Wealth creators: PMSes that delivered up to 37% annual returns in 10 years

These strategies have held major allocation to mid- and small-cap stocks. But remember, PMS schemes come with a minimal investment of Rs 50 lakh and are meant for high-risk taking investors.

1/11

The equity asset class can be accessed through mutual funds (MF), Portfolio Management Services (PMS) and National Pension System (NPS). All these routes have rewarded investors, but they all experience different types of volatility and different return trajectories. Here, we list the top PMS strategies in terms of their returns over the last 10 years, as per data from PMSBazaar Finalyca. (Among the 58 strategies with a track record of over 10 years) Most in the list have held major allocation to mid- and small-cap stocks. Returns displayed here are as per the Securities and Exchange Board of India-defined time-weighted rate of return (TWRR) method. Returns were as of October 31, 2023 while the portfolio values were as of September 2023

2/11

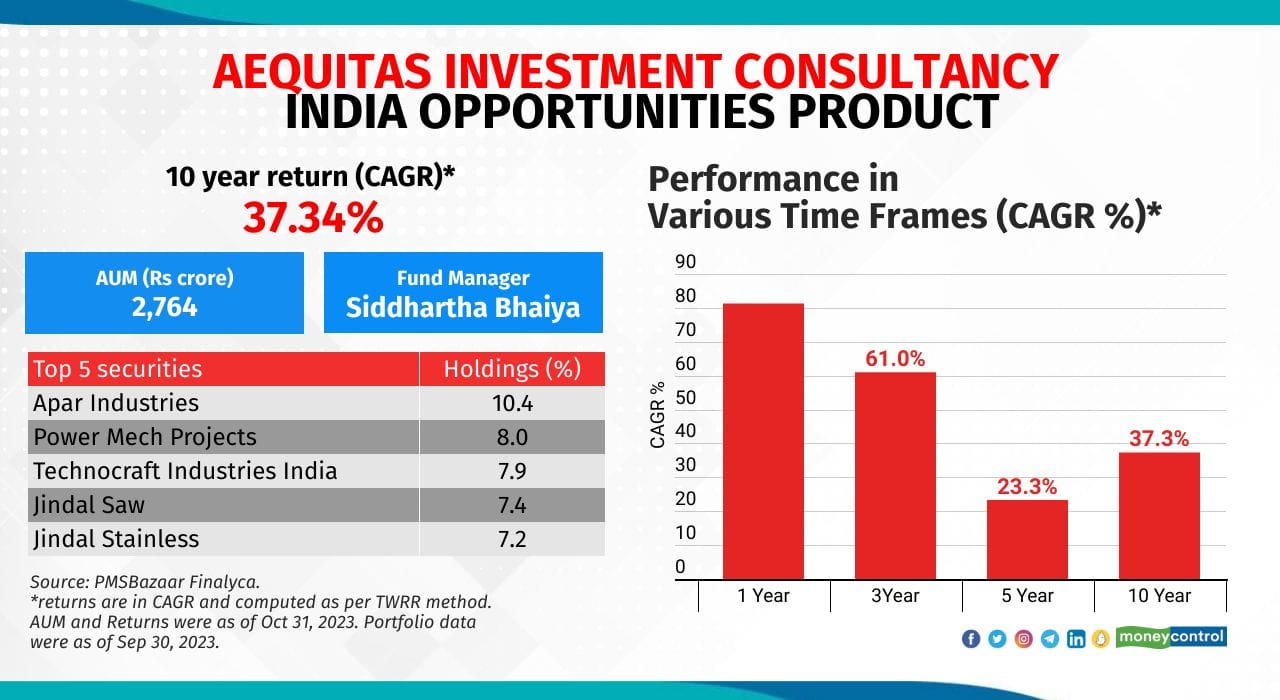

Aequitas Investment Consultancy - India Opportunities Product

Category: Small Cap

Inception date: Feb 01, 2013

Market-Cap break-up: Large-cap (2%), mid-cap (11%), small-cap (83%) and cash (4%)

Secret sauce: Risk averse, Cost efficient, Risk efficient, Simple, Transparent and Easy to manage

Also see: Opportunity in market correction: New midcap stocks that MFs added in October

Category: Small Cap

Inception date: Feb 01, 2013

Market-Cap break-up: Large-cap (2%), mid-cap (11%), small-cap (83%) and cash (4%)

Secret sauce: Risk averse, Cost efficient, Risk efficient, Simple, Transparent and Easy to manage

Also see: Opportunity in market correction: New midcap stocks that MFs added in October

3/11

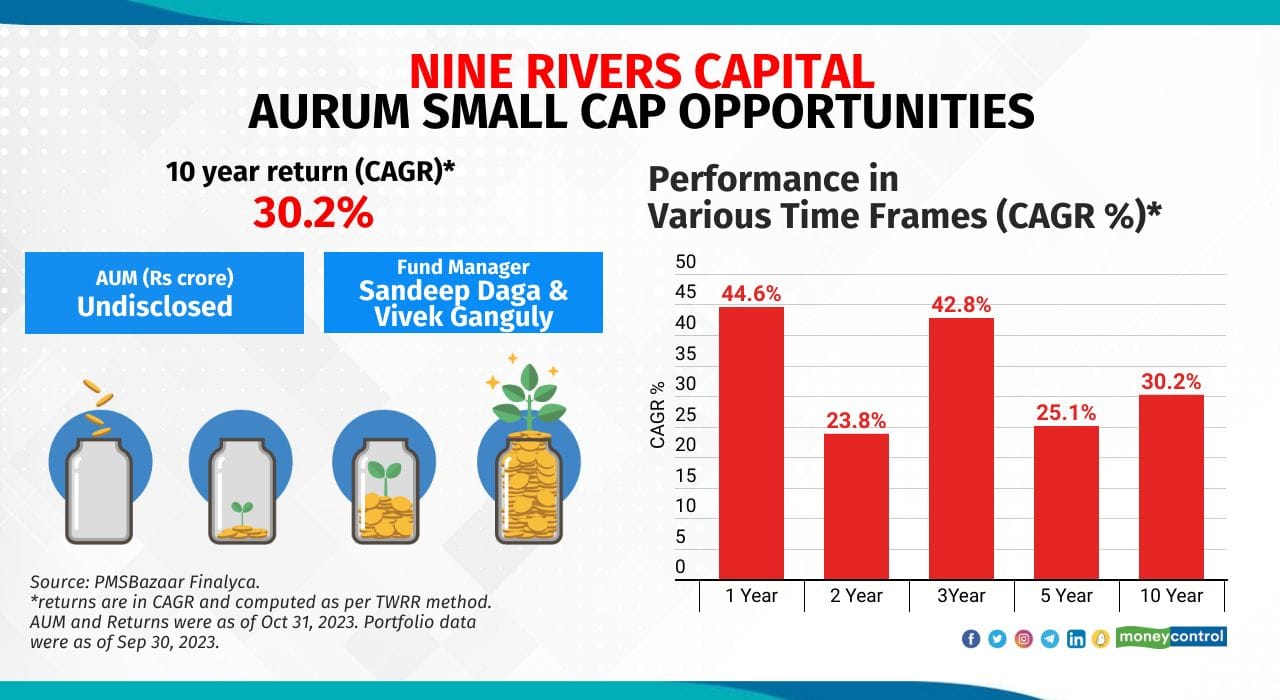

Nine Rivers Capital - Aurum Small Cap Opportunities

Category: Small Cap

Inception date: Dec 31, 2012

Market-Cap break-up: Undisclosed

Secret sauce: Focused investing in 12-15 companies, upto Rs 5000 crore M-CAP with low turnover

Category: Small Cap

Inception date: Dec 31, 2012

Market-Cap break-up: Undisclosed

Secret sauce: Focused investing in 12-15 companies, upto Rs 5000 crore M-CAP with low turnover

4/11

Master Portfolio Services - Master Trust India Growth Strategy

Category: Mid Cap

Inception date: Oct 22, 2011

Market-Cap break-up: Undisclosed

Secret sauce: invests in companies which have underutilised capacities and innovative business models which result in market share gain and margin expansion.

Also see: Active fund managers booked profit from these multibaggers. Check your portfolio

Category: Mid Cap

Inception date: Oct 22, 2011

Market-Cap break-up: Undisclosed

Secret sauce: invests in companies which have underutilised capacities and innovative business models which result in market share gain and margin expansion.

Also see: Active fund managers booked profit from these multibaggers. Check your portfolio

5/11

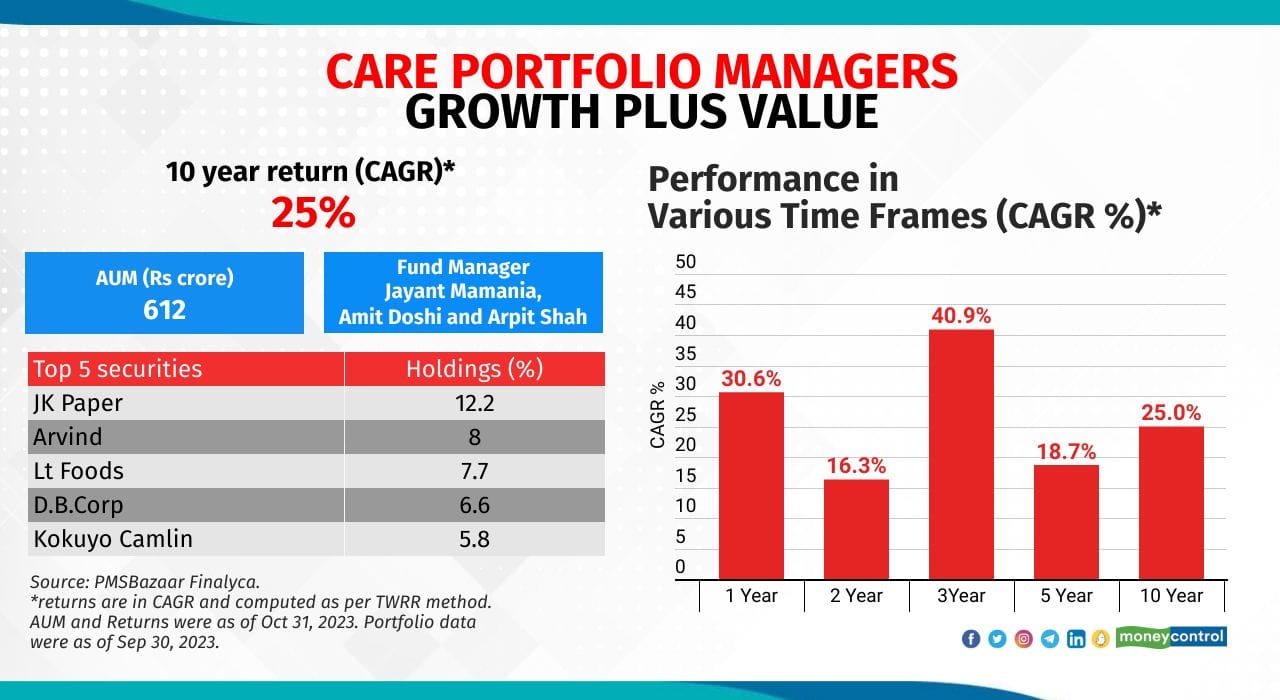

Care Portfolio Managers - Growth Plus Value

Category: Small & Mid Cap

Inception date: Jul 19, 2011

Market-Cap break-up: Large-cap (5%), mid-cap (Nil), small-cap (90%) and cash (5%)

Secret sauce: betting on the dominant players in respective segments. Bottom-up approach of growth potential, strong financials, good management, attractive valuations.

Category: Small & Mid Cap

Inception date: Jul 19, 2011

Market-Cap break-up: Large-cap (5%), mid-cap (Nil), small-cap (90%) and cash (5%)

Secret sauce: betting on the dominant players in respective segments. Bottom-up approach of growth potential, strong financials, good management, attractive valuations.

6/11

Accuracap - Picopower

Category: Small & Mid Cap

Inception date: Oct 10, 2011

Market-Cap break-up: Large-cap (1%), mid-cap (19%), small-cap (75%) and cash (5%)

Secret sauce: Stock selection is based on Artificial Intelligence, focus on business fundamental. Average holding period of stocks around 2 years. It avoids public sector & IPO.

Also see: Long-term smallcap companies that equity savings funds put their money on

Category: Small & Mid Cap

Inception date: Oct 10, 2011

Market-Cap break-up: Large-cap (1%), mid-cap (19%), small-cap (75%) and cash (5%)

Secret sauce: Stock selection is based on Artificial Intelligence, focus on business fundamental. Average holding period of stocks around 2 years. It avoids public sector & IPO.

Also see: Long-term smallcap companies that equity savings funds put their money on

7/11

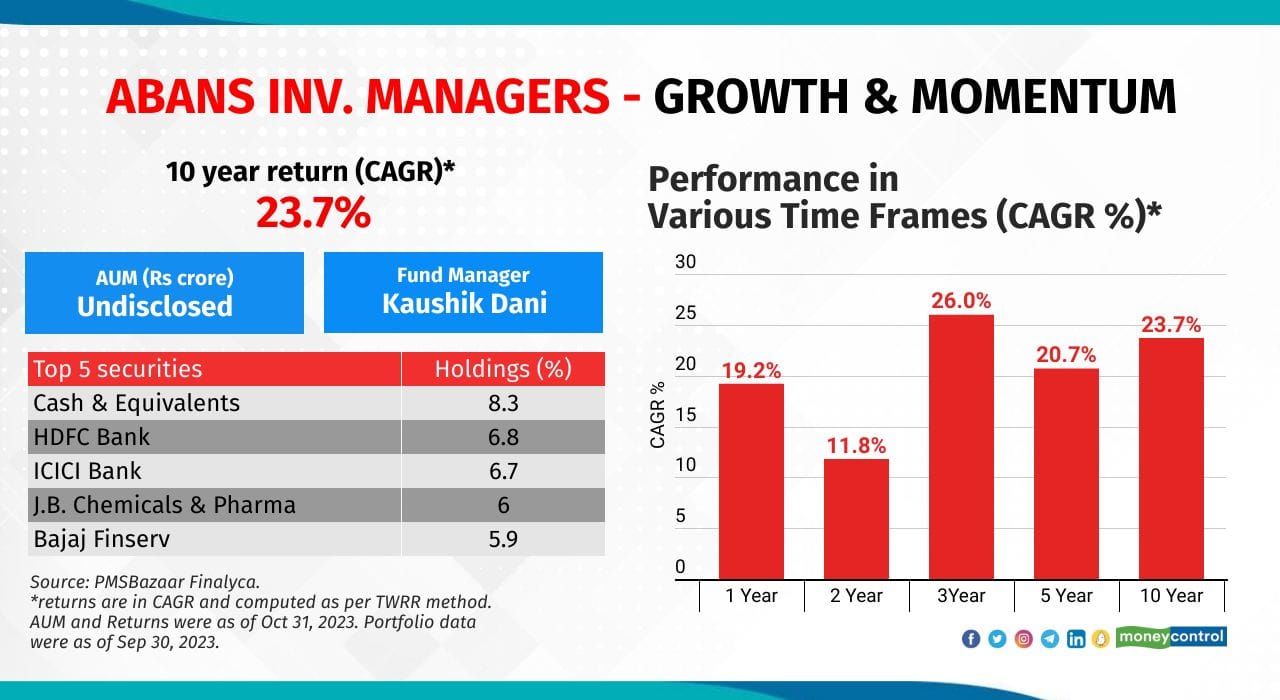

Abans Inv. Managers - Growth & Momentum

Category: Mulit Cap

Inception date: Jan 01, 2012

Market-Cap break-up: Large-cap (34%), mid-cap (26%), small-cap (32%) and cash (8%)

Secret sauce: It holds a concentrated portfolio and follows growth and momentum strategies while picking the stocks.

Category: Mulit Cap

Inception date: Jan 01, 2012

Market-Cap break-up: Large-cap (34%), mid-cap (26%), small-cap (32%) and cash (8%)

Secret sauce: It holds a concentrated portfolio and follows growth and momentum strategies while picking the stocks.

8/11

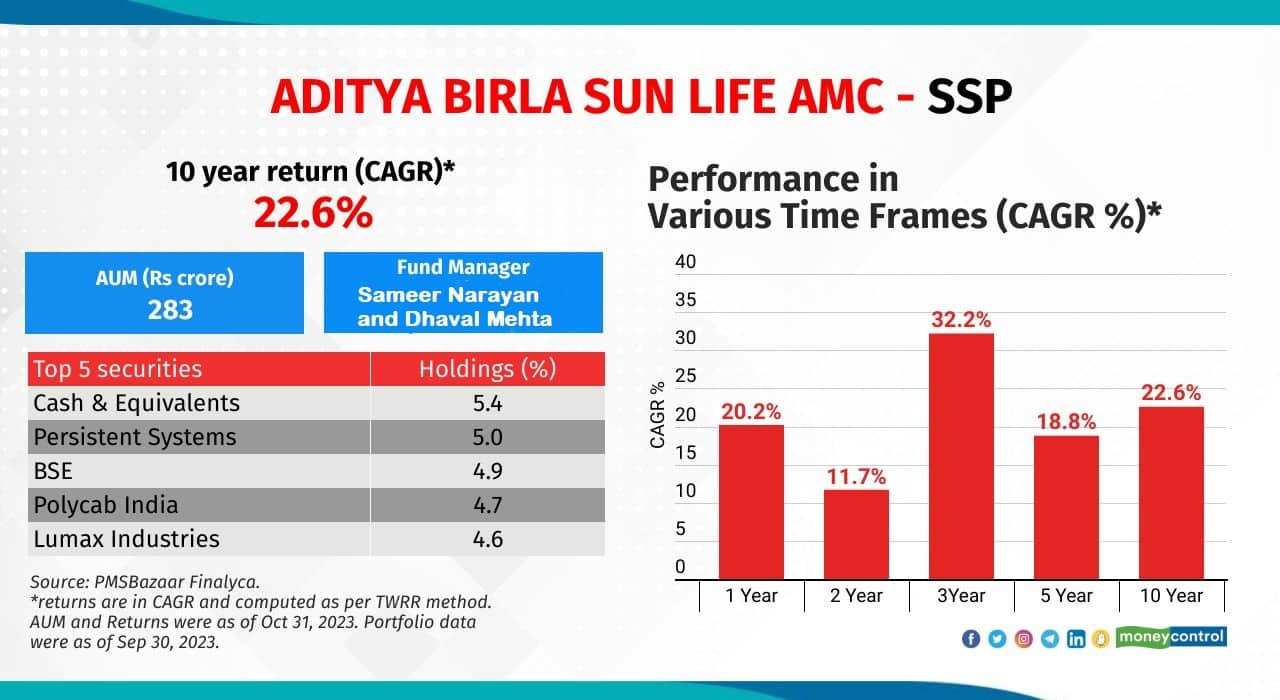

Aditya Birla Sun Life AMC - SSP

Category: Small & Mid Cap

Inception date: Oct 06, 2009

Market-Cap break-up: Large-cap (19%), mid-cap (37%), small-cap (39%) and cash (5%)

Secret sauce: It bets on companies with sustainable growth over long-term in select industries. About 80% portfolio has been invested in 4 to 6 sectors.

Also see: Macro proof your SIPs with this MC30 midcap fund by Edelweiss MF

Category: Small & Mid Cap

Inception date: Oct 06, 2009

Market-Cap break-up: Large-cap (19%), mid-cap (37%), small-cap (39%) and cash (5%)

Secret sauce: It bets on companies with sustainable growth over long-term in select industries. About 80% portfolio has been invested in 4 to 6 sectors.

Also see: Macro proof your SIPs with this MC30 midcap fund by Edelweiss MF

9/11

Centrum PMS - Multibagger

Category: Mid Cap

Inception date: Mar 05, 2012

Market-Cap break-up: Large-cap (5%), mid-cap (22%), small-cap (69%) and cash (4%)

Secret sauce: It invests in deep value stocks across sectors and segments. It identifies turnaround situation that are due to various factors like change in management, demand-supply scenario, improved business environment, favorable government policies, among others.

Category: Mid Cap

Inception date: Mar 05, 2012

Market-Cap break-up: Large-cap (5%), mid-cap (22%), small-cap (69%) and cash (4%)

Secret sauce: It invests in deep value stocks across sectors and segments. It identifies turnaround situation that are due to various factors like change in management, demand-supply scenario, improved business environment, favorable government policies, among others.

10/11

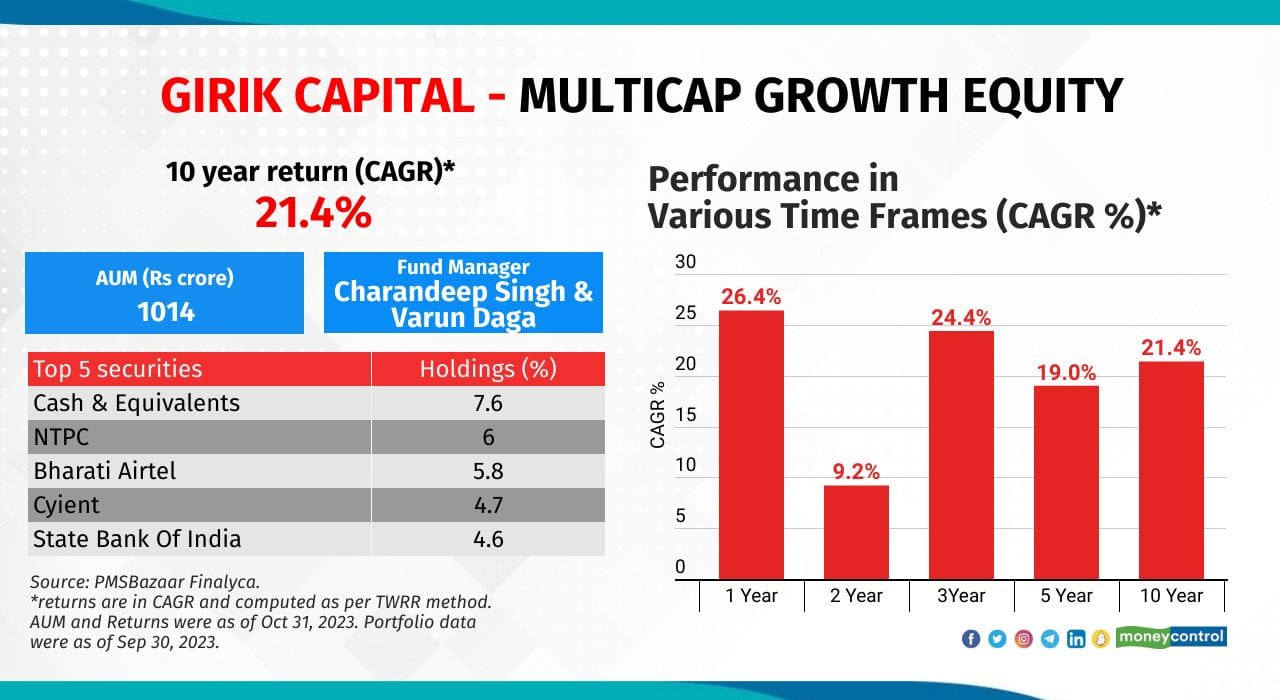

Girik Capital - Multicap Growth Equity

Category: Multicap

Inception date: Dec 03, 2009

Market-Cap break-up: Large-cap (39%), mid-cap (11%), small-cap (43%) and cash (7%)

Secret sauce: The portfolio of the strategy tries to identify “Early Leaders or Winners” much ahead of their largest earnings growth curve.

Category: Multicap

Inception date: Dec 03, 2009

Market-Cap break-up: Large-cap (39%), mid-cap (11%), small-cap (43%) and cash (7%)

Secret sauce: The portfolio of the strategy tries to identify “Early Leaders or Winners” much ahead of their largest earnings growth curve.

11/11

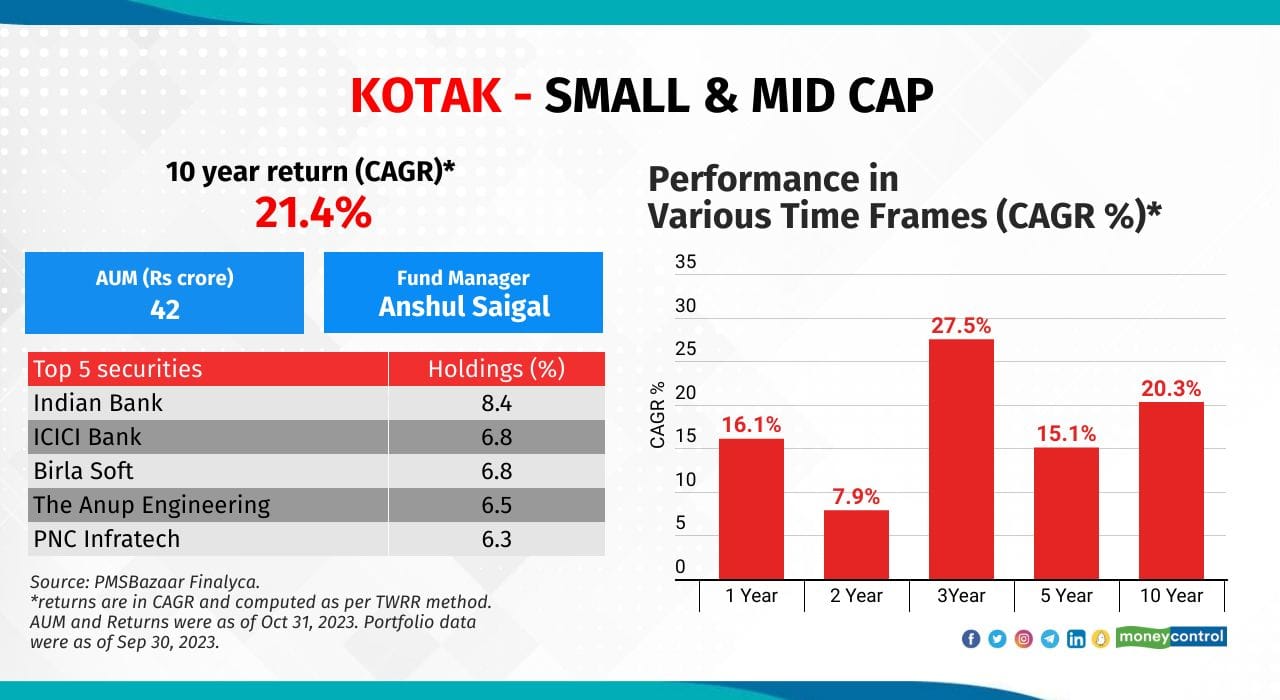

Kotak - Small & Mid Cap

Category: Small and Mid Cap

Inception date: Apr 30, 2012

Market-Cap break-up: Large-cap (13%), mid-cap (16%), small-cap (70%) and cash (1%)

Secret sauce: The portfolio follows a stock-specific approach with a medium to long term perspective. It invests across sectors with a bias to invest in companies backed by able managements with sound fundamentals and strong future potential.

Also see: Thematic ETFs: Low on liquidity but worth a look

Category: Small and Mid Cap

Inception date: Apr 30, 2012

Market-Cap break-up: Large-cap (13%), mid-cap (16%), small-cap (70%) and cash (1%)

Secret sauce: The portfolio follows a stock-specific approach with a medium to long term perspective. It invests across sectors with a bias to invest in companies backed by able managements with sound fundamentals and strong future potential.

Also see: Thematic ETFs: Low on liquidity but worth a look

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!