BUSINESS

Jubilant FoodWorks: India business picking up, valuation expensive

JFL is expecting growth momentum to pick up in India, led by healthy network expansion as well as continued robust LFL growth.

BUSINESS

Mass and premium consumption goods to both benefit from Union Budget 2025-26

More disposable income in the hands of tax payers and higher allocation to rural schemes will propel buying by consumers

BUSINESS

Tax relief to propel discretionary consumption

Companies engaged in apparel, footwear, QSR, jewellery, and personal care likely to benefit

BUSINESS

Can consumption get a lift from the Budget 2025?

The govt’s focus will continue to be on infrastructure and job creation. However, given the fiscal constraints and depreciation of the INR against the USD, the govt has limited space to provide direct consumption boost.

BUSINESS

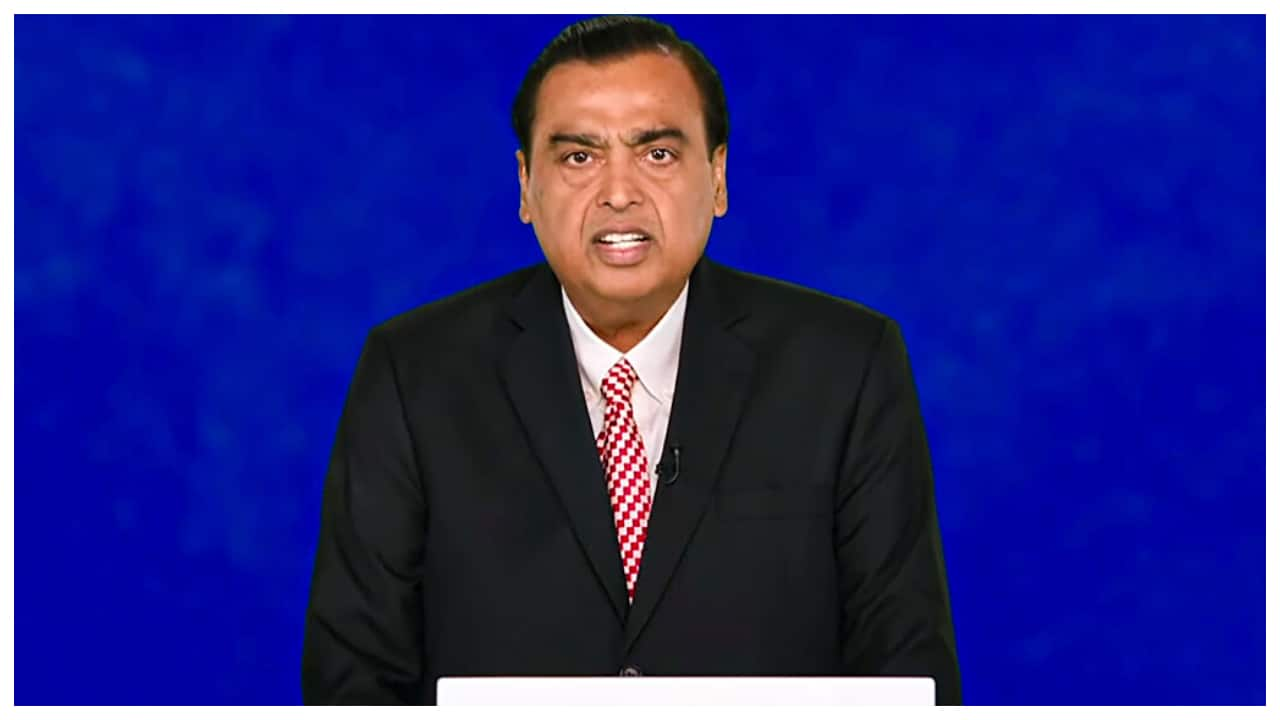

RIL Q3 FY25: Consumer businesses drive performance, support outlook

Trends such as premiumisation and rising digital adoption will benefit its consumer-facing businesses while investments in clean energy will create a future growth driver

BUSINESS

Jubilant FoodWorks: India business outlook improving, but valuation expensive

Improvement in Dominos same-store sales growth and scale-up of Popeyes franchise remain key growth triggers

BUSINESS

HG Infra Engineering: Why should you bet on this construction player?

The company has already carved a niche in the road construction space. Its diversification into newer segments is also yielding results and it boasts of a huge order book in the infrastructure segment

BUSINESS

Ventive Hospitality: Should you check into this hotel IPO?

Ventive Hospitality IPO comes at a time when the hotel industry is sustaining the up-cycle witnessed post the COVID-19 pandemic. With a valuation discount to comparable players, it is a good bet on the booming hotel space.

BUSINESS

NCC Limited: Strong outlook, but valuations cap upside

NCC has retained its FY25 order inflow guidance of Rs 20,000-22,000 crore, indicating a strong pick-up in new orders in the second half

BUSINESS

International Gemmological Institute (India) IPO: Will bourses certify the gem?

IGI India operates in the niche category of independent diamond certification and has established leadership position in the fast-growing lab-grown diamond market.

BUSINESS

Vishal Mega Mart IPO: Can this value focused retailer create wealth for investors?

Targeting the middle and lower middle class, VMML has a wide portfolio with strong positioning and product range in the opening price points

BUSINESS

EIH Limited: Why should you check into this hotel stock?

EIH Limited has outlined healthy room addition pipeline and has retained its long-term guidance of more than doubling its room inventory by 2030.

BUSINESS

Quick Take: Proposed GST hike on apparel to hurt consumer sentiment

The rate increase could translate into a 5-6 percent rise in mid-to-premium apparel prices.

BUSINESS

Senco Gold Limited: Shining growth prospects

SGL is accelerating its network reach to strengthen presence in the jewellery industry. The ramp-up of lab-grown diamonds (LGDs) and fashion accessories remains an additional growth trigger.

BUSINESS

Cello World set to pen a stronger growth script in H2

The company experienced demand traction in October, while new products and capacity expansion will act as growth levers

BUSINESS

SAMHI Hotels: Expansion plans add to earnings visibility

Robust cash flow generation will ensure that SAMHI is able to largely fund the capex via internal accruals and without stretching the balance sheet

BUSINESS

Indian Hotels Company: Well placed to ride the industry upcycle

With a strong parentage, comprehensive product offerings, scaling up of new businesses, and healthy inventory addition plans, IHCL is well positioned to ride the hotel industry up-cycle.

BUSINESS

Trent Q2 has multiple growth levers

Trent is among the fastest-growing consumption companies and the strong growth momentum is likely to continue. New initiatives like the Zudio Beauty store, international forays, and lab-grown diamonds will contribute to growth

BUSINESS

Titan Company: Second half of FY25 likely to be stronger

The cut in customs duty significantly boosted consumer sentiment, and Titan expects better growth in the second half of the fiscal

BUSINESS

Larsen & Toubro: Faster recovery in H2 likely, higher order inflows take focus

A general slowdown in the construction and engineering segment in H1 hit the company. However, higher capex and likely availability of workers and other resources are expected to make H2 stronger.

BUSINESS

Metro Brands: Eyeing strong growth in H2 FY25

The upcoming wedding and festive seasons as well as a low base in the corresponding period last year should aid performance

BUSINESS

Afcons Infrastructure IPO: Should investors bet on it?

The company has a strong parentage, rich experience, and follows the best risk management practices in the construction industry. Those investors wanting a long-term exposure in an EPC pure-play can consider the offering.

BUSINESS

Reliance Industries Q2: Consumption-oriented segments telecom, retail drive growth

While a subdued global economic environment has affected its O2C business performance, improving prospects for consumption growth and progress in new energy business will drive the stock outlook

BUSINESS

Is it time to turn cautious on DMart?

DMart is facing increasing competition from quick-commerce online players and margin pressure is likely to sustain in the near term.