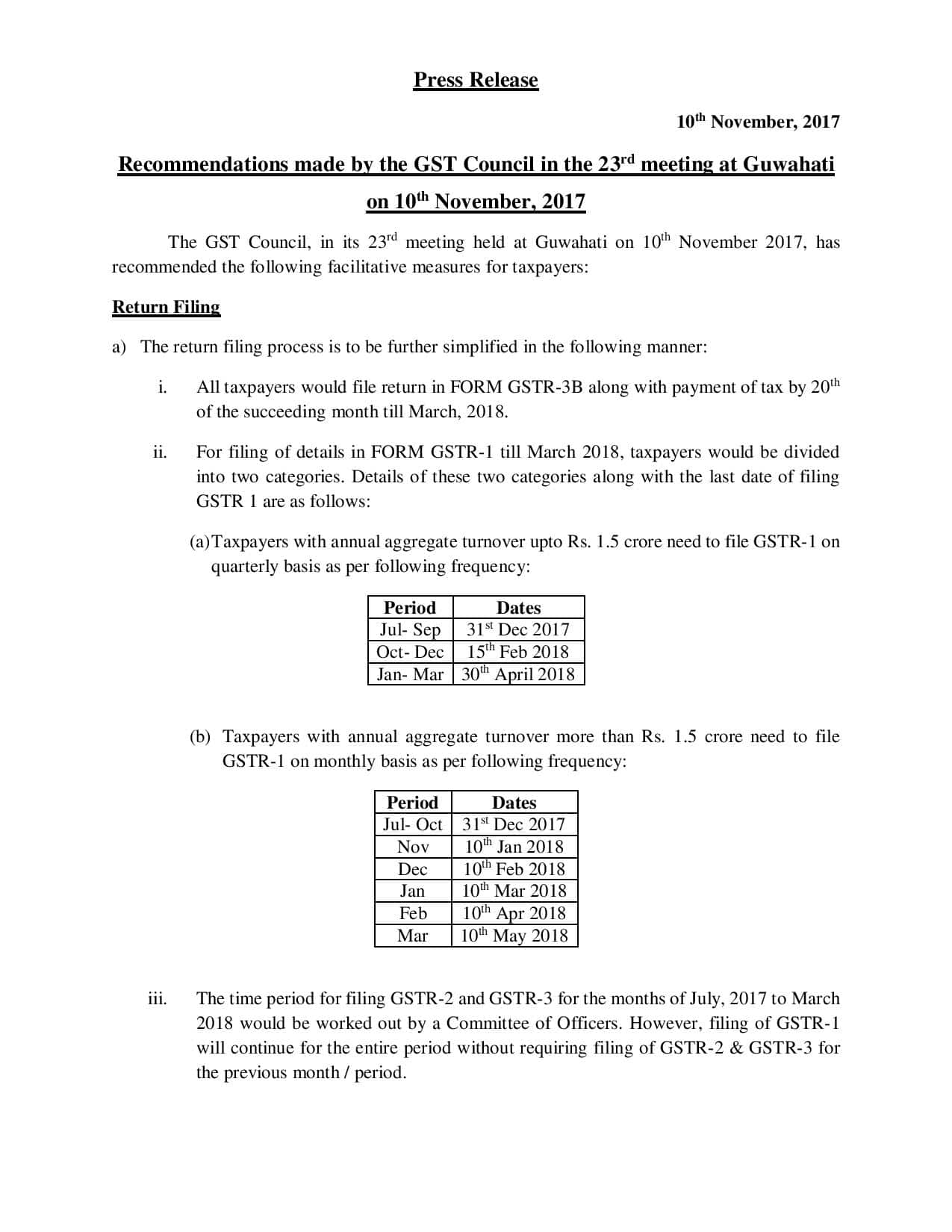

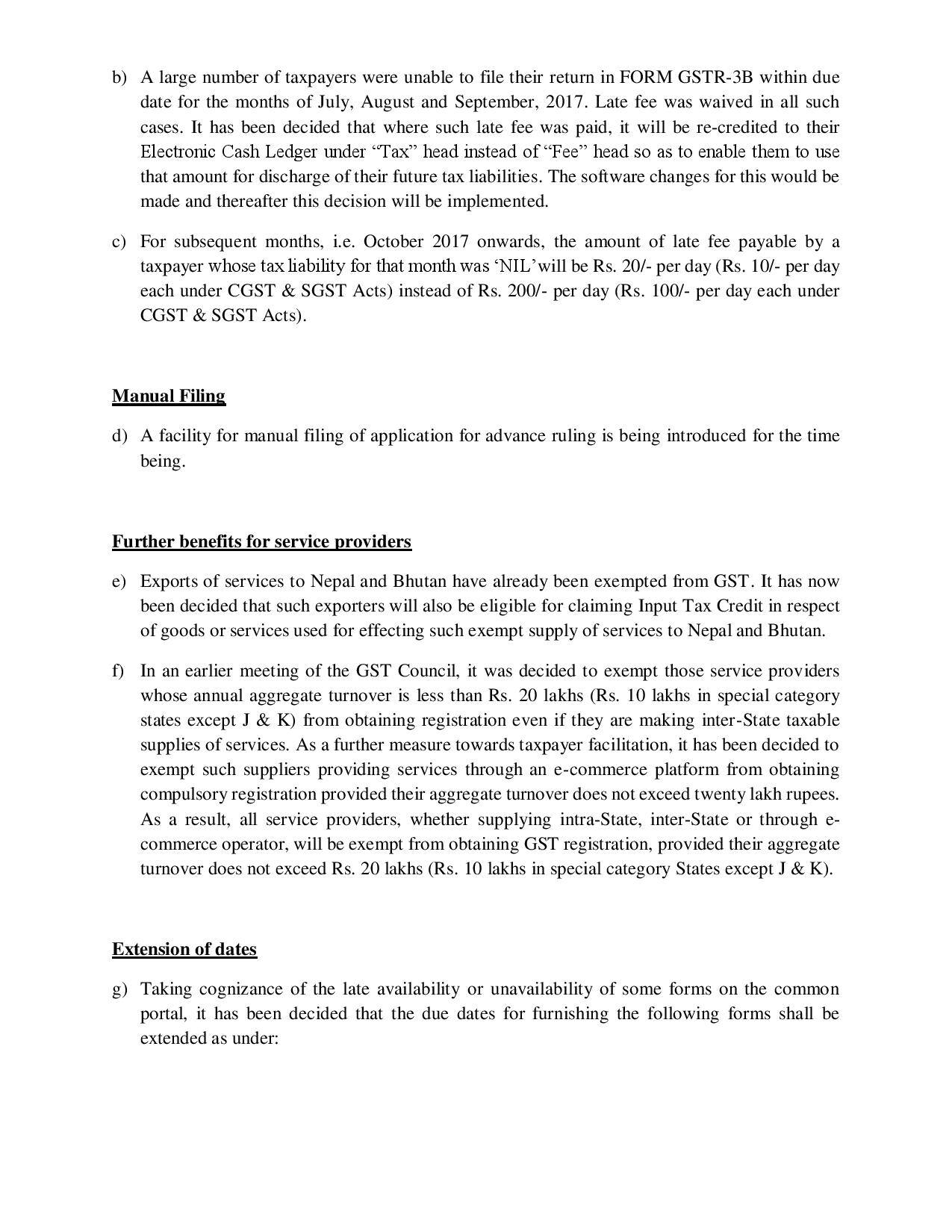

The GST Council on Friday simplified procedures, and several changes to make the 'Composition Scheme' more attractive. In another significant decision aimed at easing compliance and simplifying procedures, tax assesses will now be required to file only two sets of forms— GSTR1 and GSTR 3B — instead of four earlier.

While small taxpayers with an annual turnover of less than Rs 1.5 crore will file quarterly returns (once in three months), those with a higher turnover will file monthly returns, Finance Minister Arun Jaitley said.

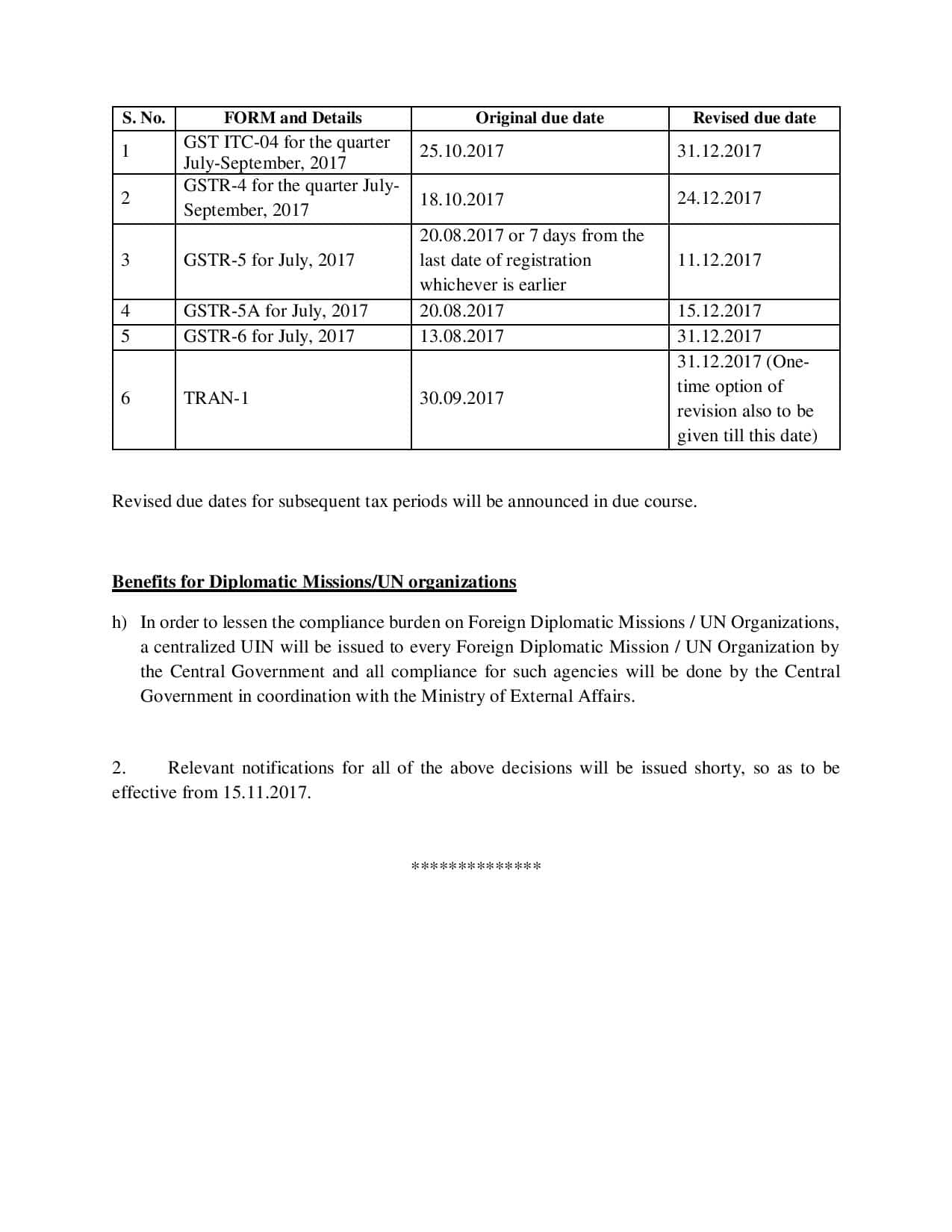

Here’s the full list of the recommendations made by the GST Council on returns filing

ALSO READ: Big Relief: GST Council slashes tax rate on 178 items to 18%; eating out gets cheaper as restaurants get tax rate cut

ALSO READ: Big Relief: GST Council slashes tax rate on 178 items to 18%; eating out gets cheaper as restaurants get tax rate cut Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.