BUSINESS

Karnataka Governor's rejection of MFI Ordinance a timely wake-up call for government

An excessive punitive approach not only risks stifling the microfinance sector but also threatens to undermine the very credit ecosystem that sustains the state's most vulnerable populations

BUSINESS

Banking Central | Will rate and tax cuts deliver the promised consumption boost?

A 25 bps rate cut alone is unlikely to significantly reduce EMIs—translating to mere hundreds of rupees in savings for most borrowers.

BUSINESS

Quick Take: Sanjay Malhotra’s first rate cut marks an important policy shift for RBI

A faltering growth scenario required monetary policy support. Inflation, the old nemesis of rate cuts, is no longer breathing fire. The RBI used this window to change tracks

BUSINESS

SBI Q3 numbers tick all the right boxes, but challenges persist

SBI’s asset quality, while stable, hints at lingering fragility within sectors like microfinance

BUSINESS

Moneycontrol Pro Panorama | Asian Paints fades on urban demand, Mint Road holds the palette

The rather disappointing earnings from Asian Paints Ltd., India’s largest paints player, is yet another indicator of a widening dichotomy between the rural and urban demand. While there is a pickup in rural demand, urban demand scenario remains sluggish.

BUSINESS

Chart of the Day | Easing price trends set stage for a Friday rate cut

Food inflation, the villain in India’s inflation story, has finally begun to ease, although it is too early to say whether the decline is deceptive.

BUDGET

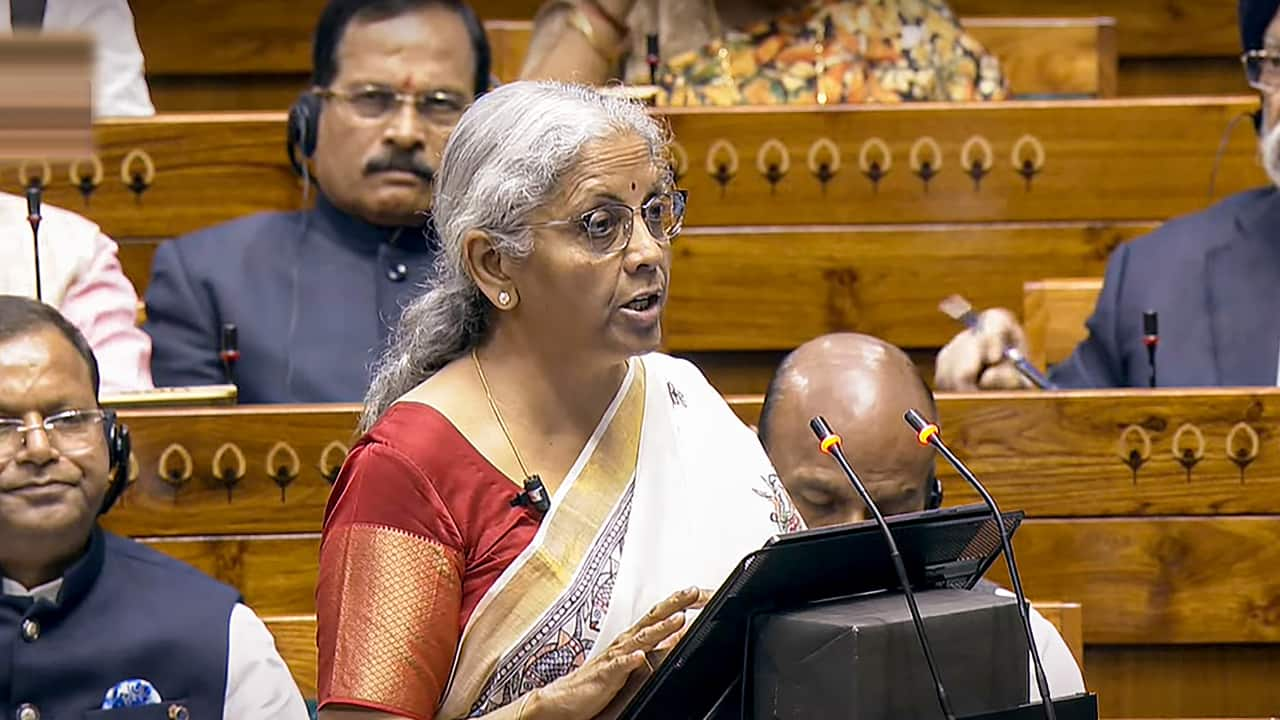

Banking Central | Banks may benefit from FM Nirmala Sitharaman’s Budget credit push

Some measures announced in the Budget 2025 such as support for MSMEs and agriculture may help banks improve credit and deposit growth but these are high-risk segments

BUDGET

Big reforms missing in Budget, but banks could benefit from FM’s consumption boost

If the consumption boost translates into higher credit and deposit growth, the sector might still find reasons to cheer.

BUSINESS

Reforms in Insolvency Code: Why FM must take cues from Economic Survey

More courts, more benches, and better infrastructure were promised, but execution has been sluggish. Without immediate investment in strengthening the NCLT’s capacity, the backlog will only worsen, defeating the very purpose of the IBC

BUSINESS

Moneycontrol Pro Panorama | We expect too much from the Union Budget

In Moneycontrol's Pro Panorama Jan 29 edition: We have had innumerable plans and blueprints. What we need to do is focus on execution

BUSINESS

Karnataka’s proposed MFI Bill can turn out be a double-edged sword for the industry

The proposed bill is intended to address the increasing complaints of harassment by lenders, especially in rural areas, where farmers and marginalized communities have become vulnerable to exploitative lending practices.

BUSINESS

Budget Snapshot | Agri credit target to cross Rs 28 lakh crore in this Budget, what’s in it for banks?

Banks are increasing fund flows to the agriculture sector because it’s an obligation under the rules. Under the priority sector lending (PSL) norms, banks are mandated to lend 18 percent of the adjusted net bank credit to agriculture

BUSINESS

Banking Central| What do the latest bank results tell us about industry trends

The banking sector's December quarter results, so far, reflect an underlying pressure. Banks face the twin challenge of managing the slowdown in credit growth and as keeping deposits healthy

BUSINESS

Moneycontrol Pro Panorama | Is the American dream souring for Indians?

For the Jan 22 edition of Moneycontrol Pro Panorama: The U.S. still holds immense potential, but its once-unquestionable allure is now being viewed through a more pragmatic lens.

BUSINESS

Budget Snapshot | No pressing need to capitalise PSBs in this Budget

The RBI rules require banks to maintain a minimum Capital to Risk-Weighted Assets Ratio (CRAR) of 11.50%. This requirement applies to credit risk, market risk, and operational risk. As the chart shows, most PSBs have a CRAR of 16% and above

BUSINESS

Banking Central| Slower loan growth, rising stress: What do bank earnings tell us about state of economy?

Banks may see slower credit growth and face pressure on interest margins.

BUSINESS

RBI’s aggressive forex interventions have countered volatility, but at what cost?

Foreign exchange interventions, both spot and forward, effectively counter capital flows volatility, with symmetric effects of purchases and sales, says article by RBI researchers

BUSINESS

Moneycontrol Pro Panorama | Rupee’s tantrums throw fresh challenges to MPC

In Moneycontrol Pro Panorama Jan 15 edition: India must boost private investment in roads, decoding indicators to understand market sentiment, government likely to present roadmap on bank privatisation, tackling agriculture productivity challenges, and more

BUSINESS

Budget Snapshot: Will government present a road map on bank privatisation?

Missing the large-ticket reforms in the next five years will put Indian banks one step back. Privatising India's dozen PSBs has been a tough task and an unkept promise

BUSINESS

Small lenders had it tough in 2024, will 2025 see a recovery?

It's not just a funding squeeze that's a bother for MFIs, their asset quality too has shown deterioration in 2024 and there are regulatory concerns on lending discipline

BUSINESS

Banking Central | Why Kerala revenue recovery law tweak leaves banks worried

The amendment to the Kerala Revenue Recovery Act, 1968, will allow the state to intervene in the recovery process. It lets the defaulter to either take back the attached property or sell to repay banks

BUSINESS

Moneycontrol Pro Panorama | Growth worries persist

In Moneycontrol Pro Panorama January 8 edition: Trump 2.0 and the risk it poses for India, challenges India's options market faces, infra sector needs to ensure consistent growth, separating facts about hMPV from fear, and more

BUSINESS

Budget Snapshot: Will Budget 2025 prioritise stress resolution in banking?

An analysis by CareEdge Ratings highlights worsening delays in the corporate insolvency resolution process (CIRP). By September 2024, over 71% of ongoing CIRPs exceeded the 270-day completion timeframe, up from 63% in September 2022 and 67% in September 2023.

BUSINESS

Banks’ Q3 business updates: Why is credit growth slowing sharply?

Business updates of banks suggest slowdown in credit growth and rise in stress across certain categories. Do these signal suggest a deeper demand slowdown?