BUSINESS

Inox India IPO: Financials, shareholding, comparison with peers in 5 charts

Inox India IPO: The company has a robust cash balance, is debt-free and has maintained a 15-16 percent annual growth consistently. It is also the first Indian company to manufacture trailer-mounted hydrogen tanks.

BUSINESS

WestBridge to continue as perpetual fund to India Shelter Finance Corporation: CEO

WestBridge, holding 56% and serving as the company's promoter, won't divest in the upcoming IPO. It is subject to a 12 to 18-month regulatory lock-in, reflecting a long-term commitment as perpetual funds, says India Shelter Finance Corporation MD and CEO Rupinder Singh

BUSINESS

Brexit-related fears sank Warburg Pincus-Tata Tech deal in 2018: Source

JLR, a key customer for Tata Technologies, could have been impacted by Brexit-related uncertainties, feared the private equity major

BUSINESS

ICICI Prudential AMC adopts a prudent stand on new-age companies amidst rising investments

ICICI Prudential AMC’s CEO highlights the importance of profitability over revenue growth, a key metric that determines whether such firms appear in his portfolio

BUSINESS

Exercise caution in midcap space due to high leverage: ICICI Prudential AMC's CEO

Saying prudence and the need for a cautious approach are paramount, Shah highlighted significant areas of concern and offered valuable advice for traders, particularly those engaged in futures and options (F&O) trading.

BUSINESS

Porinju Veliyath’s Diwali delights: Two stellar stock picks

The ace investor suggests avoiding the lure of the popular defence theme

BUSINESS

Porinju Veliyath’s lessons from the 2017-18 midcap meltdown

Investors must visualise the growth of a company over the five- to 10-year term and understand the impact of market dynamics on companies before investing in them, says Veliyath

BUSINESS

Mamaearth open to exploring tactical and strategic opportunities to outgrow markets: CEO

Mamaearth's parent company, Honasa Consumer, which has acquired three brands – Dr. Sheth's, BBlunt, and Momspresso, has achieved a 80 percent compounded annual growth rate in revenues over the last three years.

BUSINESS

Smallcaps, midcaps may shed 4-5%, but no reason to panic: Andrew Holland of Avendus

Holland is confident about the Indian markets and said that we will witness earnings upgrades in the future, and these are more likely to come from large-cap companies

BUSINESS

Blue Jet Healthcare expects to maintain revenue CAGR of ~20% from FY24-26

“We are a debt-free company with a strong capital management, boasting a return on capital figures exceeding 30 percent,” says the company management in a pre-IPO interview.

BUSINESS

IRM Energy sees no threat to CNG from the EV value chain

The city gas distribution company plans to use the bulk of its IPO proceeds on capex for expansion. However, it cautions that its growth will slow down in the years to come due to the higher base effect.

BUSINESS

SAMHI Hotels to turn profitable by FY24-end, says MD

SAMHI expects the real turnaround to happen in the third quarter ending December, after which the outlook will turn positive.

BUSINESS

Too early to reallocate investment into large-caps: Feroze Azeez

Midsize IT companies offer opportunities due to expected improvements in European discretionary spending

BUSINESS

Israel-Hamas not as big as Ukraine for equity markets: Ajay Bagga

Will Russia, China, and Iran join up on one side, with the US backing Israel on the other side? That’s where, the geopolitical risk and the potential for escalation lies, the independent market expert explained.

BUSINESS

Watch out for interest rate hikes and their impact on inflation, says Peter McGuire

Potential rate hikes in 2024 could dampen the sentiment in equity markets and investors will be mindful of their direction in the coming months, says, Peter McGuire, CEO at XM Australia.

BUSINESS

Tata Technologies IPO: Financials, shareholding, comparison with peers in 5 charts

Tata Technologies’ revenue CAGR over the last three years has far exceeded that of its peers Tata Elxsi, L&T Technologies and KPIT Technologies

BUSINESS

Vedanta’s demerger fails to excite brokerages; Stock adds up 3%

Investec sees the Vedanta demerger as a strategic move that will eventually make it easier for the promoter to consider monetisation or delisting.

BUSINESS

Valiant Laboratories to boost revenue, margins by diversifying into specialty chemicals

Valiant Laboratories’ FY23 operating margins stand at 10 percent, which is almost half, compared to other peers like Granules and Alkyl Amines Chemicals.

BUSINESS

JSW Infrastructure sees slower revenue growth in next 3 years on high base: Jt MD & CEO

According to Arun Maheshwari, the company's low-risk, low-cost model has helped it achieve higher growth compared to its competitors, including Adani and Gujarat Pipavav.

BUSINESS

Sai Silks initial public offering (IPO): Concerns on promoter pledge, low ROCE

The company’s public issue opened on September 20 to a tepid response. Here, in a pre-IPO interview with Moneycontrol, the management talks about the company’s key concerns.

BUSINESS

Signature Global Rs 730 crore IPO opens, aims to turn profitable by FY26

The company aims to recognise revenue of over Rs 7,000 crore over next three years from ongoing projects

BUSINESS

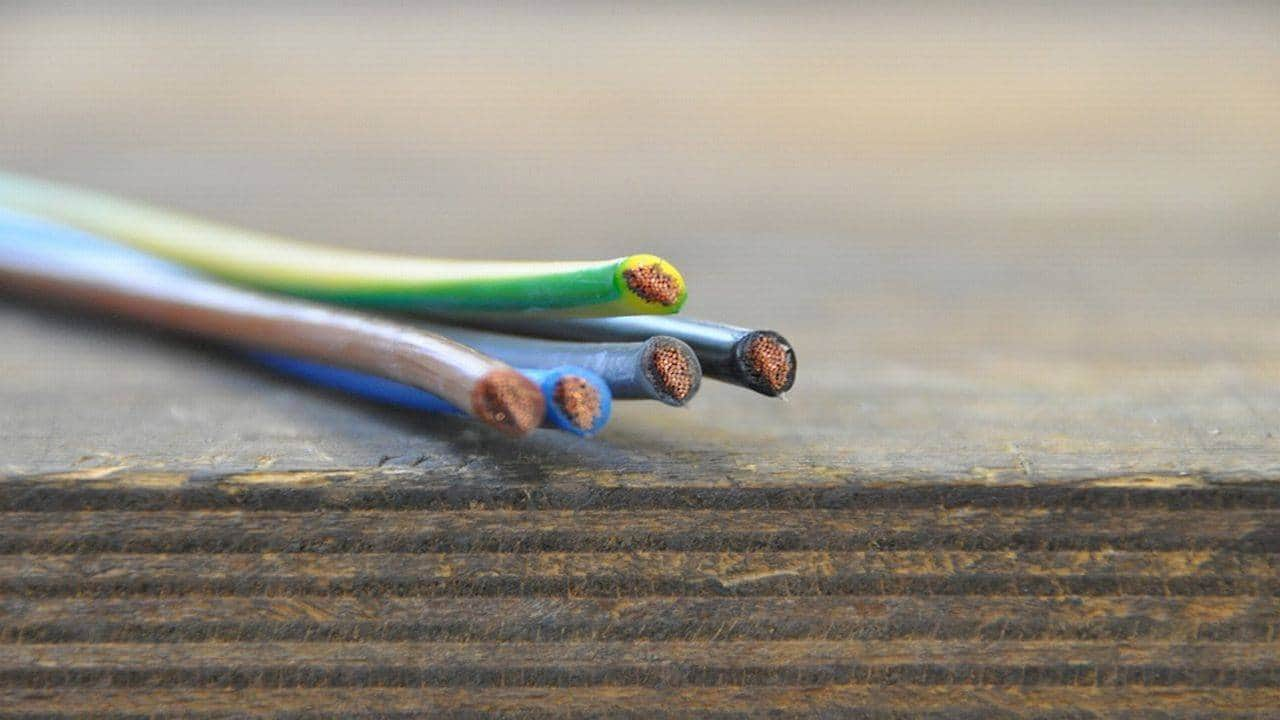

RR Kabel expects to continue to beat industry sales growth, but margin pressure to remain

The wire and cable manufacturer banks on its B2C model and the domestic-exports blend to clock higher growth.

BUSINESS

TPG to cut stake at RR Kabel via IPO, poised for 4x return on investment

TPG’s equity stake in RR Kabel will fall to 6 percent post IPO, from the 21 percent held earlier. The IPO mainly comprises an OFS for existing investors to sell stake, with a small fresh issue of shares.

BUSINESS

JSW Infra to launch Rs 2,800 crore IPO by September-end: Sources

JSW Infra’s revenues have more than doubled from Rs 1,143 crore in FY19-20 to Rs 2,273 crore in FY22-23. In May 2023, JSW Infra filed a draft red herring prospectus with SEBI for a Rs 2,800 crore IPO