BUSINESS

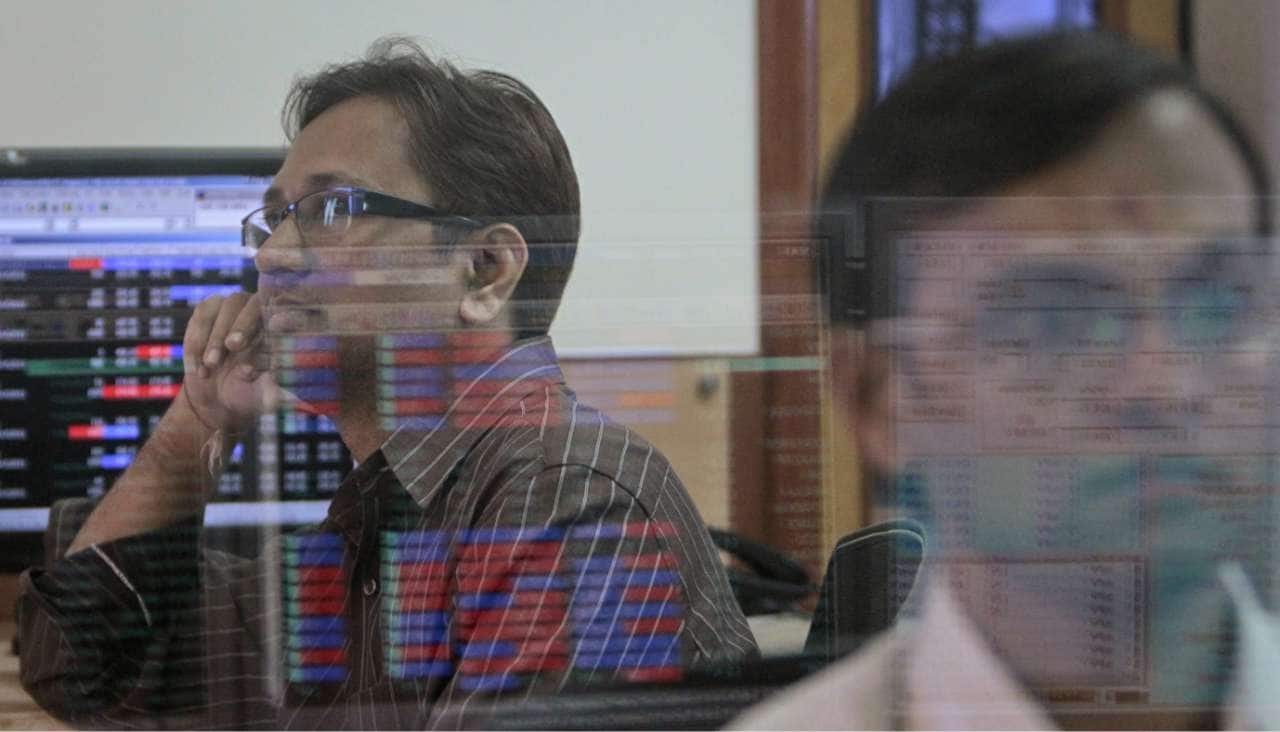

Taking Stock: Nifty ends in the green on a volatile day; India VIX climbs 7%

Benchmark indices swung both ways before closing flat. Sectorally, action was seen in energy, oil & gas, auto, and metal stocks, while profit-taking was evident in IT, realty, and capital goods space.

BUSINESS

Betting on an economic recovery? These 4 sectors likely to hog the limelight

Mishra advises avoiding stocks that have run into trouble owing to mounting debt, promoter pledge or other company-specific issues

BUSINESS

No ‘intermediate top’ but traders could go short on Nifty this week: Experts

It will not be right to say that the Nifty has made a 'top’ but the ideal strategy will be to remain cautious and go short as long as the index trades below 11,950, experts say.

BUSINESS

Gold price today: Yellow metal ranegbound; sell in the range of Rs 37,800-Rs 37,830

Experts say that investor traders can go short on gold in the range of Rs 37,800-Rs 37,830, with a stop loss of Rs 37,900 and a target of Rs 37,550.

BUSINESS

Heads up! There are a few warning signals and one should remain cautious on market

Apollo Tyres, Godrej Properties and Oberoi Realty are the three stocks which are trading at reasonable valuations when compared to historical averages

BUSINESS

Small & midcaps struggle in a volatile week; nearly 50 stocks fell 10-60%

Despite muted GDP growth hitting over a six-year low, and surprise pause from the Reserve Bank of India (RBI), the market remained resilient.

BUSINESS

Taking Stock: RBI shock hits D-St for second day; Nifty holds 11,900

The broader market underperformed – the S&P BSE Mid-cap index fell 1.2 percent, while the S&P BSE Small-cap index was down 0.86 percent on December 6.

BUSINESS

'Time to shift from overvalued stocks to cyclical and quality mid & small-cap stocks'

The finance sector is likely to outperform due to NPA resolution and reduction in the interest cost. Cyclical like metals and industrial will do better due to improvement in global and the domestic economy, says Vinod Nair of Geojit Financial Services.

BUSINESS

New highs? 11-year data suggest Sensex belongs to the bulls in December

The Sensex and the Nifty hit a record high of 41,163 and 12,158, respectively, on November 28, and are less than 1 percent away from breaking into new territory.

BUSINESS

Gold price today: Yellow metal rangebound over mixed signal on trade talks; buy on dips

Experts feel that gold may trade in the range, but investors can still look at buying the yellow metal on dips for a target of Rs 38,250.

BUSINESS

Taking Stock: RBI’s ‘temporary pause’ hits D-St; Nifty holds 12k

Sectorally, the action was seen in IT, Consumer Durables, and Capital Goods stocks while on the losing front, telecom, metals, public sector indices witnessed selling pressure.

BUSINESS

Experts say RBI may cut repo rate by 60-70 bps in 2020; 15 rate-sensitive stocks to bet on

A rate cut generally augurs well for companies that are debt-laden (as it reduces interest cost), banks as well as, non-banking financial companies (NBFCs) as it brings down the cost of funds. For the real estate sector, a fall in interest rates means lower EMIs.

BUSINESS

Top 5 reasons why Sensex fell after RBI leaves rates unchanged

The MPC decided to keep the policy repo rate unchanged but continue with an accommodative stance to revive growth, which supported the market sentiment and helped cut losses.

BUSINESS

RBI likely to cut rates by 25 bps; may keep door open for further easing

Most experts which Moneycontrol spoke to said that the central bank could well cut rates by 25 bps and may keep doors open for further easing to support growth in faltering Asia’s third-largest economy.

BUSINESS

Gold price today: Yellow metal recovers losses; experts say buy on dips

Experts feel that gold may trade in the range, but investors can still look at buying the yellow metal on dips for a target of Rs 38,250-38,330.

BUSINESS

Taking Stock: Trade deal hopes, possible rate cut on Dec 5 lift sentiment; Nifty ends above 12K

Traders should remain neutral on short side and can look to buy dip between 12k – 11970 levels, with a stop below 11935 and look for a target of 12100 levels.

BUSINESS

Portfolio play! Smallcap and midcap likely to outperform on signs of revival in growth

The broader market started to outperform due to buying in some beaten-down financial stocks because there are many signs that worst is over for the NBFC sector.

BUSINESS

Q2 GDP growth rate at 6-year low, but recovery possible by FY21; 10 economy-related stocks to bet on

Experts are of the view that amid a slowdown in growth, the central bank could well cut rates by 25-50 bps in December meeting to support growth in Asia’s third-largest economy.

BUSINESS

Gold price today: Yellow metal gains on possible delay in US-China trade deal

Experts advise investors to use dips to buy for a target of 38,500 on Gold, and 45,600 on Silver.

BUSINESS

Taking Stock: Nifty closes below 12K for the first time since Nov 22; time to buy?

The broader market underperformed as the S&P BSE Mid-cap index fell 0.95 percent while the S&P BSE Small-cap index was down 0.74 percent.

BUSINESS

Gold price today: Yellow metal trade flat amid trade war fears; follow buy on dips

MCX Gold has been intact in Triangle pattern and now a move above 38100 which suggests that upside breakout has taken place towards 38300 levels.

BUSINESS

Taking Stock: Rate cut hopes help market cut losses; Sensex, Nifty close flat

Nifty50 formed a bearish candle on the daily charts for the 2nd consecutive day in a row

BUSINESS

'Nifty50 likely to move towards 12,300; focus more on stock selection'

Since markets are trading near the record high, some consolidation cannot be ruled out in the benchmark indices in the near term.

BUSINESS

What to buy at market peak? Top 10 stocks based on Warren Buffett's investment methodology

The Master Score formula incorporates earnings growth, relative price strength, price-volume characteristics, industry group relative strength, and other factors—everything Buffet swears by.