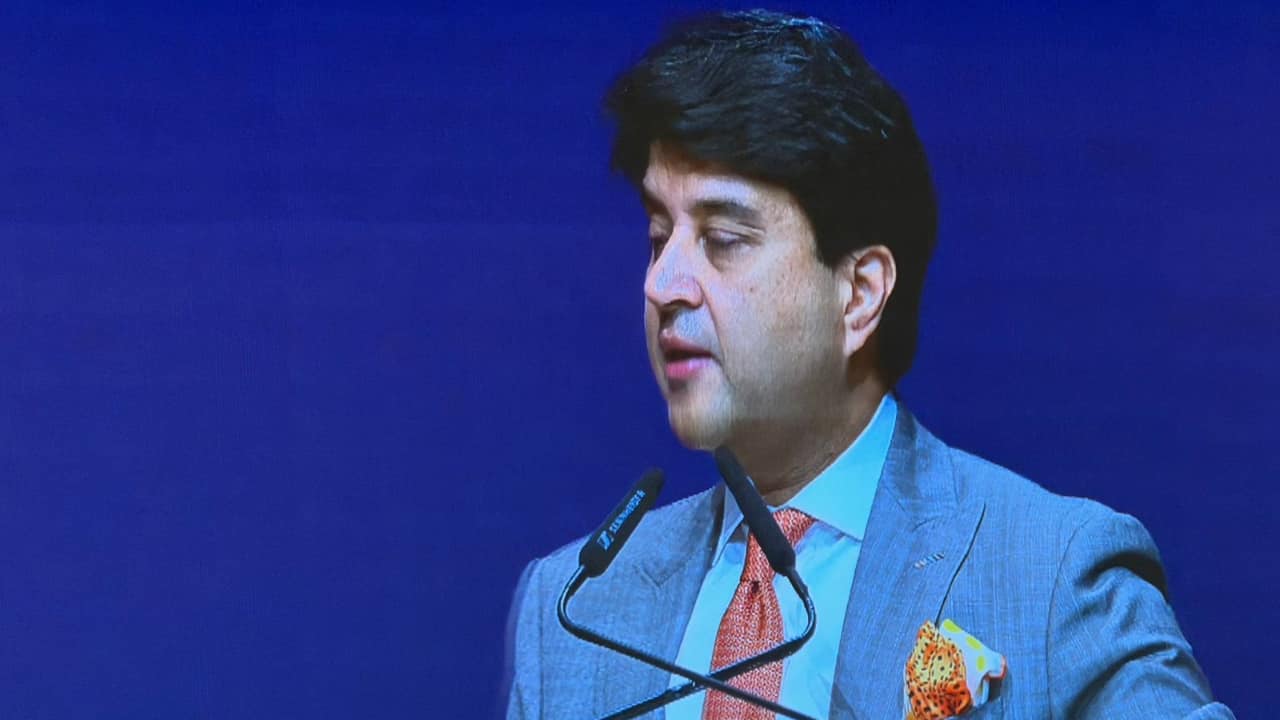

Focus on balancing welfare and development, ups and down part of political journey: Andhra IT Min Nara Lokesh

“Winning elections is important, every single cycle matter. But what's more important is convincing people about the value of continuity in governance,” said the Minister. Nara Lokesh talks about the lessons from the past, and emphasis of the Naidu's government on inclusive growth.

BUSINESS

'Only concern is creating jobs, jobs, and more jobs': Nara lokesh says '99 paise land model' key to 2 mn job goal

The Minister explained the state government is working on implementing all such policies which would create more jobs. For instance, the “99 paise land model” is mainly aimed at catalysing jobs in the state.

BUSINESS

Aiming for higher returns: EPFO to form panel with RBI, FinMin to overhaul equity, debt investments

The committee will give its suggestions by December to the EPFO, post which a call will be taken by the Fund’s Central Board of Trustees (CBT) on restructuring, said one official.

BUSINESS

H-1B fee hike is an opportunity for 'brain gain': Andhra IT Minister Nara Lokesh

"Time has come for brain gain. India is no longer just about cost arbitrage. It’s about knowledge, talent," said Nara Lokesh.

BUSINESS

Google's $10 billion Vizag data centre gets tax certainty; AP ensures no retrospective levy: IT Minister Nara Lokesh

The Minister said that there will be separate power-grid for data centres, and added that Google will pay for the power grid. "Part of it will be subsidised by the state," he said.

BUSINESS

MSME-SPICE Scheme to be expanded to include 'greenfield' projects after low uptake

According to SPICE scheme’s official dashboard only six MSMEs have availed incentives under the scheme so far, even as the programme envisages enabling more than 3400 MSEs to adopt Circular Economy (CE) solutions till 2026-27 (the end date of the scheme).

BUSINESS

Govt to add more African, South American buyers on Trade Connect to diversify textiles, leather exports

The initiative linked to the Trade Connect portal will be part of the central government’s soon-to-be-notified Rs 25,000 crore-'Export Promotion Mission' (EPM) that aims to offer a set of financial incentives to help exporters diversify to more markets.

BUSINESS

Telecom sector’s contribution to GDP to rise to 20% over in 10-12 years, says Scindia

The government is unlikely to raise its stake further in Vodafone Idea in the near future, the minister has said

INDIA

Hoping to work with industry and govt to expand their Telecom services once we are operational, says India Starlink executive

According to sources, the rules for the allocation of spectrum for satellite communications services are likely to be in place within next two months.

BUSINESS

Some AI tools unfairly impacting online prices, shows a CCI report: Can regulators rein in the algorithm?

A report by Competition Commission of India (CCI) on Artificial Intelligence has highlighted how AI tools could be getting used for unethical price manipulation and predatory pricing.

BUSINESS

CCI’s proposed 'self-audit' framework for AI 'unique' as compared to other jurisdictions: Experts

At present, UK and US encourage internal audits and algorithmic accountability. But, the CCI’s six-pillar model is relatively unique in offering a structured approach and if implemented well, experts note.

BUSINESS

Taiwan wants FTA with India, will reduce tariffs on Indian farms products, says Taiwanese economist

To get more Taiwanese investment, India should ease labour laws and streamline work visas, Kristy Hsu, director of the Taiwan-ASEAN Studies Center, has said in an interview to Moneycontrol

BUSINESS

Will make efforts to develop culture of competition compliance, promote innovation, says CCI's new market study on AI

According to CCI, AI’s impact on competition is multifaceted, as it may have both pro-competitive and anti-competitive implications. Some of the challenges are possible concentration in AI value chain, ecosystem lock-in, risk of algorithmic collusion, price discrimination, exclusive partnerships and opaque nature of algorithms, the market study said.

BUSINESS

India, China should join hands to deal with Trump tariffs and AI threat, says Liqing Zhang, a leading professor of finance

Zhang added that China is strong in some areas such as EV and renewable power panels, pointing to the fact that India can consider importing more from China. On the other hand, Beijing too can benefit from New Delhi’s strengths.

BUSINESS

India should consider joining CPTPP, ditch defensive stance in FTA talks, says Pravin Krishna

India needs to ensure that all FTAs negotiated bilaterally now are meaningful so that their benefits start reflecting as soon as they are in place, Krishna, who is professor of international economics at Johns Hopkins University, says in an interview to Moneycontrol

BUSINESS

Need to revive rule-based global trade system, UK and India should lead it: Karan Bilimoria

Karan Bilimoria, Member of House of Lords, said the India-UK free trade agreement (FTA) is going give a fillip to bilateral trade, and within the next five years, the trade’s value would double.

BUSINESS

IBC Amendment Bill: Centre re-examining draft 'out-of-court' insolvency rules to minimize litigation

The CIIRP will be different from the corporate insolvency resolution process CIRP, which comes into effect after the National Company Law Tribunal (NCLT) passes an order to initiate insolvency proceedings against a bankrupt company.

BUSINESS

Baijayant Panda to chair Parliament’s Select Committee to review IBC Amendment Bill

The Select Committee is likely to give its inputs to the government in the next two months, post which the Amendment Bill will be tabled in House for deliberations in the "Winter Session", said an official.

BUSINESS

Amazon, Flipkart pass on over Rs 300 crore in GST rate cut benefits during festive sales

Flipkart & Amazon have taken several communication and tech enhancement measures to ensure that the GST reductions are passed on to customers.

BUSINESS

Govt pulls up e-commerce players for not reducing prices after GST cuts

On September 29, consumer affairs secretary Nidhi Khare said the department has received more than 3,000 complaints of companies failing to pass on benefits of lower GST rates to consumers

BUSINESS

Supreme Court's JSW-BPSL judgment restores investor confidence in IBC, says official

Aimed at address inefficiencies and delays in the resolution process, the IBC Amendment Bill, introduced in August, introduces provisions that will prevent a repeat of the JSW-BPSL case, the official has said

BUSINESS

Trump’s H-1B visa fee a reminder of trade risks, Finance Ministry ‘monitoring’ impact on remittances and services

The GST rate rationalisation is expected to lower the tax burden on consumers, boost consumption, and provide a cushion against tariff impacts, said the finance ministry.

BUSINESS

Processed food manufacturers bet on GST cuts for domestic sales boom

The companies also feel that in the coming years, the exports of domestically manufactured processed foods will only rise as opportunities for tapping new markets are emerging.

BUSINESS

Tirumala gets India’s first AI-powered pilgrim Integrated Command & Control Centre

The centre, funded by NRIs, has more than 6,000 AI-enable cameras, with system processing 360,000 payloads every minute, 518 million events and generating 2.5 billion inferences daily in real time