SoftBank's investment arm SoftBank Vision Fund made a cumulative gain of $1.349 billion (approx. Rs 11,021.8 crore) from its Indian portfolio firms Ola Electric, FirstCry and Delhivery in the second quarter of the financial year ending September.

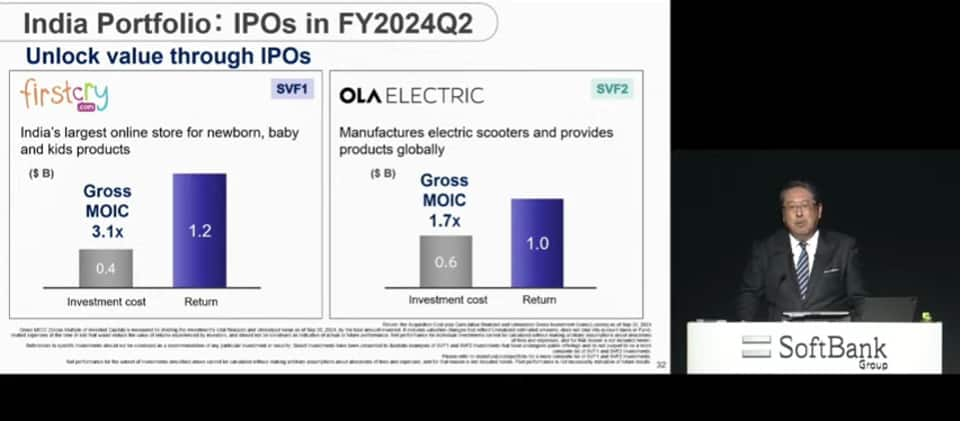

Two of SoftBank's portfolio companies in India — Ola Electric and FirstCry — hit the public market in the quarter where the Japanese investor reportedly sold shares worth Rs 1,287 crore ($153 million).

During the quarter, FirstCry boosted the SoftBank Vision Fund’s gains by $642 million, while Ola Electric and Delhivery each added $401 million and $306 million to the fund, respectively, as indicated in SoftBank’s presentation listing the quarter results.

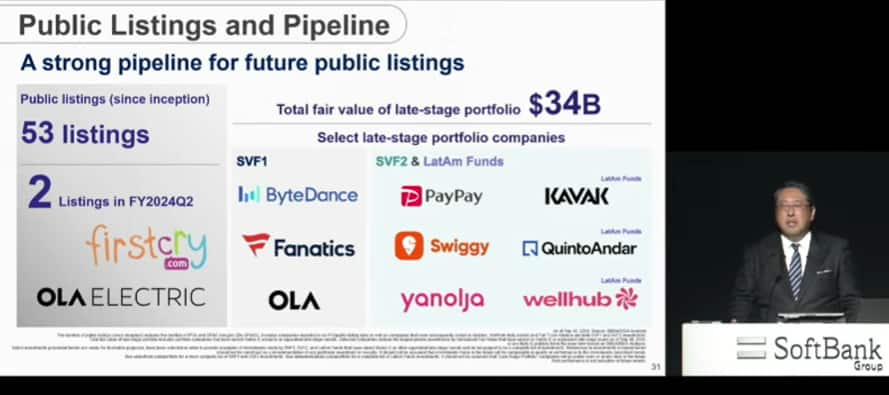

A boom in India’s IPO market is buoying the Vision Fund, which for years struggled to win returns commensurate with its $100 billion-plus scale. Seven years since the investment unit’s launch, it’s reaping gains from the debuts of startups such as e-scooter maker Ola Electric Mobility Ltd. and online retailer Brainbees Solutions Ltd., which sells baby products under the brand name FirstCry.

Source: Softbank presentation

Source: Softbank presentation

The SoftBank-backed food-delivery app Swiggy Ltd’s $1.3 billion IPO was subscribed more than three times.

Brainbees Solutions, also enjoyed a premium listing at Rs 625, 34 percent above its issue price, though it now trades below that level. Meanwhile, Ola Electric, which made a flat debut at Rs 76 besides taking a hit later, became the star firm in SoftBank’s investment portfolio. The listing of Ola Electric in August 2024 positively impacted SVF2, boosting its public portfolio valuation by 0.2 percent for the quarter.

“Up 0.2% Q-o-Q for public portfolio companies, primarily due to an increase in the share price of Ola Electric, which listed its shares in August 2024, despite a decrease in the share prices of investments such as Symbotic and AutoStore," the company latest financials for the quarter read.

SoftBank is seeing a “harvest season in India,” Devi Subhakesan, an independent analyst from Investory Pte who publishes on SmartKarma, wrote in a note prior to the earnings release. She estimates SoftBank’s stake in Swiggy to be valued at around $803 million based on the IPO price, representing a 78 percent rise from its investment in January 2022.

Source: Softbank presentation

Source: Softbank presentation

SoftBank group swings to profit

On Tuesday, the SoftBank Group swung to a quarterly profit on the back of successful Indian listings and a rebound in tech valuations that boosted the Vision Fund portfolio.

The Tokyo-based company earned a net income of $7.7 billion in the September quarter, compared with a net loss of $6.21 billion last year.

The Vision Fund reported a gain of $2.49 billion, thanks to strong initial public offerings for Indian startups and valuation gains in Coupang Inc. and Didi Global Inc.

Along with new listing gains, the Vision Fund, which cumulatively boast of over $159.4 billion of committed and deployed capital, has also been exiting investments at a quick pace, including Patym, Zomato and PB Fintech in India.

Also read: SoftBank Vision Fund records $544-million loss on full exit from Paytm

SVF 1 saw the value of its holdings rise to s $5.8 billion in the September quarter from $2.8 billion in the June quarter, while the SVF 2 saw a loss of $1.7 billion, down from $2.6 billion previously.

The vision fund unit sold investments for a total of $1.85 billion in the period, including full exits from 10 portfolio companies, including SenseTime and Paytm, and partial exits from several portfolio companies.

The investment fund a gross loss of $544 million on its $1.6-billion investment in embattled fintech major Paytm, according to a presentation made by the Japanese technology conglomerate. It exited all its holdings in Paytm in the June quarter.

On the other hand, it has recorded a $394-million gross gain on an investment cost of $199 million in online insurance aggregator Policybazaar, which it has also fully exited.

It also recorded a gain of $65 million on its full exit from Zomato where it had got a small shareholding after its portfolio company Blinkit was acquired by food aggregator in 2022.

(Rs 11,021.8 crore figure was based on exchange rate of 1 USD = 82 INR)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.