BUSINESS

Weekly Tactical Pick: ICICI Bank offers an opportunity to investors

Shrugging off its past, ICICI Bank has bounced back with a strong balance sheet

BUSINESS

Weekly tactical pick: CEAT — Ready for the run

Lower raw material prices and end-user appetite to boost CEAT's performance

BUSINESS

Weekly Tactical Pick | Bajaj Finance — High time to book profit

Valuation looks stretched as Bajaj Finance may find it difficult to regain past glory

BUSINESS

Weekly Tactical Pick: HDFC Bank

The pandemic shock is likely to make HDFC Bank even mightier as it is set to gain more clout amid the virus induced chaos

BUSINESS

Weekly Tactical Pick | NALCO

A higher dividend payout is likely from NALCO by August-September 2020 once savings from power costs become visible

MONEYCONTROL-RESEARCH

Reliance Industries: Net zero debt achieved ahead of schedule; strong upside potential

BUSINESS

Weekly tactical pick: Bharat Electronics

BUSINESS

PIF-Jio deal | Record investor participation in Jio Platforms takes RIL to striking distance of net zero debt

Jio Platforms has raised Rs 1,15,693.95 crore from global investors so far

BUSINESS

Weekly tactical pick: TVS Motors

BUSINESS

ADIA-JIO deal | Another sovereign fund bets on the proxy for the Indian digital economy

MONEYCONTROL-RESEARCH

Weekly tactical pick: Hero MotoCorp

BUSINESS

A sovereign wealth fund buys into the Jio vision

BUSINESS

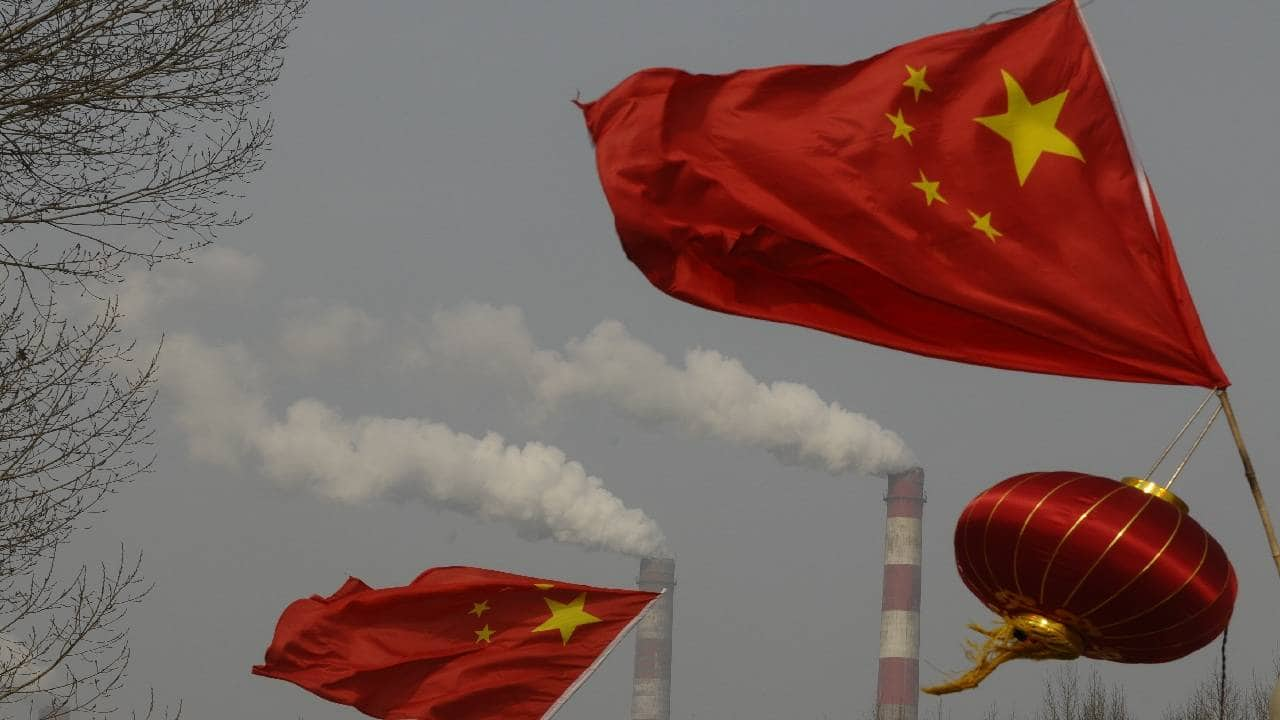

How dependent is India on China? Here is what trade data reveals

Import dependency on China for a range of raw materials (APIs, basic chemicals, agro-intermediates) and critical components (Auto, Durables, Capital goods) is skewed.

BUSINESS

Which companies could gain as global supply chains shift from China – Part 3

BUSINESS

Weekly Tactical Pick | Jyothy Laboratories

BUSINESS

Which companies could gain as global supply chains shift from China – Part 2

BUSINESS

Which companies could gain as global supply chains shift from China – Part1

BUSINESS

RIL: With KKR on board, Jio Platforms raises ~Rs 80k crore from marquee investors so far

BUSINESS

Weekly Tactical Pick | Vedanta India Ltd (VIL)

BUSINESS

Weekly tactical pick | HUL

BUSINESS

Lockdown hit to payment cycle could cause irreversible damage in a few sectors: Part-2

Here is our take on the other two important sectors; cement and automobiles.

BUSINESS

Nestle Q1: Domestic growth sustains despite COVID-19 hiccups

BUSINESS

Lockdown hit to payment cycle could cause irreversible damage in a few sectors

Receivables cycles will increase and write-offs will mount

BUSINESS

Weekly tactical pick: This agrochemical stock is positioned for a faster recovery