BUSINESS

One market, many moods: Why some sectors are depressed, and some buoyant

Not only between industries, even within an industry there are pockets of boom and gloom. The K-shaped recovery of the economy can impact consumption going ahead.

BUSINESS

Cement demand revives as slack season ends, govt infra spend picks up

Industry margins set to rebound on recovery in prices and drop in fuel costs; UltraTech, JK Cement and Dalmia Bharat are among top analyst stock picks.

BUSINESS

Taking Stock | RBI minutes-triggered volatility mars weekly expiry, indices end lower for the third day

Top Nifty losers included UPL, Mahindra & Mahindra, Bajaj Finserv, Eicher Motors and Tata Motors, with each of these stocks down between 2 and 3.4 percent

BUSINESS

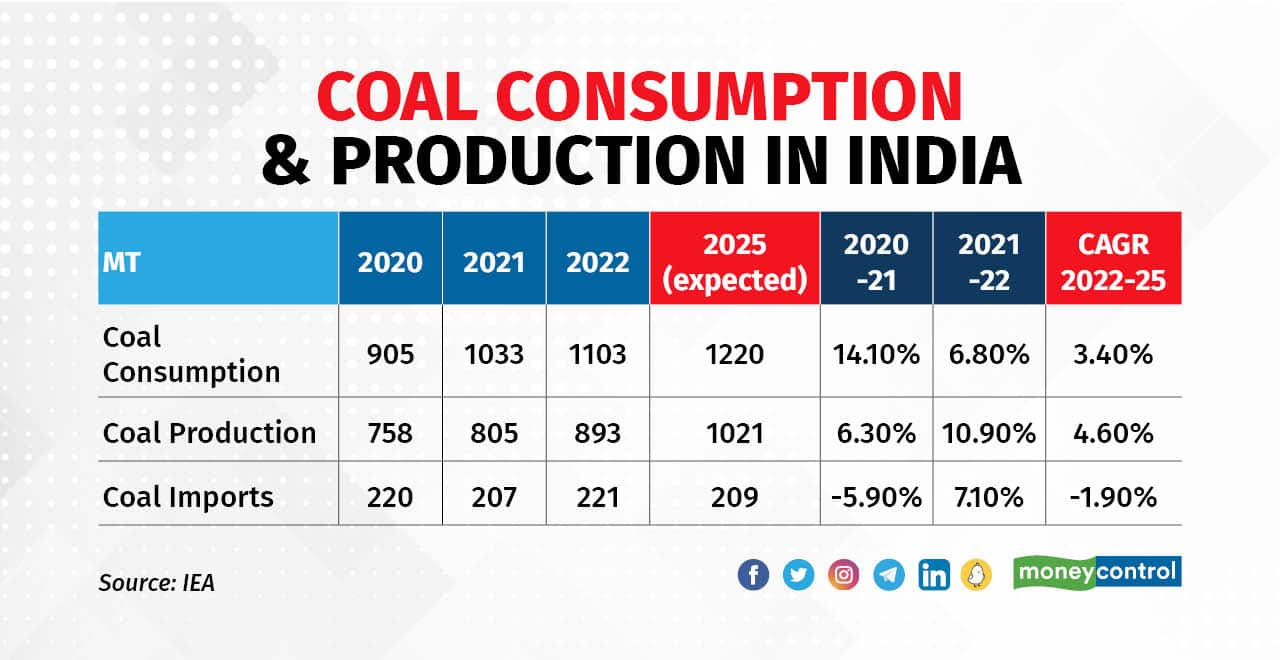

Coal on ‘fire’: India set to be growth engine for global coal demand, says IEA

Demand from power and industrial sectors to lift domestic coal consumption this year from 1,033 MT in 2021, which was a 14 percent rebound from a pandemic low in 2020, says International Energy Agency.

BUSINESS

Taking Stock | COVID fear returns to spook market; Sensex, Nifty down 1%

Adani Enterprises, Adani Ports, IndusInd Bank, Bajaj Finserv and UltraTech Cement were the top Nifty losers, sliding between 2.1 and 6.3 percent

BUSINESS

Markets are no longer betting on divestment as a fiscal cushion, trigger for stocks

For the current fiscal, the finance minister scaled down the target for divestment to Rs 65,000 crore, significantly lower than the previous year’s Rs 1,75,000 crore. Yet even this amount remains unachieved so far.

BUSINESS

MF stakes in November public issues exceed funds deployed in secondary markets

Mutual funds’ holding value at the end of November in newly listed companies stood at about Rs 3,300 crore even as they deployed Rs 1,700 crore in the secondary market

BUSINESS

Budget 2023 | What the market wants to hear from finance minister on Budget day

The hope is that there be no adverse changes in the capital gains tax regime, and for incentives that will promote savings

BUSINESS

Dalmia Bharat set to go national with acquisition of JAL’s cement business

The acquisition will allow Dalmia Bharat to expand into the central region and will represent a significant step towards realising its vision of becoming a pan-India cement company.

BUSINESS

Sula Vineyards Ltd IPO opens today: Should you subscribe?

The company’s market leadership position in the Indian wine market and high entry barriers makes it a strong proposition for investment but the offer being a complete OFS can act as a deterrent

BUSINESS

Raging volatility, end of remote working send Covid investors away from markets

Retail participation, which peaked during the pandemic, has been declining after the markets turned volatile and returns from fixed deposits and bonds started improving.

BUSINESS

Analyst Tracker | Dynamic macros result in more contrarian downgrades than upgrades

Markets run six months ahead of fundamentals. Hence, changes in macros take time to show up in the earnings estimates of analysts.

BUSINESS

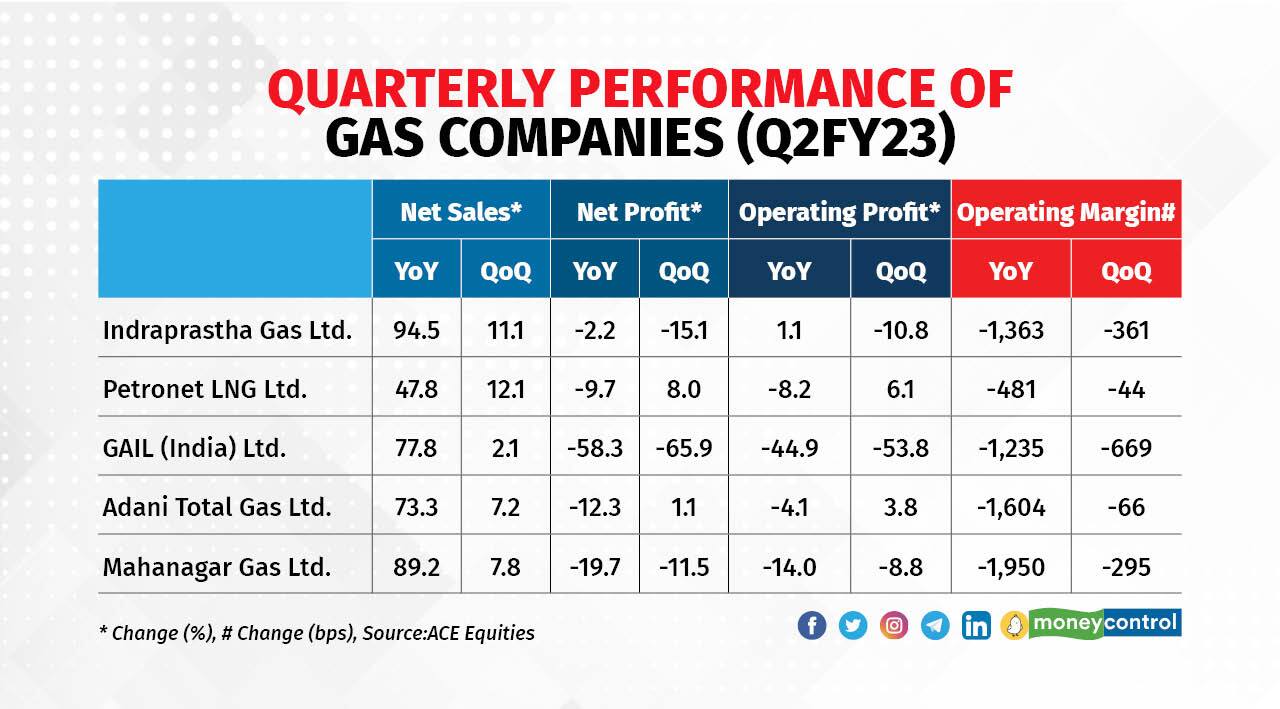

City Gas Distribution – moving towards a better future

In addition to the absolute relief of $2/mmbtu in FY24 (vs Oct 2022 price), the pricing direction announced for the next few years (i.e., escalation of $0.5/mmbtu annually), provides the much-needed visibility and clarity on priority sector gas costs for CGDs, believe experts.

BUSINESS

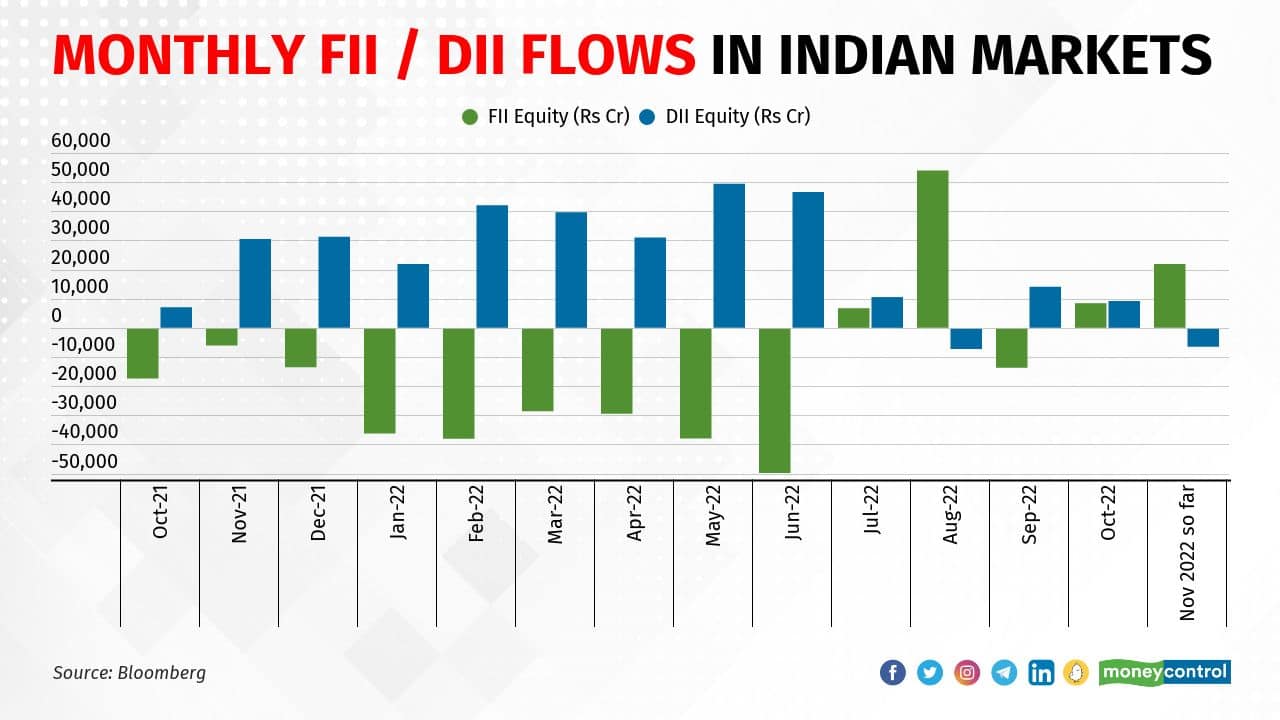

Here’s what December looks like for Indian equities

Data for the last 22 years for December shows that the Nifty has delivered positive returns for investors on 16 occasions — 73 percent of the time — and has generated 2.9 percent average returns during the month over the past 22 years.

BUSINESS

Sensex sizzles as 26 stocks trade above their 200-day moving average

The rising Index, with a high number of constituents participating, confirms a bullish trend and sustainability of the Index at higher levels, say some experts. However, one fund manager says the data hides more than it reveals, given that the returns so far have been abysmal.

BUSINESS

Check out the leaders and laggards behind India's jaw-dropping market performance

12 stocks (comprising 36 percent of Index weight) have generated positive returns while others have declined from the prices they were trading at when the Sensex had hit its previous all-time high last year.

BUSINESS

Nifty at record high: India gains as China lags in MSCI Emerging Market Index, will the trend continue?

India's weight has doubled in the global index in the last two years on market outperformance while China has dropped. Experts see the trend continuing but say high valuations may be a bump

BUSINESS

Steel sector – Export duty cut a welcome step but with limited benefits

Experts suggest it would not be correct to state that the imposition of export duty was the only key reason for correction in domestic steel prices. It should be noted that prices were already in correction mode when the export duty was imposed.

BUSINESS

Capital goods up for a big lift as government, India Inc go aggressive on capex

There are two core drivers of capex in the near term — the National Infrastructure Pipeline (NIP) and capex plans of the private sector driven by multiple sector-specific factors.

BUSINESS

Government policies to play big role in improving fortunes of shares of city gas distribution companies

A committee is expected to propose a formula that helps reduce prices for the priority sector by about $2/mmBtu or so, bringing the price down to $7/mmBtu from more than $9.2/mmBtu now.

BUSINESS

Taking Stock | Market loses steam on lack of fresh triggers, Nifty settles at 18,344

At close, the 30-share pack Sensex recovered slightly from the day’s lows and settled 230 points or 0.37 percent lower at 61,751 while the broader Nifty slipped 65.8 points or 0.36 percent to 18,344.

BUSINESS

Indian markets look pricey but foreign investors bet on robust fundamentals

While the market level valuation ratios look high compared to other markets, one needs to keep in mind that India is a more domestic economy with less impact of global factors

BUSINESS

Major global economies seem to have left worst of inflation behind

The latest CPI and WPI data indicate that inflation has eased. Even inflation data for the US, which is important from a global perspective, suggest that the worst has passed, say experts

BUSINESS

Grasim Industries Q2 Preview: Higher volumes and realization to aid 22% growth in PAT, revenues to rise 43%

Grasim is expected to report a standalone PAT of Rs 1,158 crore for the quarter, and standalone revenues of Rs 7,030 crore.