BUSINESS

“Strong buy” smallcap stocks by PMS in November

Strong corporate governance credentials, healthy prospects and right valuation are the few key parameters that the fund managers consider while picking the small- and micro-cap stocks

BUSINESS

Sensex @ 71,000; How larger asset equity MF schemes tweaked their portfolio

The schemes with larger asset size barring smallcap funds have followed buy and hold strategy and deployed the incremental corpus within their existing stocks holdings

BUSINESS

Small-cap, Innovation, logistics: Hot stocks that recently launched NFOs invest in

Newly-launched mutual fund schemes have the daunting task of picking stocks at a time when S&P BSE Sensex hovers around 70,000 mark. Here’s a glimpse into the stock ideas that fund managers are convinced about, in the middle of a market rage.

BUSINESS

Small-cap stocks with innovative business models that mutual funds love to hold

Mutual fund schemes that follow innovation theme try to identify companies across sectors that use new technologies to enhance productivity, involved in emerging technologies and disrupting businesses like e-commerce, fintech, renewable energy, artificial intelligence, electric vehicles, data analytics and cloud computing.

BUSINESS

Mid-cap mania: These ULIPs deliver up to 26% returns in the last 5 years

Only five out of 18 mid-cap focussed ULIP funds outperformed the Nifty Midcap 100-TRI over the last five years

BUSINESS

To get multibaggers, you have to buy into absolute stupidity: Siddhartha Bhaiya, MD, Aequitas PMS

Multibagger investing is about being disciplined and not trying to get rich quickly. Investors need to stay patient and build the patience to swallow multiple drawdowns. It is the multibagger mindset that counts and if you trim your winners, you might not be able to realise the full potential

BUSINESS

Powering small-cap funds: Stocks in top holding that drive performance

The top 10 holdings of a mutual fund scheme drive its performance. This is especially true in case of concentrated funds, but even for well-diversified funds. Typically, weightage of a scheme’s top 10 holdings in a diversified equity fund is around 17-72 percent

BUSINESS

Playing Safe: Large-Cap stocks that Mutual Funds have consistently added

Large-cap stocks have given solace to mutual fund schemes, amidst increasing volatility in small- and mid- cap shares. These are the large-caps that active funds have been adding for the past six months

BUSINESS

Wealth creators: PMSes that delivered up to 37% annual returns in 10 years

These strategies have held major allocation to mid- and small-cap stocks. But remember, PMS schemes come with a minimal investment of Rs 50 lakh and are meant for high-risk taking investors.

BUSINESS

Active fund managers booked profit from these multibaggers. Check your portfolio

After the stellar move in the share prices, mutual funds trimmed exposure in or exited these small-cap companies

BUSINESS

Opportunity in market correction: New midcap stocks that MFs added lately

The correction in equity markets due to geo-political reasons has provided the fund manager to add a fresh position in the quality midcap stocks with attractive valuations

BUSINESS

Long-term smallcap companies that equity savings funds put their money on

Equity Savings funds typically invest in derivative strategies to bring up their equity component to 65 percent, to retain their tax advantage. But they also invest in equities for the long run. Here are their top smallcap bets

BUSINESS

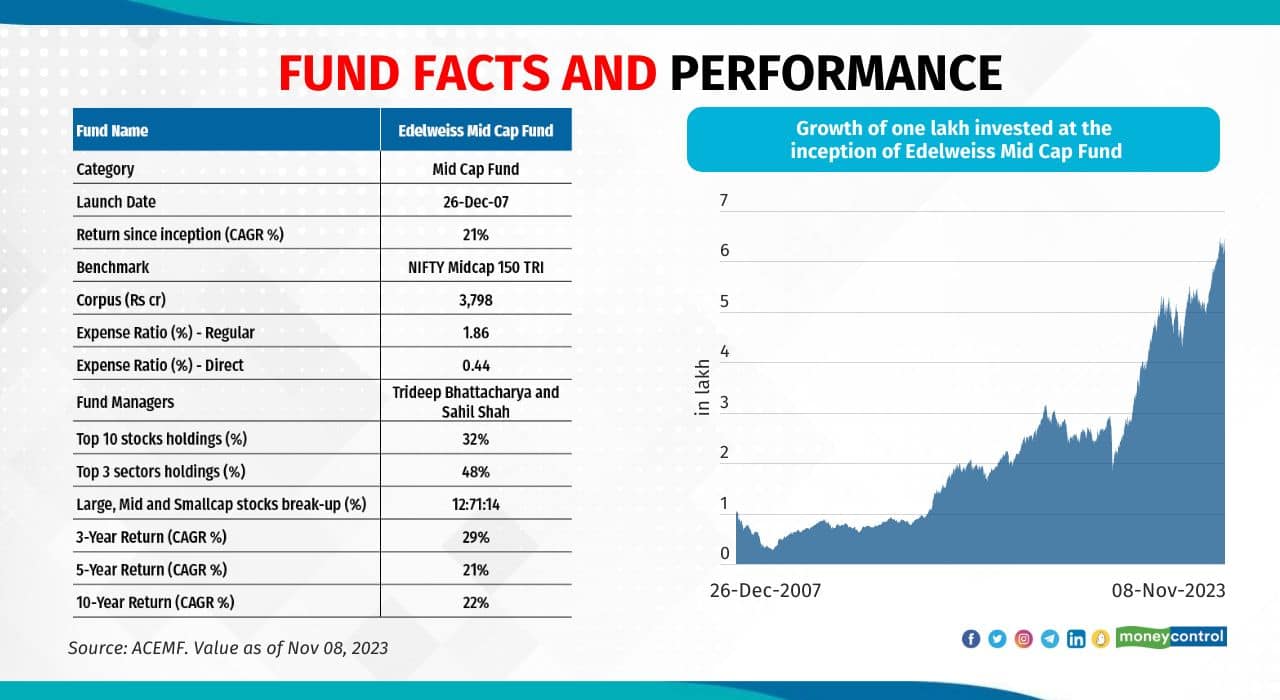

Macro proof your SIPs with this MC30 midcap fund by Edelweiss MF

Investors with medium to high risk profile can consider investing in the Edelweiss Mid Cap Fund for long term given its less macro dependent portfolio that could be less responsive to the short-term gyrations

BUSINESS

Thematic ETFs: Low on liquidity but worth a look

Most of the thematic ETFs trade with thin liquidity, higher tracking error and higher impact cost. Performance of many thematic ETFs has been a mixed bag. However, it is worth looking at them given their investment strategy that can fit the satellite portfolio of an investor with a high risk profile

BUSINESS

In Search For Long-Term Winners: Top stocks that tax-saving MFs have added

Most ELSS schemes have been enjoying the comfort of managing a less active portfolio and follow buy and hold strategy on account of the lock-in

BUSINESS

Contrarian bets in market peaks: Midcap stocks that have turned contra fund favourites

Contra funds identify out of favour stocks due to short term challenges that could have potential to show a turnaround

BUSINESS

Mutual Funds hitch a ride on auto stocks for a drive in the fast lane

India’s auto sector are going through some good times. Softening of raw material prices led to operating margin expansion for auto companies. Increased Government spending too provided a boost to CV and construction equipment sales

BUSINESS

15 smallcap gems that category III AIFs love to hold

Category III Alternative Investment Fund - long only funds are managed like mutual fund schemes. They mostly invest in listed equities across large, mid and smallcap spectrum. But unlike mutual funds, AIFs cater to rich and high networh individuals

BUSINESS

MF industry added these stocks afresh in September. Do you own any?

Instead of holding cash, fund managers find newer opportunities to deploy the fresh flows into the market

BUSINESS

Check out these MF favourite sectors that are undergoing business upcycle

Business Cycle Funds identify sectors that are undergoing a business upcycle or that are expected to and then add stocks within those sectors that stand to benefit

BUSINESS

Hot stocks added by top smallcap funds in September

Fund managers of smallcap funds seem to never shy away from deploying into new opportunities in the smallcap and microcap universes irrespective of market peaks and rich valuations. They spread the risk by adding more stocks to the portfolio

BUSINESS

Enhanced Value index funds topped the return chart past year. Here are their top stocks bet

Value factor tends to be overweight on PSUs and PSBs in India. PSUs and PSBs in Financial Services, Commodities, and Energy sectors have done exceedingly well over the last couple of years

BUSINESS

Time to rebalance your portfolio? Check out these aggressive hybrid funds that provide stability and high growth

With the equity markets are trading at their peak, investors who have achieved their financial targets and also investors with medium risk profile can consider shifting their investments from high-risk investments such as mid- and small-cap funds to relatively less risky funds such as hybrid funds

BUSINESS

Nifty @20K: Can these low volatile stocks cushion your portfolio volatility?

Smart-beta funds, focussed on Nifty100 Low Volatility 30 Index, aim to reduce volatility when equity markets ride high and experts predict a correction ahead. But even diversified funds invest in such stocks