BUSINESS

Sigachi explosion: What the insurance covers & how claims will be settled

As investigators probe the cause of the blast, Moneycontrol explains the insurance mechanisms in place and how compensation will be processed.

BUSINESS

Axis Max Life probes alleged customer data breach after anonymous threat

A detailed cyber investigation is underway in consultation with cybersecurity experts to identify the root cause and implement necessary remedial measures, company says

BUSINESS

No compensation under Motor Vehicles Act for deaths caused by rash driving, says Supreme Court: Report

Investigation must prove the deceased was not at fault, through police chargesheet, eyewitness accounts, expert reports, and absence of negligence, to claim compensation, say legal experts

BUSINESS

General Insurance Council, IRDAI in talks with govt to set up independent healthcare regulator

According to the CMD of GIC Re, two major issues have prompted this move: fraudulent practices and discriminatory pricing by hospitals based on a patient’s insurance status

BUSINESS

Bandhan Life targets 100% annual growth in premiums for next 2 years, eyes composite licensing: MD & CEO Satishwar B

Composite licensing could help attract greater foreign direct investments, as it would encourage global health insurance experts to enter the Indian market, Satishwar says

BUSINESS

Amid global data breach of 16 billion passwords, Indian insurers reel from record cyber incidents in FY25

BUSINESS

NRI deposits rise 0.46% in April 2025, driven by surge in FCNR(B) deposits, RBI bulletin says

Inflows for NRO accounts in April 2025 were at $31 million, as against a higher $103 million provisionally recorded for April 2024-26, bulletin says

BUSINESS

Global supply-side risks, external demand weakness could pose headwinds for India: RBI bulletin

The Iran-Israel conflict, which intensified in mid-June, has reversed the short-lived optimism spurred by temporary tariff freezes and trade deals earlier this year, bulletin said

BUSINESS

Rural demand picks up as consumer optimism holds steady, RBI’s bulletin says

High-frequency indicators of aggregate demand for May suggested a pick-up in rural demand, especially given the strong performance of the agricultural sector, RBI bulletin says

BUSINESS

FinMin likely to allow Value-Added Services in insurance via legislative amendment end of July

The services offered would include wellness programs, preventive health check-ups, and teleconsultation, alongside core insurance products, sources say

BUSINESS

HDB’s right to use HDFC brand tied to July 2028 deadline; DRHP warns of potential rebranding

Trademark licence with HDFC Bank is revocable and ends when HDB ceases to be a subsidiary or by July 1, 2028 as per IPO documents. The DRHP points to funding and brand reliance, intra-group competition risks.

BUSINESS

Growth concerns, a major pain point for investors in financials

The broader consensus among investors seems to be that income growth among the population needs to improve for real credit demand to pick up.

BUSINESS

RBI's change in norms for NBFCs led to HDFC- HDFC Bank merger, says Deepak Parekh

The former HDFC chairman said ICICI Bank once made an offer to take over the mortgage lender but it was declined. On a podcast with ICICI Bank’s former chief, Chanda Kochhar, he recalled his most memorable experiences with the banking regulator

BUSINESS

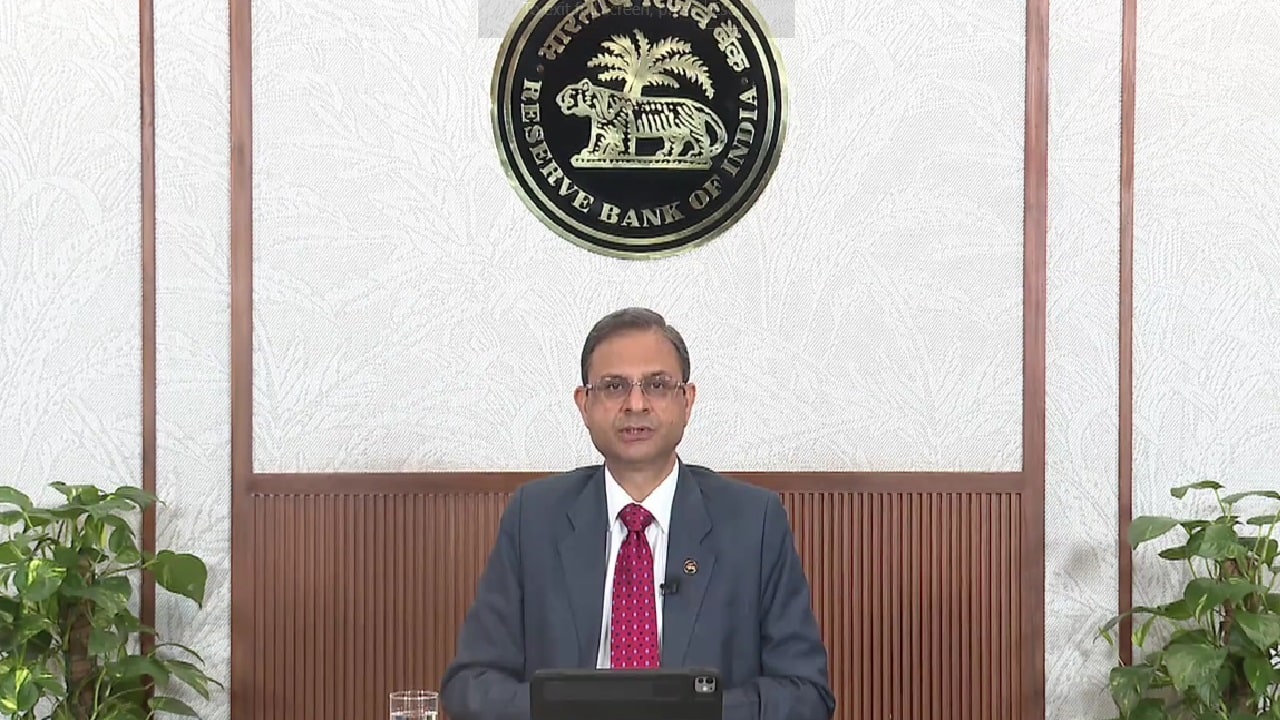

MPC minutes: 100 bps rate cuts provide certainty in uncertain times, support growth, says RBI Governor

The package of measures will provide some certainty in the times of uncertainty and is expected to support growth, says RBI Governor Sanjay Malhotra

BUSINESS

HDB Financial’s IPO leaves close to 50,000 early investors face up to 48% notional loss

Priced at Rs 700–740 per share, the IPO is up to 50 percent below levels paid by early investors pre-IPO

BUSINESS

MC Explained | ‘Dark patterns’ and ‘privacy zuckering’: Why they're the next big buzzwords in Insurance

A LocalCircles survey has revealed that digital insurance platforms are using tactics such as pre-ticked boxes, policy bundling and 'privacy zuckering' to push unwanted products and collect excessive data, prompting regulatory scrutiny.

BUSINESS

Credit-life policies fall 30% in FY25 for top life insurers, as they pull back from MFI market

Major players such as HDFC Life Insurance, ICICI Prudential Life Insurance, SBI Life Insurance, and Bajaj Allianz Life Insurance have significantly cut their exposure to group product category in FY25.

BUSINESS

Unpacking insurance claims for the Air India plane crash: Who pays what and how

The IIB portal acts as a centralised database of insurance policies issued by various insurers across India. It is primarily designed to assist in identifying and verifying insurance coverage

BUSINESS

Without open architecture, harder to build sustainable career in insurance: Go Digit's Kamesh Goyal

Health insurance is going through a phase of structural stress—both for customers and insurers, says Goyal

BUSINESS

UGRO Capital to acquire Profectus Capital in Rs 1,400-crore all-cash deal to boost MSME lending

Sources say the transaction which has concluded at 1.07 times Profectus’ projected FY26 net worth, is being funded by UGRO through proceeds from its recently completed equity raise and internal accruals.

BUSINESS

India’s Insurance sector faced maximum cyber onslaught in FY25

Prominent insurers such as Star Health and Allied Insurance, Niva Bupa Health Insurance, HDFC Life Insurance, Tata AIG General Insurance, and Life Insurance Corporation of India (LIC) have found themselves at the forefront of data breaches

BUSINESS

Why global reinsurers are concerned about wet lease agreements in Indian aviation

While domestic insurers handle the initial aviation payouts, the bulk of the financial risk, often up to 95 percent, is passed on to global reinsurers

BUSINESS

Ahmedabad plane crash: Travel insurance premiums unlikely to spike, experts say

While the aviation insurance sector faces mounting pressure from global events, individual travel insurance policies are expected to remain stable for now, with only moderate increases projected over the next year

BUSINESS

Air India, Akasa Air and SpiceJet may face potential insurance premium hike to $40–50 mn, may increase airfares by 2–5%

Aviation insurance premiums are calculated based on risk assessments, which consider factors like aircraft type, manufacturer reputation, airline safety records, and incident history