BUSINESS

Equity mutual funds meltdown: The biggest losers on the day of Lok Sabha election results

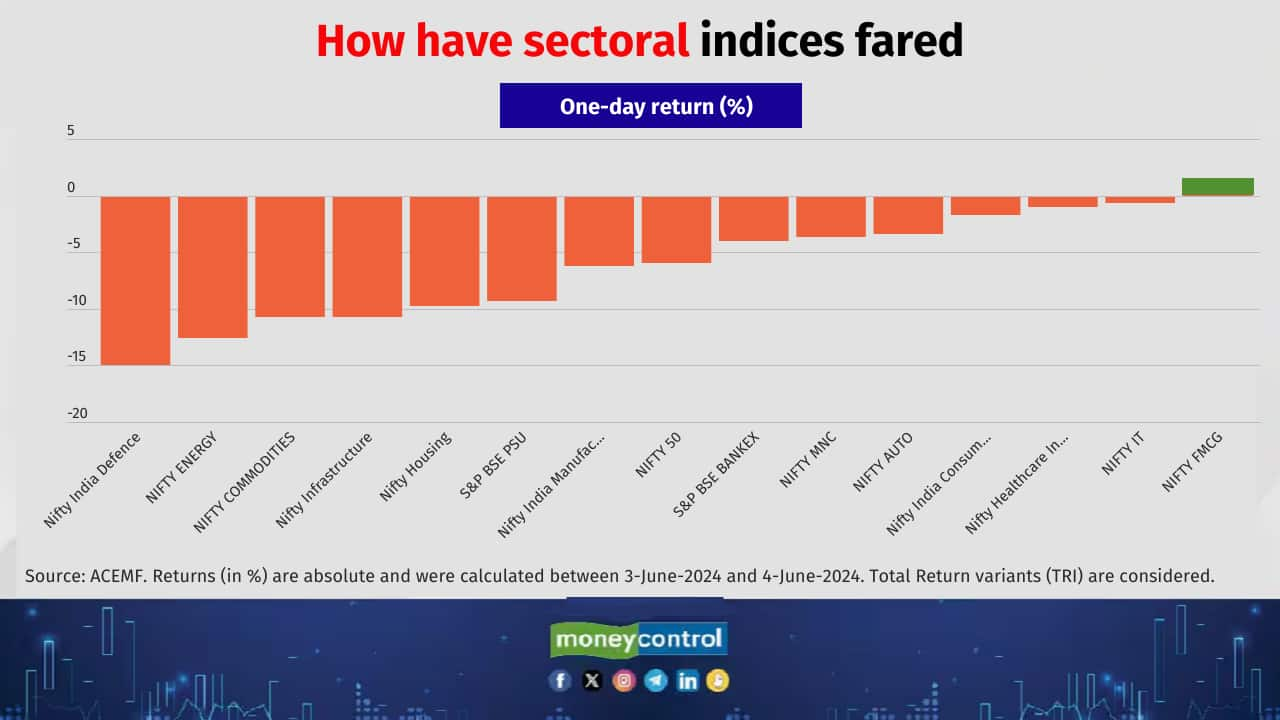

All equity-oriented mutual fund categories were battered on June 4 after it became clear that the BJP won't go past the majority mark on its own and would be heavily dependent on support from allies, with investors being jittery about the stability of the government and 'compulsions' that a coalition regime might face. However, experts advise investors not to be swayed by short-term gyrations and focus on long-term investment goals instead.

BUSINESS

Ignore short-term gyrations. Here are five simple index funds for long-term wealth creation

Don’t be swayed by short-term gyrations, stick to your asset allocation and focus on long-term goals. Here are five passively managed index funds each from the mega, large, mid, small and microcap segments can help you get better returns over the long run

BUSINESS

Check out these election-proof sectors; Are you invested in them?

While some sectors are more sensitive to the possible electoral outcomes, there are those that are impervious — a prudent, defensive hedge, regardless of the results. Here are few sectors that would not be affected by who comes to power, according to six portfolio managers

BUSINESS

10 newly added stocks by MFs that make hay from special situations

Special Situations funds aim to make money from unique events that companies face like corporate restructuring, regulatory changes, technology-led disruption and innovation, new trends and emerging sectors and companies

BUSINESS

Retail investors drive MF growth, here's how they played the game

Retail investors now form a significant chunk of mutual funds investors, which has translated to a monthly SIP contribution of around Rs 20,000 crore

BUSINESS

Fund managers on a treasure hunt in these 10 sectors. Check your portfolio

Fund managers look for sectors with healthy growth potential and consistent profitability. These are the top sub-sectors wherein the fund managers have increased exposure significantly in these sectors over the last three months

BUSINESS

Nifty Realty index delivered 110% last year; check out the hot stocks among fund managers

Rising affordability and stable interest rates have resulted in higher sales of residential properties. Policy support from the government by way of up to 100 percent FDI for townships and settlements, and rising commitment from the PM Awas Yojana have also aided realty companies

BUSINESS

10 mid-cap stocks that large-cap MFs love to hold for higher returns

The outperformance of large-cap mutual fund schemes lies in, among other things, how efficiently fund managers manage the remaining 20 percent portion that they have to invest in small- and mid-cap stocks. These 10 mid-caps stocks tend to spice up the return of large-cap funds thus, in turn, likely to outperform the benchmarks.

BUSINESS

Mid-cap and Small-cap Funds: How can retail investors get the best out of them?

Midcap and smallcap funds have been wealth creators over the long run. However, it is crucial for small investors to be cautious when investing in mid and smallcap funds depending on their risk tolerance. Here we elucidate how small investors can approach mid-cap and smallcap funds

BUSINESS

Top 10 stocks that power MC30 equity schemes

MC30 top funds: The top 10 stocks in a mutual fund scheme, especially an equity scheme, holds significance as a higher weight in them dictate fund performance

BUSINESS

SIPs in MC30 top mutual funds deliver consistent returns

Systematic investment plans (SIP) in mutual funds are used to channelise regular investments in mutual funds. A Moneycontrol study shows that equity schemes from MC30 have largely delivered better returns than the category and the benchmark returns over five-year periods.

BUSINESS

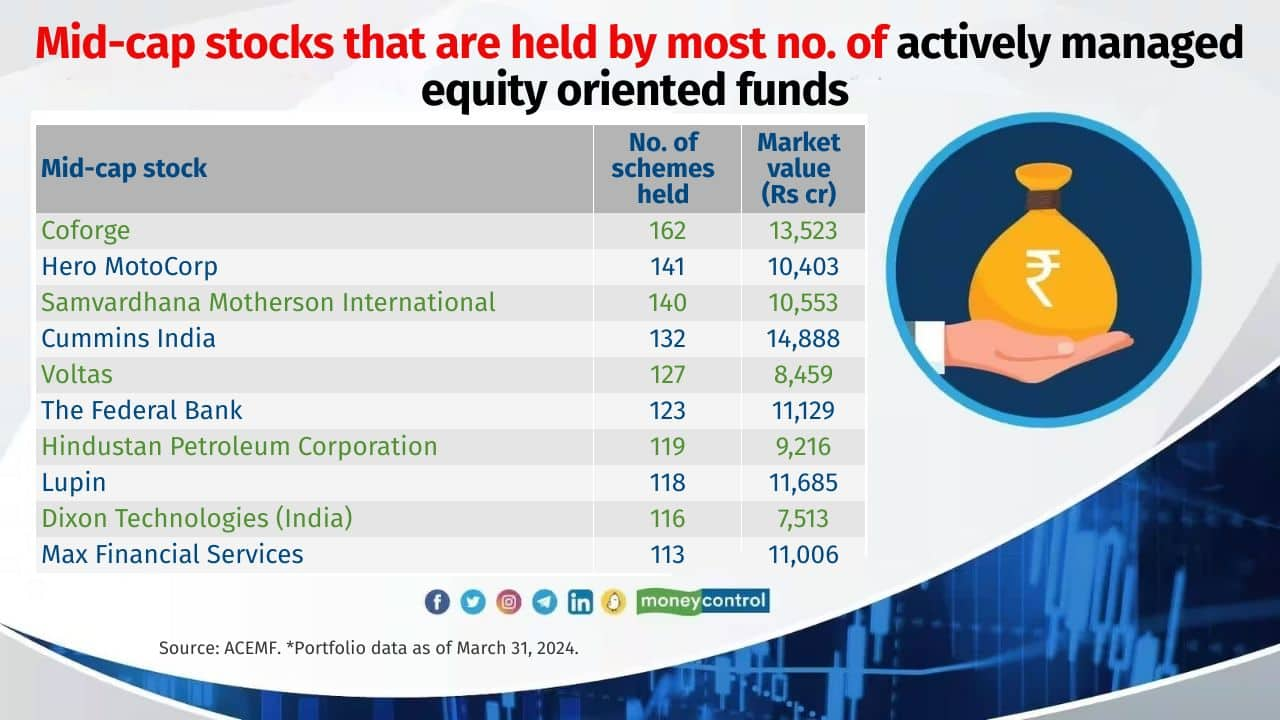

Midcap stocks that find no takers among active fund managers. Check your portfolio

Mid-cap stocks that are part of the portfolio of equity schemes have rewarded the investors. However, companies that lack business sustainability, are buried in debt, do not execute business strategies efficiently, and come with an unattractive valuation, rarely find a place in the portfolio of the actively managed mutual fund schemes.

BUSINESS

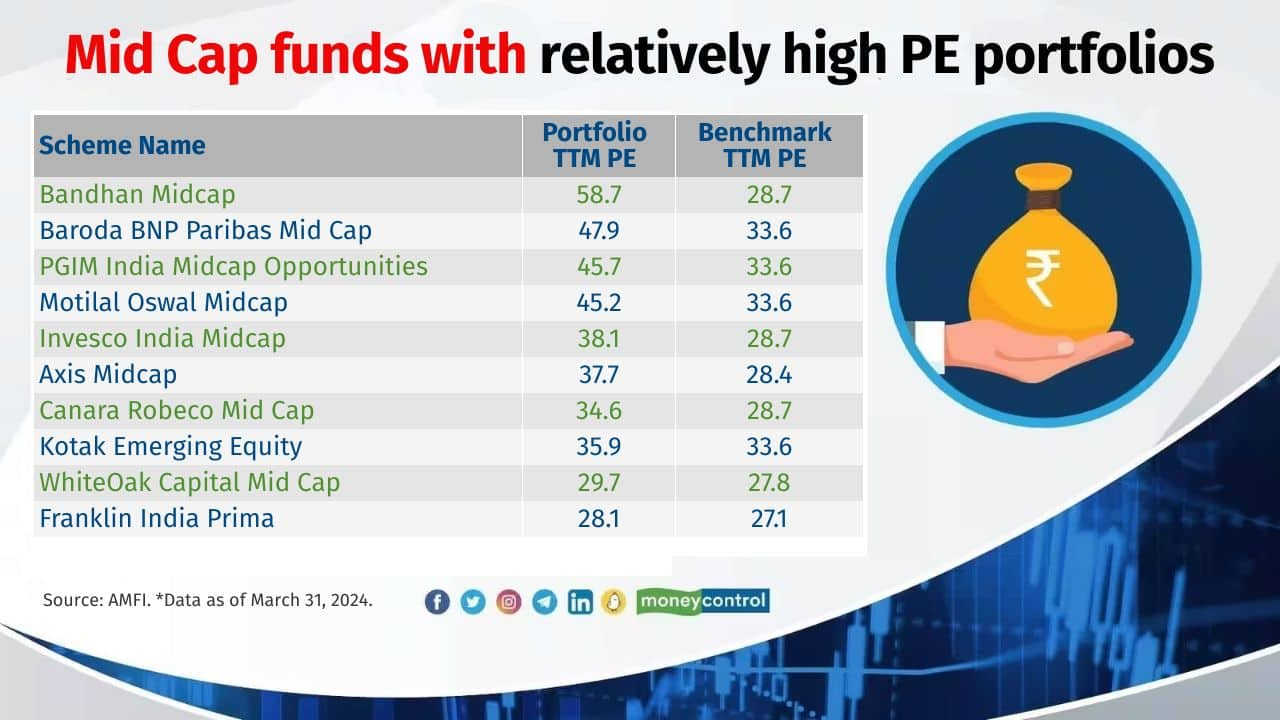

These 15 high-PE stocks make your midcap funds expensive

Companies that have a high growth potential and return on equity command a higher Price-Earning ratio. That isn’t a bad thing, though. High PE might just indicate good future prospects

BUSINESS

MF stress test impact: Stocks that larger-sized smallcap funds increased exposure in March

The liquidity disclosure requirement is unlikely to impact the portfolio construction of the midcap and smallcap funds. Provided, there's a chance that fund managers may increase their holdings in stocks with higher liquidity to be in a better position to compete within the category

BUSINESS

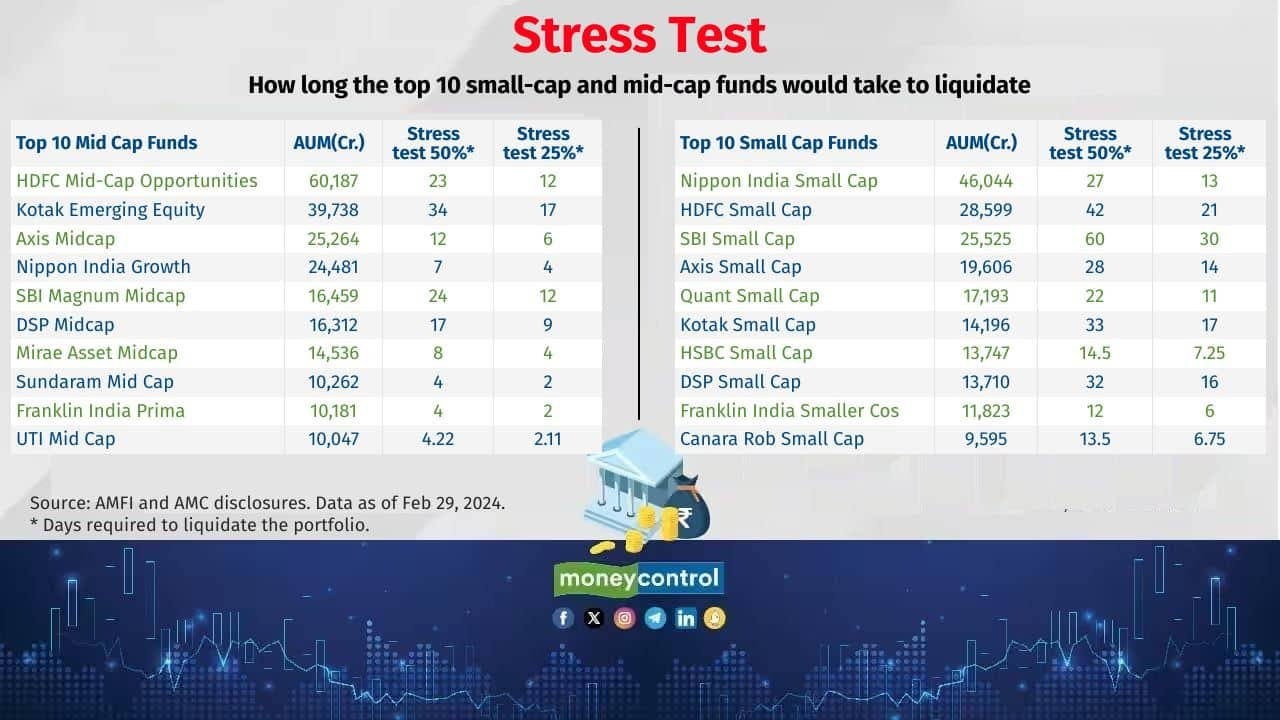

MF Stress Test Round 2: Have top small-cap funds improved their liquidity positions?

The second round results revealed that small-cap funds would need 13.7 days on an average, to liquidate 50 percent of their portfolios, almost similar to the category average of 14 days that was disclosed a month ago

BUSINESS

MF stress test, round 2: How did the 10 largest midcap funds do?

As per the second-round results, mid-cap funds would need 6.5 days on an average, to liquidate 50 percent of their portfolios, almost similar the category average of 6.6 days that was disclosed a month ago

BUSINESS

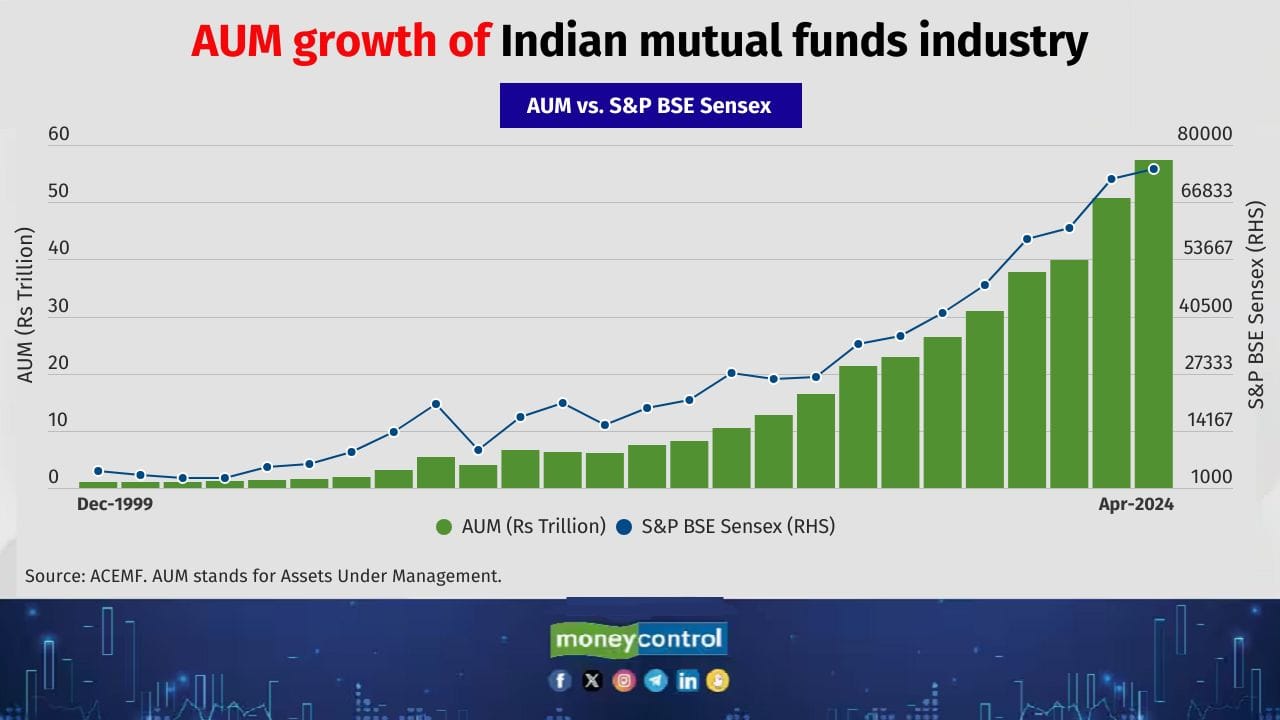

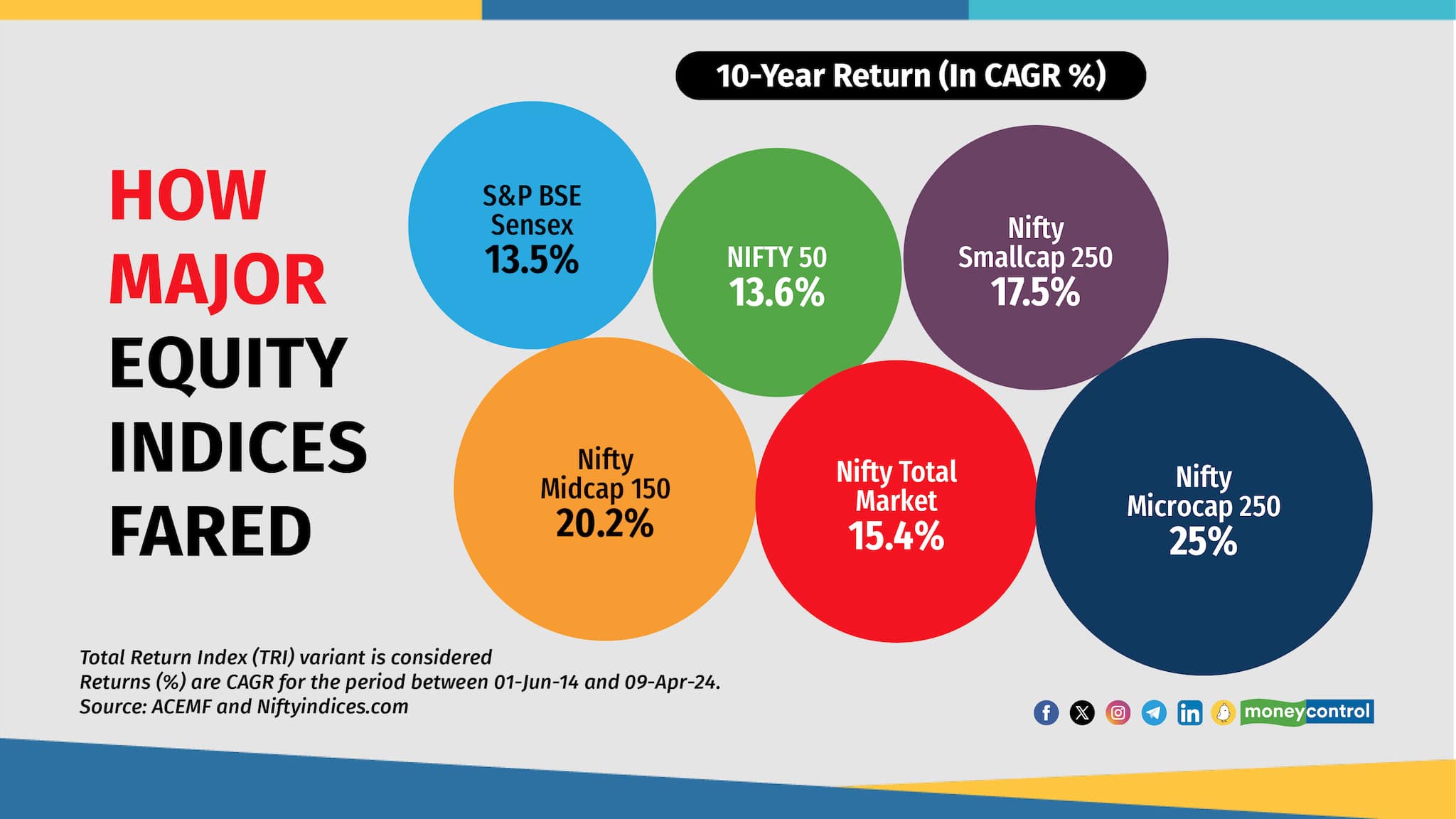

10 years of Modi regime: How mutual funds turned into a must-have investment

The equity market has grown by nearly 14 percent on a 10-year basis, commemorating Narendra Modi-led NDA government. That brought retail investors into mutual funds by the drove as equity funds benefitted

BUSINESS

Sectors that PMS expect big returns from in 2024

From financial services to healthcare and chemicals, here are top sectors that PMS fund managers believe have promising prospects

BUSINESS

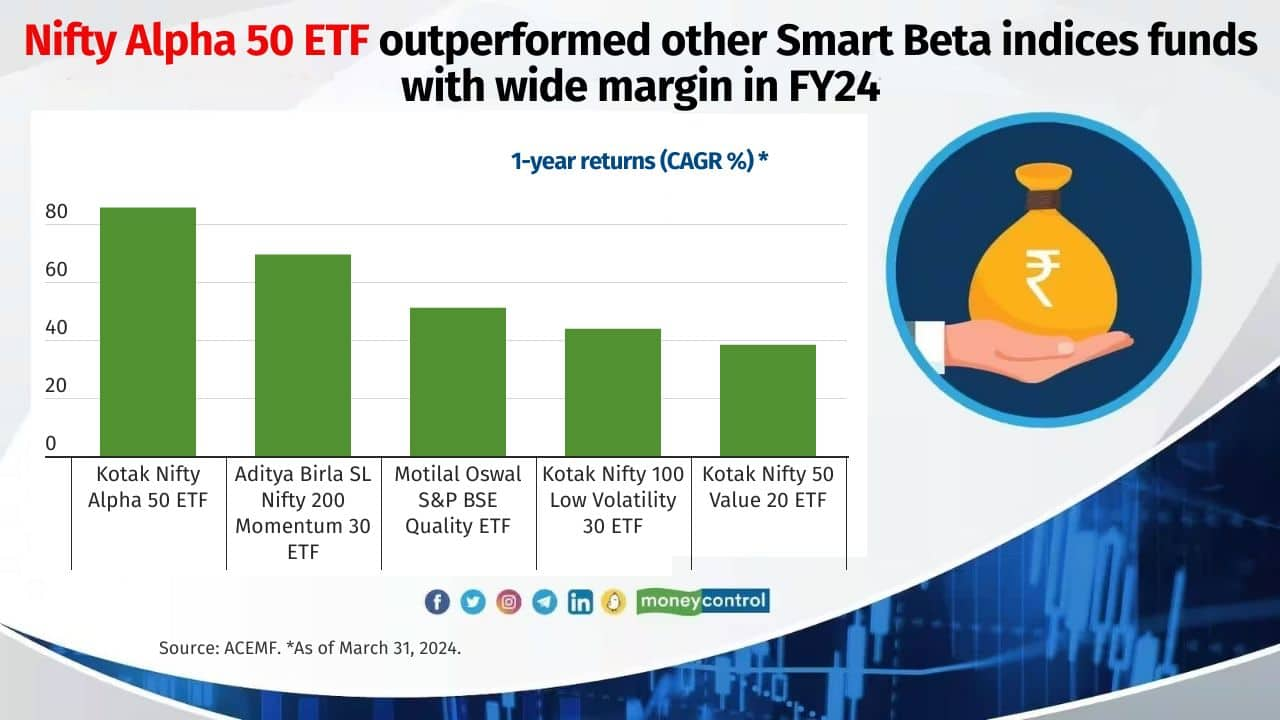

This high alpha strategy fund topped charts in FY24: Here are the Top 10 stocks

Kotak Nifty Alpha 50 ETF tracks ‘Nifty Alpha 50 index’, which measures the performance of the top 50 stocks in terms of higher alpha chosen from the universe of 300 companies

BUSINESS

The winners’ club: Here’s the list of the top performing equity mutual funds across categories in 2023-24

Equity mutual fund schemes that had relatively higher exposures to select PSU, finance, power, construction, defence, and automobiles stocks delivered better returns in FY24

BUSINESS

10 mid-cap gems that children-oriented MFs love to hold for the long term

Children-oriented funds are open-ended schemes with a lock-in period of at least five years or till the time the child attains the age of maturity, whichever is earlier. The compulsory lock-in provides fund managers a leeway to buy quality mid-cap stocks and hold for the long term

BUSINESS

These large-cap multibaggers rewarded MF investors up to 400% in last one year

Large-cap stocks tend to generate relatively lower returns compared to mid-cap and small-cap counterparts over long run, but many can be multibaggers if you pick them after due diligence.

BUSINESS

MF stress test: Check whether your smallcap fund has these illiquid stocks

SEBI asks fund houses to ignore the least 20% illiquid stocks while assessing liquidity. The idea is to let microcaps- the tiniest of the smallcaps- to grow unfettered as they could turn into tomorrow’s multibaggers. In the first such attempt, Moneycontrol identifies these 20% stocks.

BUSINESS

Silver lining from marooned markets: Midcap stocks that turned the latest MF favourites

Frothy market valuation on midcap and smallcap segments has been a concern for the regulator and experts. However, market heightened valuation and volatility have not been a constraint parameter for active fund managers in adding quality midcap stocks to their portfolio