BUSINESS

RBI has a case to rethink on the proposed liquidity norms on tech-enabled retail deposits

RBI wants banks to be ‘innovative’ in mobilising deposits even as it is framing a rule that’ll essentially burden banks if they use digital channels to get deposits.

BUSINESS

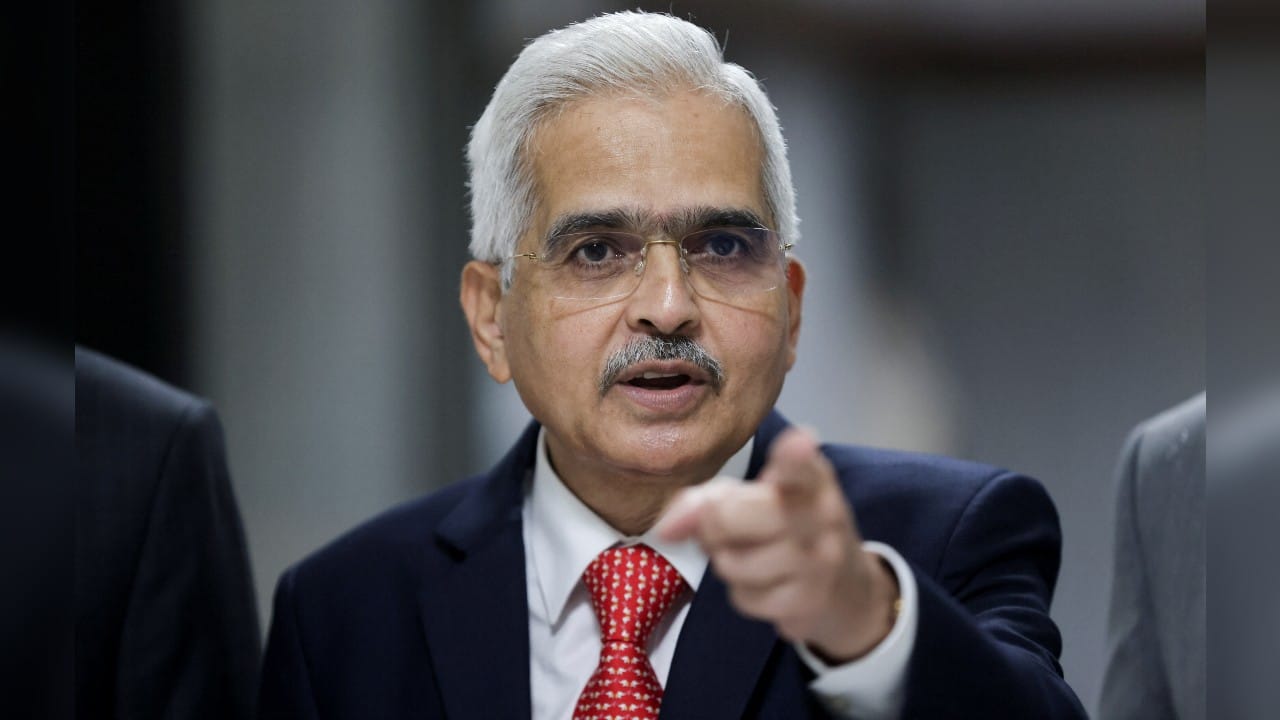

RBI Governor Shaktikanta Das is in no hurry to cut interest rates

In the August review, Das has made a convincing case for the MPC to continue the status quo till the retail inflation falls to the 4% mark. That aligns with the stated position of majority members in the last nine meetings.

BUSINESS

Socialising losses is a bad idea, but PSBs have been doing it all along

Every loan loss mandates banks to provide fully for such loans. In turn, this impacts profitability and capital. In the case of PSBs, the burden of capitalization falls on the government.

BUSINESS

Why is bank credit growth slowing down?

Incremental deposit growth has overtaken credit growth in recent months as banks went aggressive on deposit mobilisation and credit growth slowed following RBI action

BUSINESS

Banking Central | Dear depositor, think twice before you bite the ‘double your money’ bait

Often, individuals or institutions promising too-good-to-be-true returns lure investors into a deadly trap. Always look at promises of unrealistic returns with caution.

BUSINESS

Will the MPC blink this week?

The 8th of August announcement by the RBI Governor is likely to be a dud event for markets. Expect no fireworks for now.

BUSINESS

Banks get a Rs 8,500 crore worth pot of gold from the bottom of the pyramid

Should banks alone be blamed for heavy penalties charged on non-maintenance of minimum balance? In all fairness, state-run banks have been under tremendous pressure by the government to open more accounts.

BUSINESS

Opinion | On technology, RBI must send a more nuanced message to banking industry

The regulator should ensure that its warnings do not have the effect of discouraging tech-enabled transactions. Instead, banks will have to learn to live with the risks of faster transactions, albeit after adopting adequate safeguards.

BUSINESS

RBI’s bank-like PCA framework for bigger co-op banks is good news for depositors

In terms of financial health, most of these banks have been walking on a thin rope. These banks needed more effective monitoring of financials and early recognition of stress, which is what the new PCA framework will do.

BUSINESS

Government’s silence on WazirX mess is unfair to India’s 19 million crypto investors

From an investor point of view, the exchange’s recent announcement to socialise losses is grossly unfair. The key question is why would customers pay the price of WazirX’s inability to safeguard investments?

BUSINESS

Banking Central | RBI’s proposed norms on LCR could be a dampener for some banks

The RBI seems to be a bit worried that in the new era of fast-paced technology (mobile, internet banking), customers can withdraw massive amount of deposits at a click

BUSINESS

India has a small bank problem, and it needs to act soon

Smaller banks are struggling to stay afloat for different reasons. Many have shut shop, others remain as zombie banks.

BUSINESS

Will the government walk the talk on IBC reforms announcements?

In the Budget, FM Nirmala Sitharaman announced a slew of measures to make the IBC process faster. That’s great news to de-clog the system, provided execution is proper

BUSINESS

Did Budget 2024 just add to the woes of PSU banks?

FM Sitharaman’s Budget lacked any major banking sector reforms, except some finetuning of the IBC process. It’s a missed opportunity

BUSINESS

Economic Survey 2023-24 has a word of caution for banks: Resist the lure of short-term profits

In recent years, there have been several cases where banks have been caught red-handed selling products to customers that they don’t require or understand well.

BUSINESS

Banking Central | Big Brother is watching! MFIs get a wake-up call as RBI flags a caution on rate frenzy

Banking Central June 24 edition raised the issue of some MFIs charging too-high-rate-of-interest from borrowers. The RBI has taken note of the issue and has issued a clear warning.

BUSINESS

The $230 million crypto theft at Wazirx a wake-up call for Indian regulators, government

Time and again, the RBI has been cautioning investors on crypto currencies, calling it gambling. This market has been drawing more investors, despite India not having a regulatory framework on crypto. This scenario can’t continue

BUSINESS

Moneycontrol Pro Panorama | Karnataka’s risky experiment on job reservation

In Moneycontrol's Pro Panorama latest edition: Karnataka’s risky experiment for job reservation for locals, how a likely affordable housing push and infra boost in Union Budget could be good news for investors, India completes 55 years of bank nationalisation, and more

BUSINESS

Budget Snapshot | Will IBC reforms get a push from FM Sitharaman?

IBC process needs to be lot quicker. Timeframe needs to be cut to improve recovery percentage for creditors

BUSINESS

Banking Central | June inflation print vindicates MPC move, food prices hold key to rate cuts

Going ahead, the trajectory of food inflation will depend on how the monsoons are playing out through the season. If rains stick to the schedule, food inflation should ease, helping the headline CPI back to the gliding path of the central bank.

BUSINESS

Indian banks may have an agri loan problem ahead

Increasing pace of bank lending in the agriculture sector vs falling contribution to GVA suggests potential build-up of stress.

BUSINESS

Five management lessons for aspiring fintechs from Paytm Bank fiasco

Had PPBL played by the book, Vijay Shekhar Sharma could perhaps have built a pan-India bank riding on the popularity of the Paytm brand and tapping the government’s fintech push. In that sense, it is a wasted opportunity.

BUSINESS

Who will bell the modern-day loan sharks?

Today’s illegal loan apps are nothing but tech-enabled avatars of the old local moneylenders

BUSINESS

Banking Central | Banks look good as bad debts fall, but who pays for the write-offs?

As per the latest Financial Stability Report of RBI, there is a massive drop in both gross and net NPAs of commercial banks. How did this happen and who ultimately pays the price? Read on