BUSINESS

Election results to keep bond yields, Indian rupee volatile in near term, say experts

BJP-led NDA bagged 293 seats and the opposition bloc INDIA finished at 233. BJP has failed to reach the majority mark of 272 on its own.

BUSINESS

Bond yield jumps 10 bps, Rupee down 36 paise as INDIA bloc leading in 232 seats

According to the Election Commission of India’s (ECI) website, Bharatiya Janata Party (BJP) is leading on 235 seats and won 1 seat. Indian National Congress (INC) is leading on 95 seats.

LOK-SABHA-ELECTION

Indian National Congress won five seats in coastal area of Kerala

Kozhikode, Ponnani, Thrissur, Ernakulam, Alappuzha, Kollam, Attingal, and Thiruvananthapuram are constituencies from coastal areas.

LOK-SABHA-ELECTION

Indian National Congress wins five seats in Kerala's Travancore region

Counting has started in all constituencies. First leads are expected and will be updated as soon as in.

LOK-SABHA-ELECTION

Indian National Congress won five seats in Kerala's Malabar region

Kasaragod, Kannur, Vadakara, Wayanad, Kozhikode, Mallapuram, and Ponnani, are Lok Sabha constituencies in Malabar region.

LOK-SABHA-ELECTION

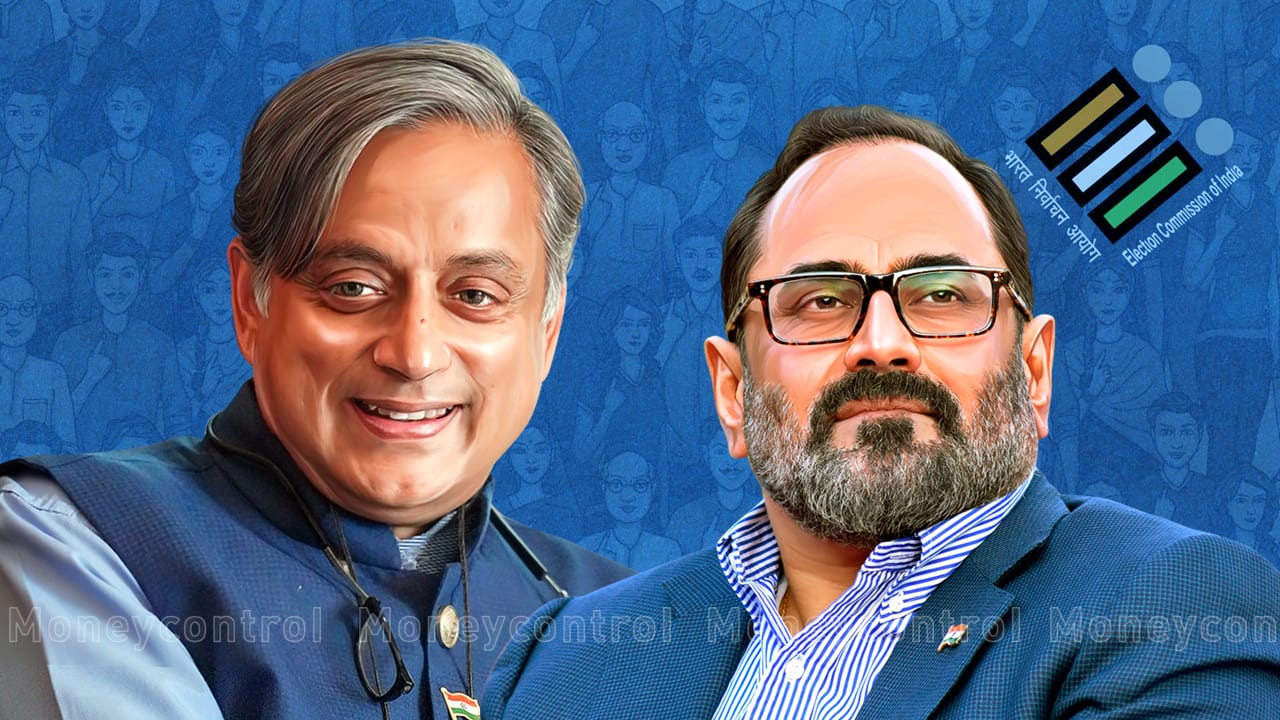

Shashi Tharoor wins from Thiruvananthapuram with 16,077 margins

Thiruvananthapuram seat was won by Tharoor in the last three Lok Sabha elections.

LOK-SABHA-ELECTION

INC’s Anto Antony wins from Pathanamtthitta by 66119 margin

Anto Antony secured 367623 votes and Issac secured 301504 votes, data added.

BUSINESS

Banks may hike lending, deposit rates if credit growth remains strong post monetary policy, budget

Per RBI data, the weighted average lending rate on fresh rupee loans of scheduled commercial banks was 9.55 percent in April 2024, compared to 9.37 percent in March 2024.

BUSINESS

Rupee surges, bond yields sink as exit polls forecast landslide victory for NDA

The 10-year benchmark bond 7.10 percent 2034 opened at 6.9505 percent, as against 6.9809 percent close on May 31, while the rupee opened at 82.99 against the dollar on June 3

BUSINESS

Dollar/rupee forward premia falls in two weeks after Fed rate cut expectations wane

Experts are of the view that if the Reserve Bank of India keeps intervening in the forward market, the forward premia may further decline. .

BUSINESS

S&P outlook revision may not impact Indian markets, but bond yields may trade stable on strong local cues: Experts

Today, the 10-year benchmark bond 7.10 percent 2034 bond yield closed at 6.9966 percent.

BUSINESS

Rupee, bond to react negatively if BJP-led NDA fails to secure 300 seats, say experts

The first phase of the election started on April 19. The election results are set to be announced on June 4 to the 543-member Lok Sabha. The BJP-led NDA is expecting to win 400-plus seats.

BUSINESS

RBI Policy | RBI unlikely to announce liquidity measures, to continue VRR auctions, say experts

The MPC led by the Reserve Bank of India (RBI) is likely to maintain status quo in the upcoming June monetary policy while remaining cautious on inflation, according to Moneycontrol’s poll of 20 economists and bankers.

BUSINESS

Falling bond yields likely to help banks make treasury gains in Q1FY25, say experts

Since April, the yield on government securities fell around 10-15 basis points due to multiple factors , like the easing inflation print, Brent crude oil prices, and the higher dividend transfer announced by the Reserve Bank of India.

BUSINESS

MPC Poll: RBI to leave key interest rates unchanged in June monetary policy, say economists, bankers

The six-member Monetary Policy Committee of the RBI will meet from June 5 to 7 to decide on interest rates.

BUSINESS

MC Exclusive| Paytm partnership going extremely good; 1.2 bn transactions every month, says Yes Bank CEO Prashant Kumar

The entire flow of Paytm transactions is happening through us without any problem, Kumar said .On March 15, Moneycontrol reported that Yes Bank and Axis Bank are going live on Paytm app.

BUSINESS

Interview | Yes Bank spending Rs 1,000 crore annually to bolster technology, says CEO Prashant Kumar

In a detailed interview, Yes Bank CEO outlined the path ahead for the bank including building a microfinance business and the corrective actions taken so far.

BUSINESS

MC Exclusive | Yes Bank CEO Prashant Kumar says he's not concerned about shareholding change at the bank

Regulations state that a bank cannot remain invested in another bank, Kumar pointed out, adding that it was important to find a strategic investor to replace State Bank of India when YES Bank had returned to normalcy.

BUSINESS

MC Exclusive: 25% of YES Bank’s investment in RIDF to mature in FY25: Prashant Kumar, CEO

The bank has around 11 percent of its funds placed in the RIDF, which works out to be around Rs 44,000 crore, Kumar added.

BUSINESS

Higher RBI dividend may improve banking liquidity, ease short-term rates, say experts

On May 22, the RBI’s Central Board of Directors approved the transfer of Rs 2.11 lakh crore as surplus to the government for the financial year 2023-24.

BUSINESS

Higher RBI dividend to help ease fiscal deficit by 0.2-0.4% in FY25, say economists

In the interim Union Budget 2024, the government has targeted a fiscal deficit of 5.1 percent of the GDP for 2024-25.

BUSINESS

RBI board approves record surplus transfer of Rs 2.11 lakh crore to government for FY24

The dividend, transferred in 2024-25, is sharply higher than what the government had expected. It will reflect in the government’s account for FY25.

BUSINESS

Open interest contracts rise in currency derivatives market as corporates ramp up hedging amid rupee volatility

From 83.4675 in the beginning May, the rupee has appreciated to 83.30 against the dollar now.

BUSINESS

RBI conducting Rs 75,000 crore 2-day VRR auction today

The liquidity in the banking system is estimated to be in deficit of around Rs 2.56 lakh crore