BUSINESS

Attention!! New Rules from 1st March 2025: Know How it will Affect Your Pocket

The start of March will bring about several significant changes that will affect numerous aspects of daily life. Updates to the regulations about nominations, LPG cylinder prices, FD rates, UPI payments these are among the modifications that will take effect on March 1, 2025. Here's a breakdown of the key changes. Watch here

BUSINESS

How does Donald Trump's 'gold card' plan stack up against other 'golden visas'?

The 'gold card' visa will replace the EB-5 program which requires foreigners to invest between $800,000 and $1.05 million in US businesses that generate at least 10 full-time jobs

BUSINESS

Looking for tax-savers ahead of March 31? Check out these small saving schemes that offer 80C deductions

Public Provident Fund, Sukanya Samriddhi Account and National Savings Certificates are some of the small-saving schemes eligible for Section 80C deductions under the old tax regime

BUSINESS

Edelweiss Mutual Fund limits investments in 7 global schemes

Some of the Edelweiss Mutual Fund schemes are inching closer to the head room available for overseas investment limit as set by Indian regulators

BUSINESS

RBI repo rate cut: Union Bank, Central Bank of India offer the cheapest home loans

Several banks have started passing on the full repo rate cut benefit to home loan borrowers. Leading banks are offering interest rates ranging from 8.10% to 9% on a home loan with a 20-year tenure.

BUSINESS

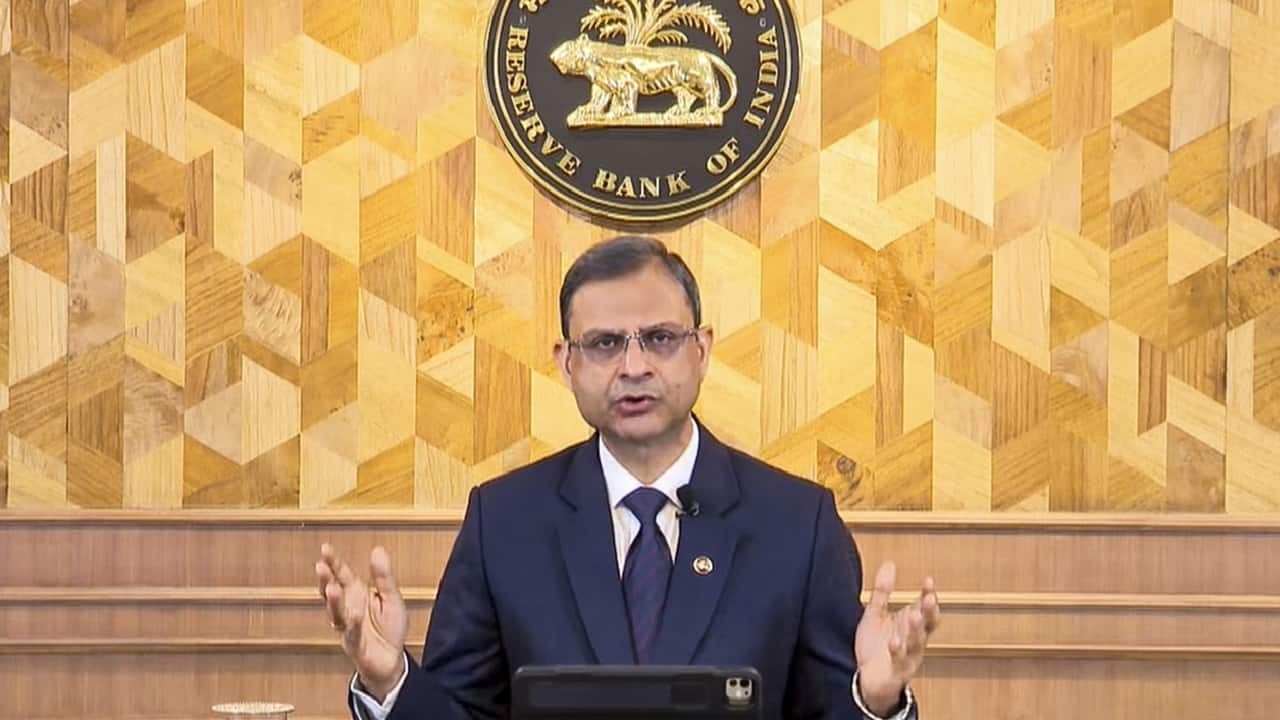

RBI MPC: Now, additional PIN for international online card transactions too

The RBI proposes to extend the additional factor of authentication (AFA) requirement to international digital payments made to offshore merchants

BUSINESS

Boost to shareholders as budget doubles TDS threshold for dividend income to Rs 10,000

At present, companies distributing dividends are required to deduct Tax Deducted at Source (TDS) at a rate of 10% on dividends exceeding Rs 5,000 in a financial year.

BUSINESS

NPS Vatsalya now eligible for tax deduction of Rs 50,000 under old regime

Sitharaman announced that NPS Vatsalya will now be treated at par with regular NPS accounts

BUSINESS

Senior citizens get tax exemption on National Savings Scheme withdrawals

National Savings Schemes are government-backed financial instruments aimed at encouraging savings among citizens, especially among the lower-income groups

BUSINESS

Relief for house owners, can claim nil tax on two self-occupied properties now, without conditions

The Budget has also simplified the annual value of self-occupied property

BUSINESS

Mutual funds observing non-business day on Feb 1, orders placed today will get Monday's NAV

Exchange-Traded Funds (ETFs) on the other hand, will be open for business, as stock markets are open.

BUSINESS

Budget 2025 wish list: Increase senior citizens' basic exemption limit to Rs 10 lakh, provide relief on health premium deduction

Deduction on health insurance premiums paid by senior citizens or their children on their behalf should be raised from Rs 50,000 to Rs 1 lakh, say industry-watchers.

BUSINESS

Mutual funds crucial in channelling domestic savings for risk capital formation, says Economic Survey

The rise in retail participation through mutual funds is reflected in the doubling of unique investors from 2.9 crore in FY21 to 5.6 crore as of December 2024, the Economic Survey said.

BUSINESS

Unifi MF files for its first fund with SEBI, a dynamic asset allocation fund

Dynamic asset allocation or balanced advantage fund is the biggest category in hybrid funds with net AUM of Rs 2.86 lakh crore through 34 schemes as of December 31

BUSINESS

SEBI clamps down on finfluencers: Here’s how to pick the right financial advisor for you

Picking a financial advisor is not an easy task. An advisor’s true worth is realised only after a few years, depending on how your investments have weathered the market volatility and whether your financial goals are achieved

BUSINESS

Will FM Nirmala Sitharaman scrap the old, with-exemptions tax regime in Budget 2025?

Though the government is incentivising a shift towards the new tax regime, it is unlikely that the old regime will be scrapped entirely, say tax experts. This is because a section of tax-payers does benefit from this with-exemptions tax structure. However, it might not be retained once the Income Tax Act is revamped.

BUSINESS

ITR filing: Did you miss the extended January 15 deadline? You can still file 'Updated' returns

ITR filing: An updated income tax return can be filed by a taxpayer to correct any mistakes or omissions in the original or belated return. However, such returns cannot be filed to claim tax refund or reduce tax liability. The process can be completed within two years from the end of the relevant assessment year.

BUSINESS

Crypto industry seeks regulatory clarity and tax relief on capital gains from Budget 2025

The year 2024 saw a significant growth of crypto assets, marked by Bitcoin surpassing the $100,000 level and a surge in institutional investment.

BUSINESS

Extended Jan15 ITR deadline: Revise your income tax returns today to claim tax rebate under Section 87A

It is also the last chance for other individual tax-payers who may have missed filing their returns by July 31, or spotted errors in their submitted returns, to file belated returns or revise them.

BUSINESS

US fires a developing situation, too early to estimate insurance loss figures: Swiss Re

India’s economic growth is creating risk hotspots in states such as Gujarat, Maharashtra, Tamil Nadu and Delhi with high concentrations of industrial clusters, which are vulnerable to natural calamities such as floods, cyclones or earthquakes, a Swiss Re report said.

BUSINESS

Markets continue to slide: What should mutual fund investors' strategy be?

Looking ahead, experts believe that it's essential for investors to remain vigilant and adapt to the shifting market landscape. They believe that the market may move away from low-growth, low-quality segments towards companies with strong fundamentals and sustainable growth prospects.

BUSINESS

Budget 2025: Introduce separate tax benefit for term insurance, increase health premium deduction limit, say top insurance officials

Insurers also want FM Sitharaman to consider extending the additional Rs 50,000 tax exemption for NPS contributions to pension plans from life insurance companies too

BUSINESS

Budget 2025: Include HRA in the new tax regime, raise standard deduction to Rs 1 lakh, urge experts

Also, the return-filing process needs to be simplified for NRIs, who are facing several challenges as tax refunds are not credited to their overseas bank accounts.

BUSINESS

Wait until I-T portal glitch is resolved before revising returns, CAs tell tax-payers

At present, small tax-payers with special rate income such as short-term capital gains are unable to claim the rebate under section 87A, even if their income is below the basic exemption limit, as the updated utilities are not calculating the amount automatically.