Small-cap, Innovation, logistics: Hot stocks that recently launched NFOs invest in

Newly-launched mutual fund schemes have the daunting task of picking stocks at a time when S&P BSE Sensex hovers around 70,000 mark. Here’s a glimpse into the stock ideas that fund managers are convinced about, in the middle of a market rage.

1/10

From a small-cap fund, an innovations funds that invest in innovative sectors and stocks to a transportation and logistics-themed sector fund, new mutual fund schemes continue to be launched.

In 2023 so far, 219 new fund offers (NFOs) have been launched, as against the 252 NFOs launched in 2022.

Here we compile the top 10 stock holdings of the newly launched active equity schemes. Schemes with inception date of after October 1, 2023 are considered.

These portfolio holdings reflect the current trends identified by fund managers and their convictions on the market movement.

Portfolio data are as of November 2023. Source: ACEMF.

In 2023 so far, 219 new fund offers (NFOs) have been launched, as against the 252 NFOs launched in 2022.

Here we compile the top 10 stock holdings of the newly launched active equity schemes. Schemes with inception date of after October 1, 2023 are considered.

These portfolio holdings reflect the current trends identified by fund managers and their convictions on the market movement.

Portfolio data are as of November 2023. Source: ACEMF.

2/10

HDFC Pharma and Healthcare Fund

Category: Sector Fund

Inception Date: 04-Oct-2023

AUM (First Portfolio): Rs 507 crore

Category: Sector Fund

Inception Date: 04-Oct-2023

AUM (First Portfolio): Rs 507 crore

3/10

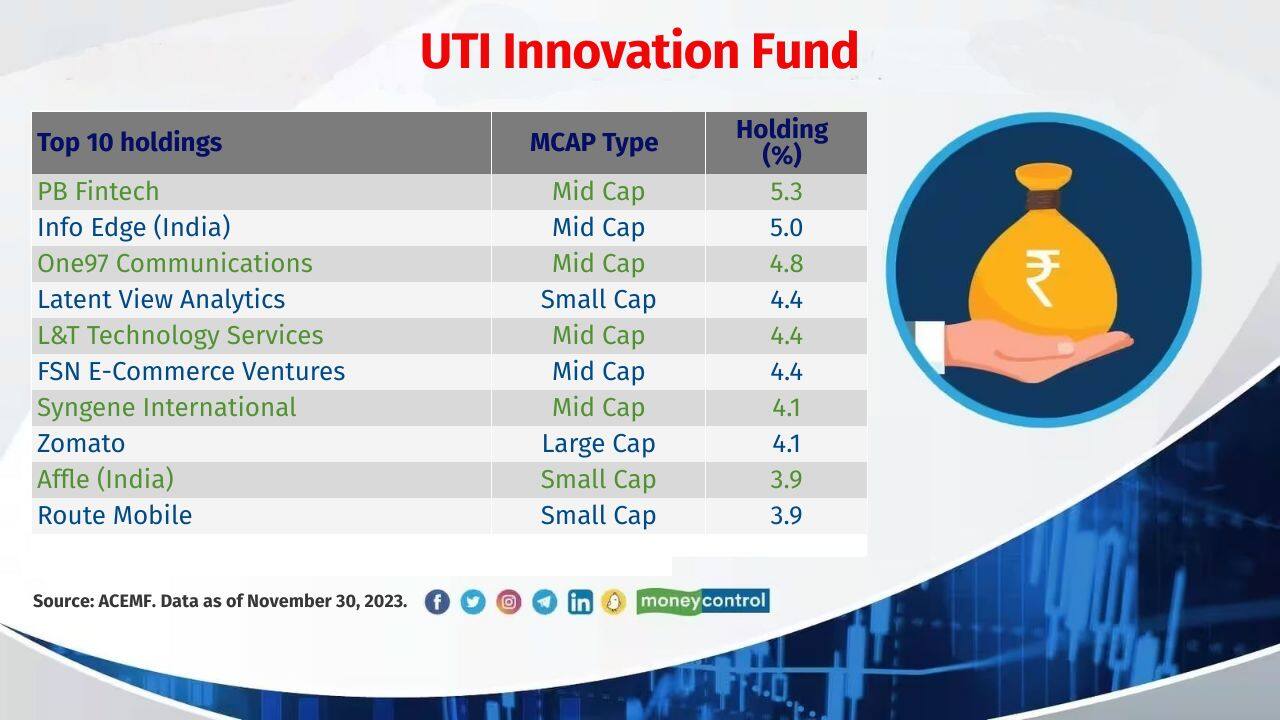

UTI Innovation Fund

Category: Thematic Fund

Inception Date: 13-Oct-2023

AUM (First Portfolio): Rs 449 crore

Also see: Opportunity in market correction: New midcap stocks that MFs added lately

Category: Thematic Fund

Inception Date: 13-Oct-2023

AUM (First Portfolio): Rs 449 crore

Also see: Opportunity in market correction: New midcap stocks that MFs added lately

4/10

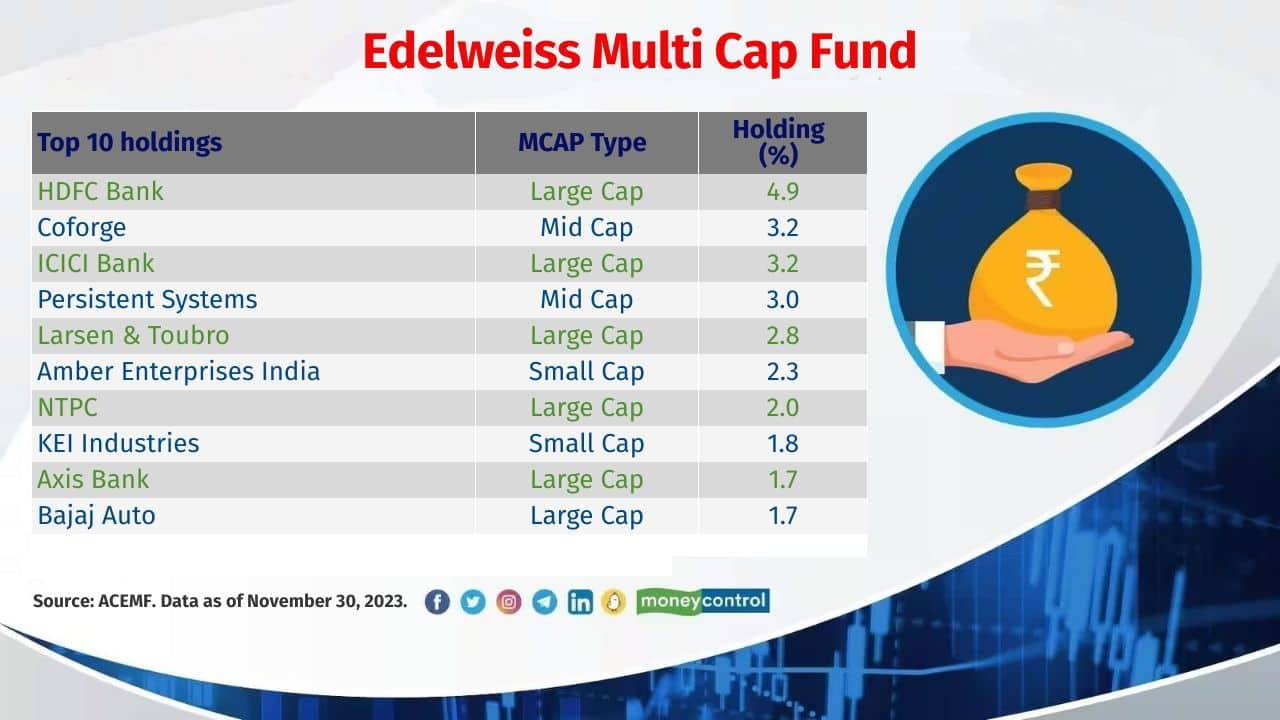

Edelweiss Multi Cap Fund

Category: Multi Cap Fund

Inception Date: 25-Oct-2023

AUM (First Portfolio): Rs 992 crore

Category: Multi Cap Fund

Inception Date: 25-Oct-2023

AUM (First Portfolio): Rs 992 crore

5/10

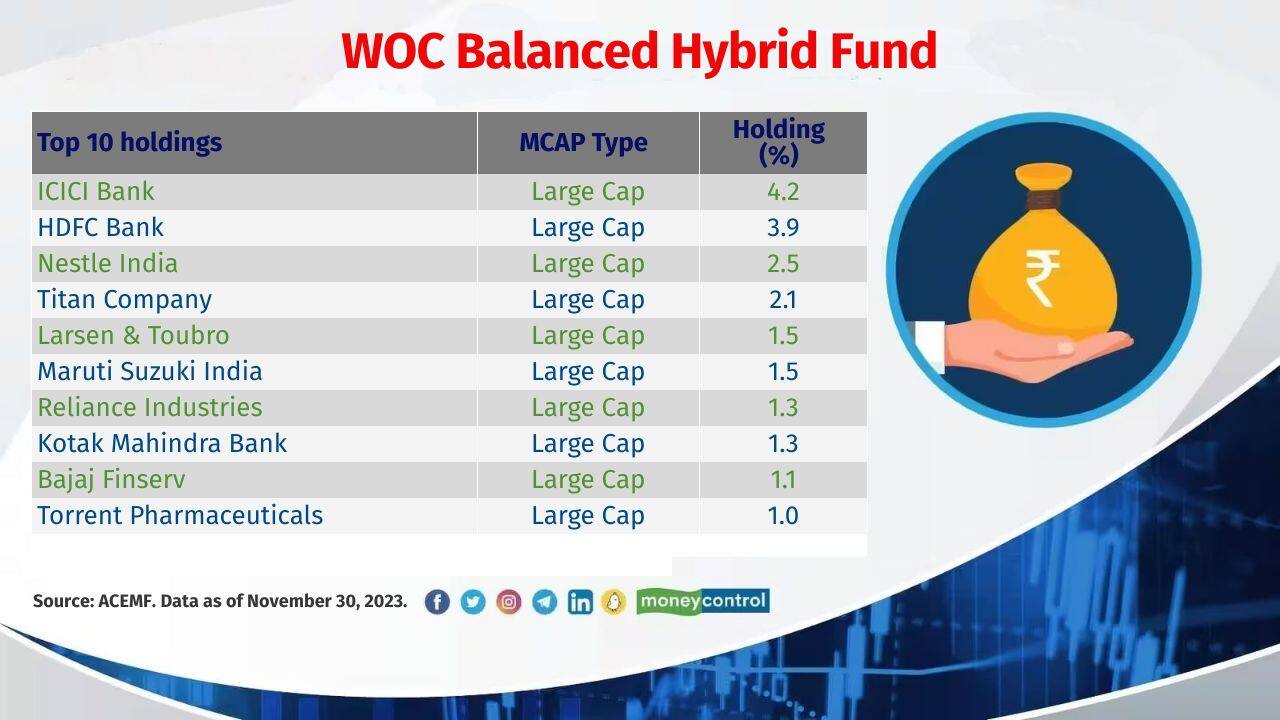

WOC Balanced Hybrid Fund

Category: Balanced Hybrid Fund

Inception Date: 27-Oct-2023

AUM (First Portfolio): Rs 66 crore

Also see: Active fund managers booked profit from these multibaggers. Check your portfolio

Category: Balanced Hybrid Fund

Inception Date: 27-Oct-2023

AUM (First Portfolio): Rs 66 crore

Also see: Active fund managers booked profit from these multibaggers. Check your portfolio

6/10

Baroda BNP Paribas Small Cap Fund

Category: Small cap Fund

Inception Date: 30-Oct-2023

AUM (First Portfolio): Rs 1106 crore

Also see: To get multibaggers, you have to buy into absolute stupidity: Siddhartha Bhaiya, MD, Aequitas PMS

Category: Small cap Fund

Inception Date: 30-Oct-2023

AUM (First Portfolio): Rs 1106 crore

Also see: To get multibaggers, you have to buy into absolute stupidity: Siddhartha Bhaiya, MD, Aequitas PMS

7/10

Quantum Small Cap Fund

Category: Small cap Fund

Inception Date: 03-Nov-2023

AUM (First Portfolio): Rs 29 crore

Category: Small cap Fund

Inception Date: 03-Nov-2023

AUM (First Portfolio): Rs 29 crore

8/10

Helios Flexi Cap Fund

Category: Flexi Cap Fund

Inception Date: 13-Nov-2023

AUM (First Portfolio): Rs 624 crore

Also see: Mid-cap mania: These ULIPs deliver up to 26% returns in the last 5 years

Category: Flexi Cap Fund

Inception Date: 13-Nov-2023

AUM (First Portfolio): Rs 624 crore

Also see: Mid-cap mania: These ULIPs deliver up to 26% returns in the last 5 years

9/10

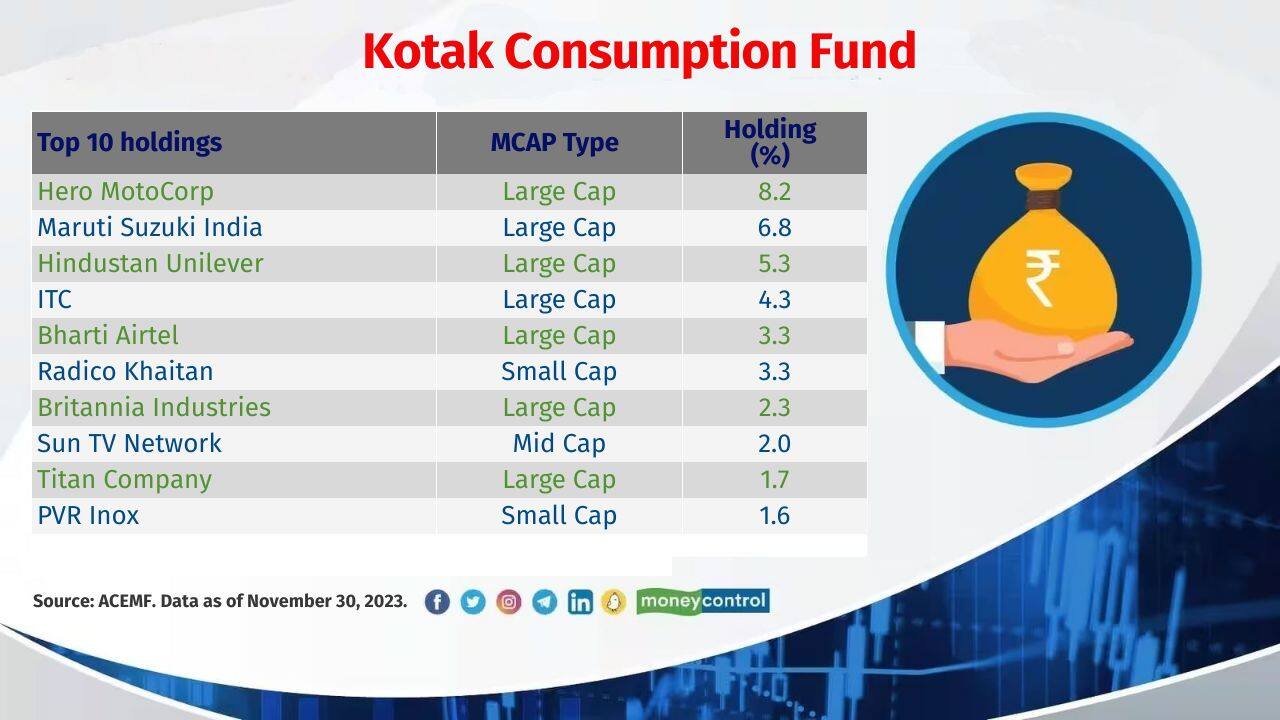

Kotak Consumption Fund

Category: Sector Fund

Inception Date: 16-Nov-2023

AUM (First Portfolio): Rs 332 crore

Category: Sector Fund

Inception Date: 16-Nov-2023

AUM (First Portfolio): Rs 332 crore

10/10

Aditya Birla SL Transportation and Logistics Fund

Category: Thematic Fund

Inception Date: 17-Nov-2023

AUM (First Portfolio): Rs 884 crore

Also see: Small-cap stocks with innovative business models that mutual funds love to hold

Category: Thematic Fund

Inception Date: 17-Nov-2023

AUM (First Portfolio): Rs 884 crore

Also see: Small-cap stocks with innovative business models that mutual funds love to hold

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!