BUSINESS

Navin Fluorine: Multiple agreements, new capacities strengthen outlook

The company could benefit from the China-plus-one theme in fluorine chemistry

BUSINESS

Resilient US economy buys Fed time amid tariff turbulence

India gains ground as Fed maintains rates and investors seek stability beyond the West

BUSINESS

UK-India FTA: Sectoral shake up – who gains, who loses?

Key Indian export sectors to benefit are, textiles, leather, footwear, marine products, gems & jewellery, auto parts, engineering goods, and organic chemicals.

BUSINESS

Himadri Specialty: Near-term growth triggers missing

Given the weak domestic demand for the auto sector, an unfavourable supply-demand balance is likely to show up in margins

BUSINESS

Ami Organics: Internal accruals fuel growth capex

While client concentration is a key risk in the early years of building a CDMO business, a strong pipeline of products and capex for R&D augur well for the company

BUSINESS

PCBL: Russian advantage now posing as a liability

In the last couple of years, the company benefitted from shortages of Russian supplies of carbon black to the European markets due to the Russia-Ukraine war and related sanctions

BUSINESS

Laurus Labs: CDMO-led growth to enhance return ratios

Drug discovery and development collaboration are the key drivers for the Indian CDMO industry.

BUSINESS

Syngene: Growth trajectory to moderate in FY26

The operating environment for the global CRDMO industry remains challenging

BUSINESS

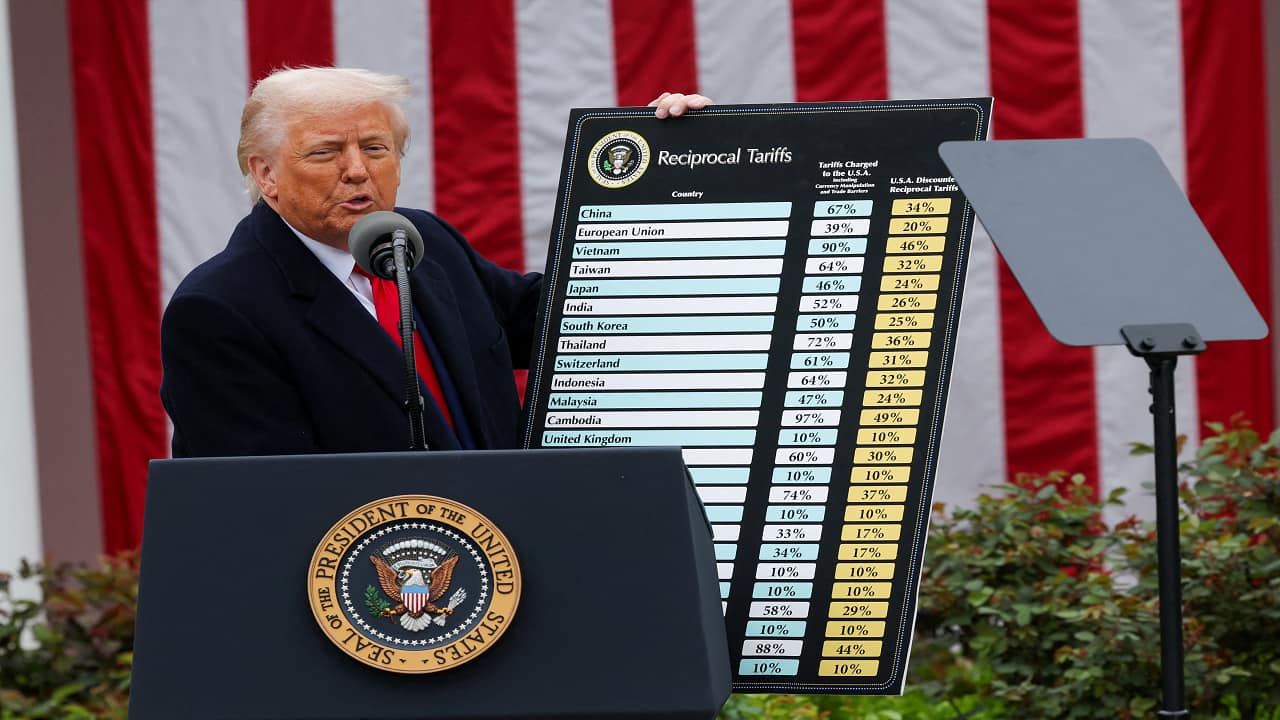

Trade War: How should investors position for the likely Fed pivot?

Investors need to be wary of heavily tariffed countries (relative to India) as they increase the risk of dumping

BUSINESS

Reciprocal Tariffs: How will India’s markets navigate the storm?

Trump’s steep tariff hikes reshape global trade, with India finding both challenges and unexpected opportunities

BUSINESS

What do leading monsoon indicators suggest for this season?

Most forecasts indicate a low likelihood of an El Niño phase in the next three to five months, which should be good for the rural economy

BUSINESS

Fed turns cautious, but considers tariff inflation as transitory

Markets to remain volatile, but Indian investors have the opportunity to pick up growth stocks at reasonable valuations

BUSINESS

What does the resumption of US-China trade war mean for India?

The USA’s China focus should ultimately lead to the resumption of China-plus-one trade

BUSINESS

How does oil supply dynamics shape up in the new world order?

Weak consumption trend can depress oil prices as supply is poised to increase

BUSINESS

Syngene: US acquisition underlines welcome tweak in business model

Acquisition of Emergent Manufacturing Operations Baltimore LLC facility ensures proximity to one of the innovation hubs in the US, which is critical for a CRDMO player.

BUSINESS

Sun Pharma: Checkpoint acquisition strengthens speciality portfolio

In the near term, pricing pressure in generics and moderation in contribution from Revlimid is a key watch, along with potential tariff announcements by the US

BUSINESS

US 10-year yield: Trump 2.0’s favourite metric – What it means for the markets

While lower treasury yields are positive for USD/INR & Indian equities, there is a risk that if trade/investment related uncertainty extends equity markets can be negatively impacted

BUSINESS

SRF: Sequential recovery in chemicals likely to gather strength

While competition from China remains a key variable to watch, SRF represents a niche export sector player which can outperform

BUSINESS

HEG: Better positioned for the steel investment cycle in the US

The company should benefit from the structural trend of decarbonisation in the steel industry

BUSINESS

Trump Tariff – How much can it hurt Indian pharma?

The first order impact will be a slow market share gain from innovators after a generic launch

BUSINESS

Syngene: Conversion of pilot projects to long-term contracts a big positive

The company remains a strong play on the global China-switch strategy

BUSINESS

Galaxy Surfactants: Weak show signals more pain for the FMCG sector

A pickup in domestic urban consumption, end of de-stocking in general trade, and the pricing trajectory of fatty alcohol are key variables to watch for.

BUSINESS

Metal prices to melt further on Trump’s fresh tariff levy

Indian companies may face sustained profitability pressure though the extent may vary

BUSINESS

Medanta: New facilities gradually stabilising; remain constructive

Encouraged by the demand-supply gap in healthcare needs in the hinterland, the company continues to add bed capacities