BUSINESS

Market sustainability will depend on the behaviour of the COVID-19 curve: Naveen Kulkarni

Rebalancing in ETFs and pension fund buying support helped the markets rally. The RBI announced an out-of-turn rate cut and measures to improve liquidity in the system.

BUSINESS

High-dividend stocks seem safe bet in times of uncertainty; which one should you buy?

Most of these high dividend-paying companies have healthy cash reserves which could be utilized for paying dividends in difficult times as well when the core businesses get impacted.

BUSINESS

Gold price today: Yellow metal gains amid mounting recession fears

Experts are of the view that Gold witnessed its best week in the last 12 years and the rally is likely to continue. Investors could deploy buy on dips approach.

BUSINESS

For the time being, 7,511 can be taken as a bottom in the intermediate-term: Umesh Mehta

April may turn out to be a sucker’s rally where the fence-sitters will be pulled in. We will see some amount of price stabilizing but a major rally to go past 10,000 on the Nifty is less likely.

BUSINESS

Market & Meditation: Time to turn inward as life hits reset button

Mental strength is of utmost importance because that will help us to tide over rough patches of life with minimum damage.

BUSINESS

Carnage in broader markets; over 200 stocks in the small-cap space down 10-40%

In the coming truncated week we expect the index to consolidate in the broad range of 9000-7800 amid stock-specific action with elevated global volatility

BUSINESS

'Bulls could return on D-Street if Nifty crosses above 10,000 in April series'

If Nifty can come above 10,000 levels if the situations in front of COVID-19 improves from here because valuations are very attractive at current levels.

BUSINESS

The Market Podcast | Dalal Street will bounce back, right time to accumulate ‘jewels of India’

Investors should look at buying the companies where there is a strong business model, says Shailendra Kumar.

BUSINESS

Taking Stock: ‘Buy on rumours & sell on news’ plays out on D-St after RBI measures

The Nifty forms a bearish candle on intraday basis but closes above its 5-day EMA

BUSINESS

Experts feel the next round of package could be for the industry

Experts feel that the next round of packages could be for the industry and especially for the sectors such as banks, consumption, hospitality, auto, durables, agriculture, and healthcare.

BUSINESS

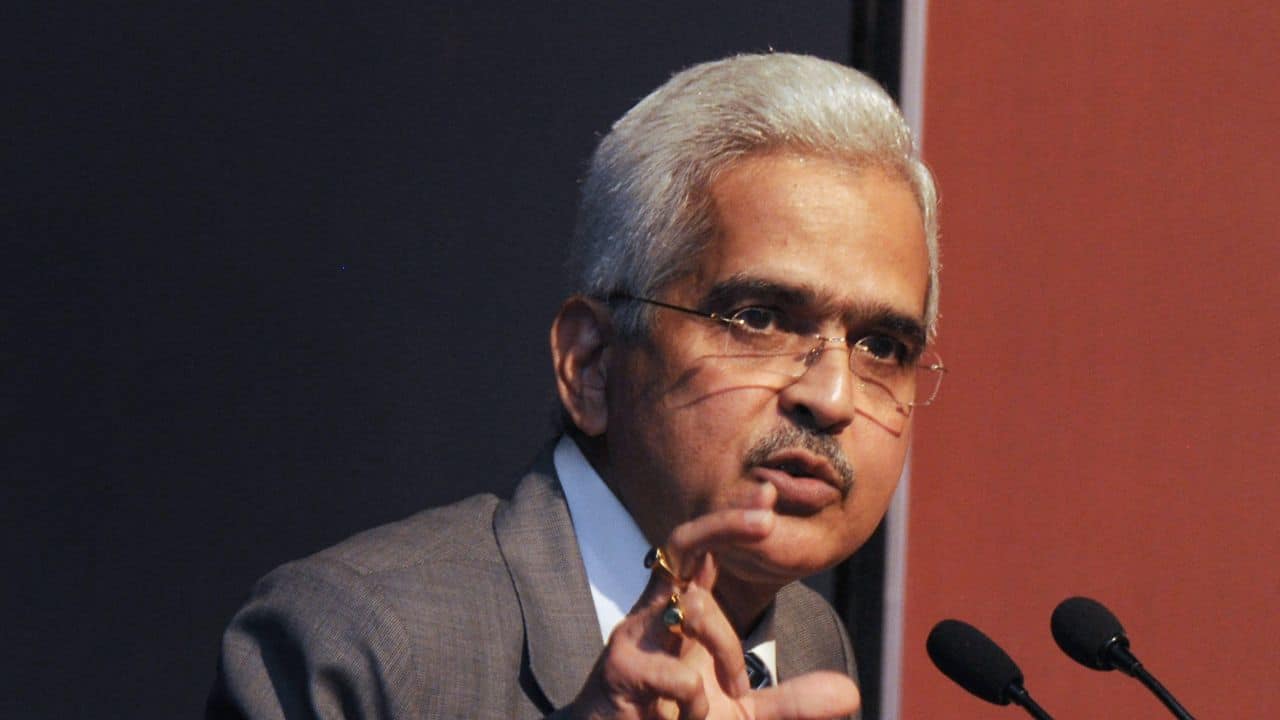

You said it right, Mr Governor! Tough times do not last, but tough people do

Addressing the media via teleconferencing, RBI governor begins his policy statement saying ‘Tough times do not last but tough people do and tough institution’. I think we are in those times right now.

BUSINESS

Gold price today: Yellow metal drops amid profit taking; buy on dips for target of 43,500

The precious metal is likely to remain volatile but experts say investors should maintain a buy-on-dips approach amid profit-taking at higher levels.

BUSINESS

Taking Stock: Nifty50 rallies 4% on F&O expiry; falls 25% in March series

The S&P BSE Sensex closed with gains of 1410 points to end at 29,946, just a shade below 30,000.

BUSINESS

This stock gained more than 100% in 1 year: What is driving the rally in Dixon Technologies?

Dixon Technologies has witnessed a return of 213 percent in less than six months—from Rs 1,560 in August 2019 to the recent high of Rs 4,895.

BUSINESS

Gold price today: Yellow metal edge higher on Coronavirus worries; may retest 40,200

On the MCX, April gold contracts were trading higher by Rs 148, or 0.37 percent, at Rs 40,123 per 10 gram at 0920 hours.

BUSINESS

Experts pick 15 stocks that are long-term buys even as Budget disappoints

Experts advise stock-specific approach with a focus on fundamentally strong companies

MARKETS

Taking Stock: Market recoups Budget Day losses! Investors’ wealth rises nearly Rs 3 lakh cr

Sectorally, the action was seen in consumer durables, metal, Oil & Gas, energy, and realty stocks

BUSINESS

Gold price today: Yellow metal could inch towards 41K; buy on dips, say experts

Experts feel that traders could look at buying the yellow metal around 40,500 levels for an upside target of 41000 per 10 gram. But, there could be some stiff resistance near 40,875 levels, they say.

BUSINESS

Budget 2020: Brokerages name 16 companies that may see negative impact of proposals

In terms of sectors, the Budget was negative for stocks in sectors such as Fertlisers, tobacco, insurance, real estate, and some part of capital goods space.

BUSINESS

D-Street Talk: What should stock market investors do post Budget 2020?

Mayuresh Joshi post Budget picks include Escorts to play the rural theme. From the consumer discretionary space, Joshi like Bata India, and pharma will again come back to focus.

MARKETS

Taking Stock: Chinese liquidity push, manufacturing PMI help Nifty bounce back

In case if bulls succeed in defending the low of 11614 levels then a best case target of 11934 can’t be ruled out on Nifty in next couple of sessions.

BUSINESS

Gold price today: Yellow metal below 41,000 even as China injects liquidity

Experts are of the view that Gold is likely to remain volatile, but traders can look at investing in the yellow metal on declines for a target of Rs 41,400 on the upside.

BUSINESS

Not happy with Budget 2020? About 40 stocks are likely to benefit the most

Sectors that are likely to benefit the most are electric manufacturing, footwear, natural gas, water pumps, transport infrastructure and IT

BUSINESS

Avoid bottom fishing on Monday as Nifty could fall to 11,500 levels: Experts

It looks like the Nifty50 has made an intermediate top at 12400 for now, but given the fact that we are trading near long term moving average, consolidation cannot be ruled out.