BUSINESS

Gold price today: Yellow metal falls on gains in equities

In the futures trade, gold and Silver prices were volatile on October 17 on Brexit related reports.

BUSINESS

Yes Bank is on the roll; what should you do?

Market participants say a volatile stock price is a challenge to fundraising, even though the bank has been claimed that it is on track to raise funds.

BUSINESS

Slowdown blues | Economy to start looking up in H2 FY20, say economists

There has been a strong demand for a cut in GST rates and income tax as well, to boost consumer demand. However, given the current fiscal situation, it looks less likely that the government will go for such measures.

BUSINESS

Gold price today: Yellow metal futures in the red on weak spot demand

Weaker US consumer data may trigger one more rate cut by the US federal reserve in the next policy meet which is positive for gold.

BUSINESS

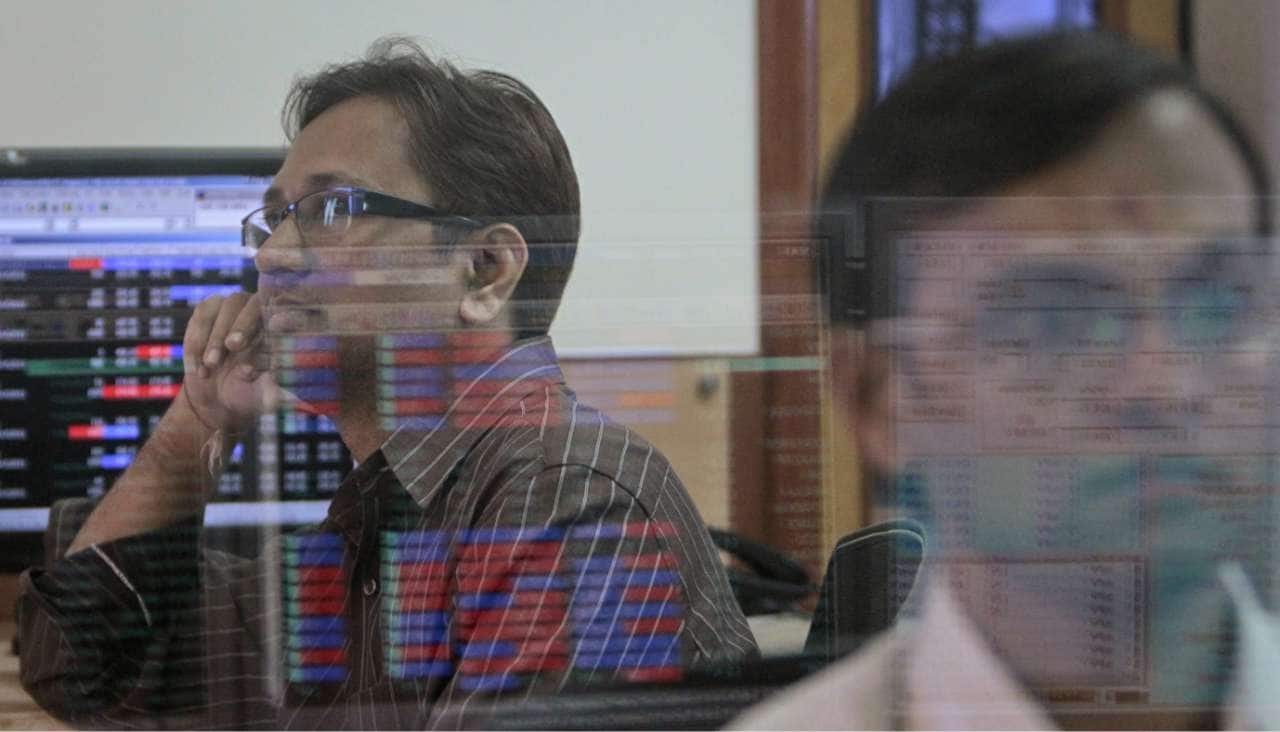

An evening walk down D-St: Market rises for 3rd consecutive day; bank, auto, FMCG top contributors

Vedanta, Mahindra & Mahindra and ONGC closed as the top gainers in the Sensex index, whereas Bharti Airtel, Infosys and Tata Motors emerged as the top losers in the index.

BUSINESS

HUL Q2 results beat expectations: Should investors buy, sell or hold?

Domestic brokerage firm Motilal Oswal Financial Services has a 'buy' recommendation on the stock, with a target price of Rs 2,265.

BUSINESS

An evening walk down D-St: Indian market rises for 2nd day in a row

Among the secondary indices, BSE Midcap outperformed Sensex, rising 0.44 percent while Smallcap index underperformed, ending with a mild gain of 0.12 percent.

BUSINESS

A dream debut for IRCTC, but 8 of 10 stocks with best openings have failed to hold gains

IRCTC listed at Rs 644 on the BSE, a 101.25 percent premium over its issue price of Rs 320 per share.

BUSINESS

Infosys Q2: Numbers broadly in line, but challenges ahead; here's what brokerages say

Credit Suisse has an 'underperform' call on Infosys with a target price of Rs 690 due to high valuations and an expectation of a weaker second half of FY20.

BUSINESS

An Evening Walk Down D-Street: Bulls back in charge; Infosys jumps 4%

The secondary indices underperformed the benchmark. BSE Midcap and Smallcap indices ended 0.24 percent and 0.38 percent up, respectively.

BUSINESS

Q2FY20 preview: Some pain, some gains for pharma

The ramp-up in specialty portfolios has been slower than anticipated, squeezing margins in the interim due to huge upfront costs.

BUSINESS

Brokerages cut target price, revise estimates for TCS after a dull Q2 show

Credit Suisse has trim revenue estimates by 1 percent and EPS estimates by 5-7 percent adding that the company has a high-quality franchise but is not immune to an uncertain environment.

BUSINESS

An Evening Walk Down D-Street: Market resumes downward march ahead of key earnings

Bharti Airtel, Reliance Industries, Hindustan Unilever and HCL Technologies settled as the top gainers in the Sensex index while IndusInd Bank, Yes Bank, Tata Motors, Vedanta and ICICI Bank emerged as the laggards.

BUSINESS

Auto Q2 preview: Brace for one of the worst quarters in a decade

Along with the numbers, investors will focus on management commentaries, demand outlook for the second half of the FY20 and BSVI transition.

BUSINESS

Will RJio's IUC charge trigger a re-rating for telcos?

Jio customers will be charged an interconnect usage charge (IUC) rate of 6 paise per minute for calls made to other mobile operators effective October 9.

BUSINESS

An evening walk down D-St: Hike in DA, banking & financial help market break 6-day losing spree

Among secondary barometers, BSE Midcap and Smallcap indices climbed 1.38 percent and 0.66 percent, respectively, underperforming the Sensex.

BUSINESS

Will Q2 numbers lift market sentiment? Here's what brokerages say

"For Q2FY20, we forecast our coverage universe’s revenue and profit to decline by 3 percent and 6 percent, respectively," said brokerage Edelweiss Securities.

BUSINESS

TCS Q2 preview: Brokerages expect mixed results; BFSI, weak IT spending may drag growth

Along with the numbers, brokerages say, outlook and visibility for double-digit growth in FY20, commentary on BFS and trajectory of margins amid rising sub-contractor expenses are the key points to watch out for.

BUSINESS

Q2FY20 Preview: Private lenders likely to show stable growth; PSBs to report subdued numbers

"Performance of PSU banks is likely to be soft and volatile, but private banks will continue to be on a stable footing," said brokerage firm Edelweiss Securities.

BUSINESS

A healthy Q2 likely for IndusInd Bank; asset quality will be closely watched

Edelweiss Securities expects the bank to report a YoY jump of 65.2 percent in its core PAT, which may come at Rs 1,520.5 crore for the September quarter.

BUSINESS

Trade Setup for Wednesday: Top 15 things to know before Opening Bell

Key support level for Nifty is placed at 11,081.47, followed by 11,036.53. If it starts moving up, key resistance levels are 11,202.57 and 11,278.73

BUSINESS

An Evening Walk Down D-Street: No end to misery as investors lose Rs 6.21 lakh cr in 6 sessions

After opening lower, key indices moved higher and traded with decent gains for the most part of the day. However, the market failed to hold the gains as a fresh wave of selling emerged in the fag end, causing it to settle with losses.

BUSINESS

Is there a room for another rate cut by RBI? Here's what global brokerages are saying

Also, RBI's revision of real GDP growth for FY20 downwards to 6.1 percent from 6.9 percent in the August policy spooked investors

BUSINESS

D-Street Buzz: Nifty Pharma falls 2%; Glenmark, Auro Pharma, Piramal Enterprises, Lupin touch 52-week lows

Shares of Glenmark Pharmaceuticals fell after the US Food & Drug Administration issued a warning letter to the company's Baddi facility.