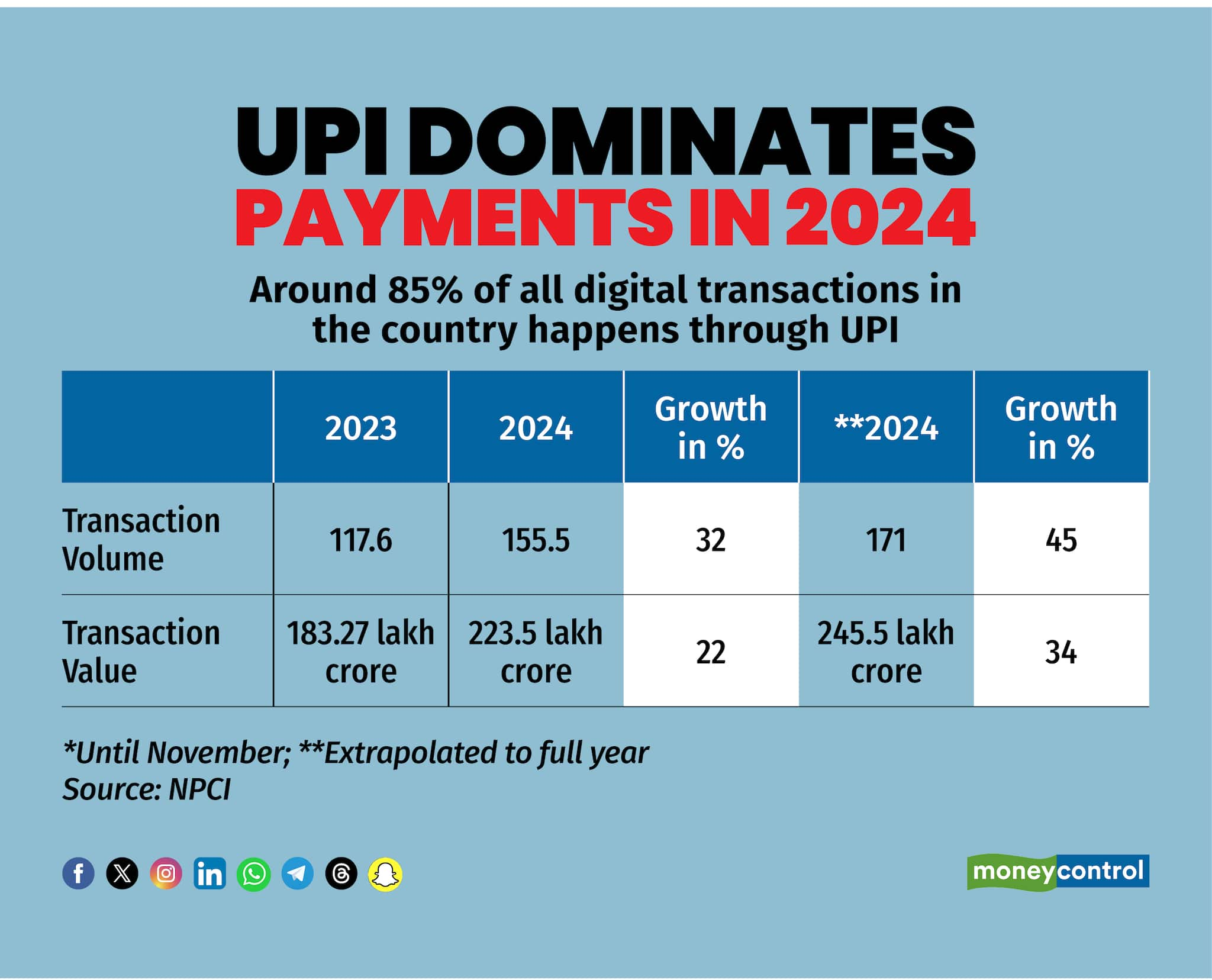

Unified Payments Interface (UPI) is likely to cross 171 billion transactions in 2024, a 45 percent growth compared to the previous year, a substantial rate of growth considering the high base.

The platform recorded around 117 billion transactions during 2023, according to data from the National Payments Corporation of India, which runs UPI.

The value of transactions also will likely see a 34 percent growth to Rs 245 lakh crore in 2024, compared to Rs 183 lakh crore, the platform recorded in 2023.

To be sure, the growth rate and the full-year numbers are based on extrapolation of the daily and monthly numbers that UPI records on an average, albeit based on a conservative estimate of the remaining few days of December.

UPI 2024

UPI 2024The platform clocks around 16 billion transactions in a month on average while the value is around Rs 22 lakh crore. However, this is growing every quarter and goes up depending on festival spending and other online and offline sale events.

UPI is the country’s most popular real-time payments platform, facilitating almost 85 percent of all digital payments.

New players emergeWhile PhonePe and Google Pay continued to dominate with close to 85 percent market share, new players such as Sachin Bansal-backed Navi, Flipkart Group’s super.money and Fampay registered good month-on-month growth.

In 2024 alone, 20 companies received third-party application provider (TPAP) approval from NPCI, which is required to provide customers with UPI services. According to the NPCI website, 40 firms have received TPAP approval since 2016.

Navi is now the fourth largest surpassing Kunal Shah-led CRED, which managed to maintain its market share. While these apps made a mark, NPCI is still struggling to shake off the stronghold of the top two apps.

The push into this space has been also driven by the NPCI’s desire to see the UPI platform being deleveraged from the hold of PhonePe and Google Pay in the ecosystem. Unfortunately, NPCI was thrown another curveball when the regulator restricted some of Paytm’s banking activities, which saw its market share dropping from 11 per cent to 7 percent this year.

According to the NPCI rule issued in early 2021, no UPI app should have more than 30 percent of the UPI payments market. The organisation is likely to be forced to extend the deadline by two years, yet again.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!