JSW Infrastructure, whose ongoing Rs 2,800-crore initial public offer (IPO) has been subscribed more than two times on Day 2, is projecting slower revenue growth over the next three years while it expands its port capacities and cuts debt. The JSW group company, which intends to be debt-free after the public issue, has ambitious expansion plans, said Joint Managing Director and Chief Executive Officer (CEO) Arun Maheshwari in an interview with Moneycontrol.

JSW Infrastructure saw its total income register an impressive compounded annual growth rate (CAGR) of 41.77 percent from FY21 to FY23. However, the company anticipates a slower growth rate of approximately 25 percent from FY25 to FY27 due to a higher base. This is also because of the proposed investments in expanding capacities and lower utilisation levels initially, with capacities growing in a phased manner.

jsw-infrastructure Revenue CAGR

jsw-infrastructure Revenue CAGR

Currently the second-largest commercial port in India with a cargo handling capacity of 158 million metric tonnes per annum (MTPA), JSW Infrastructure aims to expand its capacity to 300 MTPA by 2030.

Maheshwari said the company's low-risk, low-cost model has played a significant role in achieving higher growth compared to its peers. "JSW Infrastructure has demonstrated superior operating metrics compared to its peers, notably Adani Ports. In terms of profit after tax (PAT) and return on equity (ROE), the company has outperformed its competitors, including Adani and Gujarat Pipavav,” he said.

About half of JSW Infrastructure’s capacity is in its greenfield ports — Dharamtar and Jaigarh ports — and the remaining half comes from government-operated terminals. Here, “the entire ecosystem is provided by the government, and the company has to pay a royalty to the government for the evacuation system, dredging, and breakwater — for the entire services,” Maheshwari said.

Jsw-Infrastructure versus peers

Jsw-Infrastructure versus peers

JSW paring debt but comfortable raising leverage again:

While JSW plans to become net debt-free using the IPO proceeds, it is comfortable taking some leverage on its book as it expands.

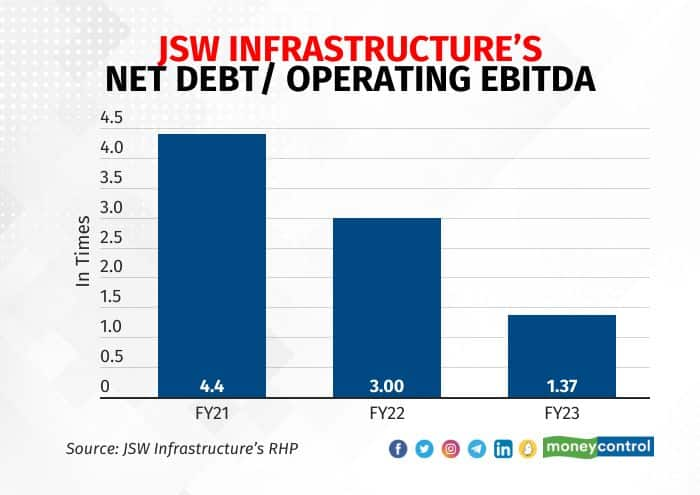

The company’s net debt to operating to earnings before interest, taxes, depreciation and amortisation (EBITDA) ratio has fallen significantly, from 4.4 times in FY21 to 1.37 times in FY23. It expects to cut debt further and become debt-free following the IPO. However, it would still be comfortable with a net-debt-to-EBITDA ratio of 2.5 times as it expands.

“We would like to maintain a net-debt-to-EBITDA ratio of 2.5x. This is what we have in terms of internal guidance. And I think that would be very comfortable for us to grow multi-fold from here on,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.