BUSINESS

For Siemens, structural story burns bright, but mind the valuation

Growth drivers of Siemens in place, but high valuations could be an issue in the near term

BUSINESS

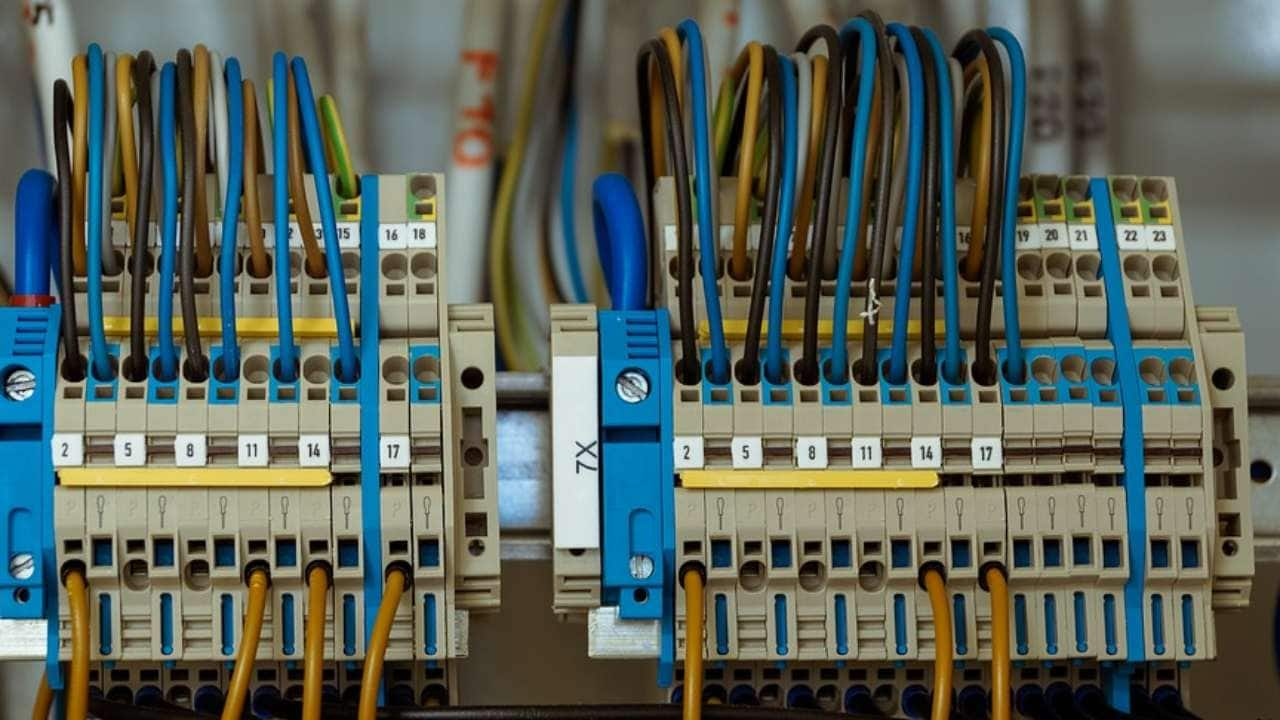

KEI Industries: Aiming to recover in the second half

While business is going through a short term pain, valuations of KEI Industries are in a good shape

BUSINESS

Cummins India: No re-rating on the cards

Short term pain not adequately priced in for Cummins' valuations

MONEYCONTROL-RESEARCH

Thermax: Rich valuation and near-term pressure on earnings to limit returns

Expensive valuation can put a cap on price appreciation even though Thermax's business is relatively better

BUSINESS

Indian Energy Exchange: Strong business performance drives stock to new high

While growth drivers are in place, valuation could limit returns in the near term for Indian Energy Exchange

BUSINESS

Larsen & Toubro sees COVID second wave as a blip, not a derailment

Despite impact of second wave of COVID-19, the company has guided for 13-15 percent revenue growth in FY22 as it thinks the present crisis is short term and its impact would be lesser

TRENDS

Naval Ravikant’s formula for health, wealth and good life

Naval's life equation is gold mine for many curious minds who are eager to learn health, wealth and happiness

BUSINESS

KEC International: Short-term speed breakers; stock trades at reasonable valuations

The KEC stock is still cheap at 12 times its fiscal 2023 estimated earnings, particularly in light of growth, strong balance sheet and orders in hand

BUSINESS

Praj Industries: Two-fold jump in orders fuels strong growth

Recent spike in share price of Praj Industries captures near-term positives

BUSINESS

This single advice of Charlie Munger can improve your thinking ability remarkably

Thinking is crucial, but even equally critical is how to think. Charlie Munger's technique is worth a look

TRENDS

ABB India: Business recovery could take a pause led by second wave of virus

Fundamentals start to reflect second wave of COVID, which may only accentuate in coming months

TRENDS

Power Grid InvIT: Offering good and predictable yield

With secured cash flows, long-term nature of the assets, strong balance sheet, support of the parent and the highest credit rating, the Power Grid InvIT issue should reward its unit holders

BUSINESS

8 big ideas from the book 'The hard thing about hard things'

Author Ben Horowitz talks about why building a company is tough and shares nuggets of wisdom on dealing with these adversities from his own experience

TRENDS

Grauer & Weil (India): A high quality business available at attractive price

Despite the huge stress and crisis caused by COVID-19, Grauer & Weil has remained profitable

MONEYCONTROL-RESEARCH

Indian Energy Exchange: Creating a valuable franchisee model

The company has built a strong competitive advantage and a dominant position in the power trading space. This is only growing as more and more volumes shift to exchanges.

BUSINESS

MTAR: Good long-term play despite strong listing

The strong listing of MTAR Technologies in the secondary market has lifted valuation to around 75 times

BUSINESS

NCC: On the growth runway

With robust earnings visibility and improving execution, earnings are expected to grow strongly over the next two years which would drive the NCC stock

BUSINESS

KEI Industries is back to the growth path

Business activity is returning to pre-covid levels, earnings could surprise on the higher side in the coming quarters

BUSINESS

Reliance Industries: On a four-lane superhighway

The proposed reorganisation of the O2C business adds to the prospect of raising growth capital, which in turn will serve as a catalyst for the legacy growth engine of RIL

BUSINESS

Engineers India: More room for growth

Strong order book recovery in execution to support growth for EIL in coming quarters

BUSINESS

ION Exchange: What ails this company?

Drop in revenues and lower order book raise concerns over ION Exchange's near-term growth

BUSINESS

Power Grid: Focus is on earnings return

With higher capitalisation likely in the current quarter, better utilisation of assets and contribution from other ventures should translate into higher growth for Power Grid in 2020-21

BUSINESS

Va Tech Wabag: Higher execution and improving balance sheet to support growth

Led by higher execution and strong order book, Va Tech Wabag is set to deliver higher growth

MONEYCONTROL-RESEARCH

ABB India: Revival of private capex key to supporting lofty valuation

High price to earnings and lack of growth in the near term for ABB India leave very little for investors