Tata Consultancy Services (TCS), India's most valuable IT services company, paid Rs 57 crore in remuneration to its key managerial personnel (KMPs) in FY24. Yet, those top bosses of TCS, who lord over 6 lakh employees around the world, might still be thinking they made the wrong career choice — as the top brass of new-age tech companies beat them hands down in terms of pay.

Although new-age companies like Paytm and Delhivery are yet to turn profitable, and a couple — such as Zomato and Policybazaar — were in the black for the first time in FY24, these firms have been spending hundreds of crores to pay their top executives and founders. Employee stock options granted to founders and top bosses make up a bulk of these payouts.

Take, for instance, embattled fintech unicorn Paytm. As a result of regulatory action, the company was forced to make big changes in its business, and its stock price dropped by 37 percent in FY24.

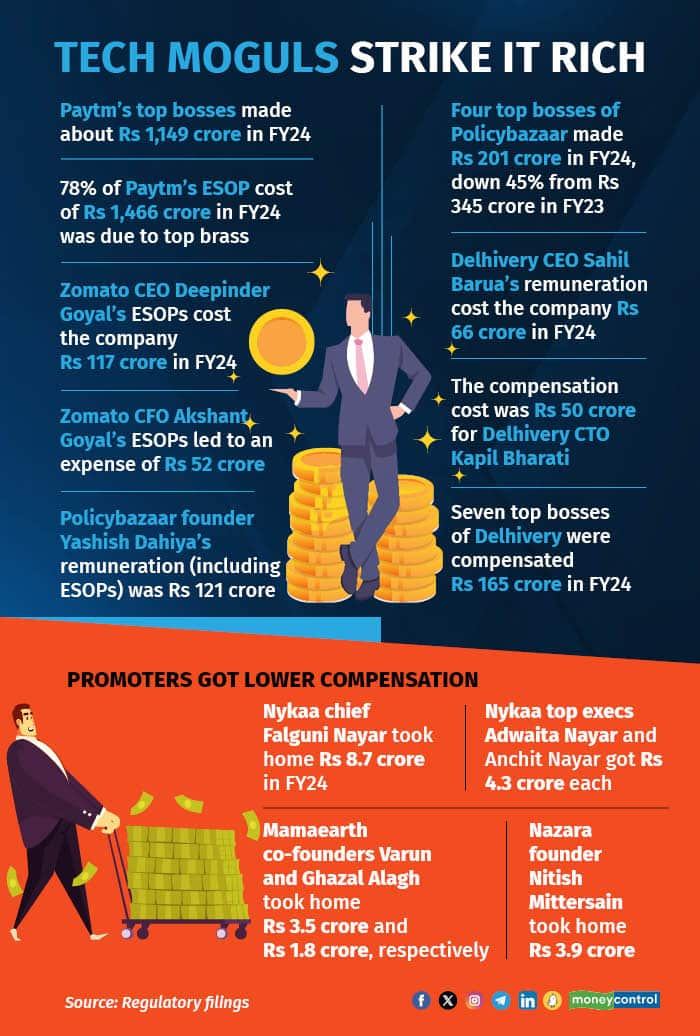

The fintech firm logged expenses of Rs 1,138 crore during the fiscal on account of ESOPs to its top brass, while the cash component was about Rs 11 crore. As Paytm’s total ESOP cost in FY24 was Rs 1,466 crore, it also means that 78 percent of the stock option expenses were due to its KMPs, directors, and their relatives. This figure was 77 percent in FY23, when the company’s total ESOP cost was Rs 1,456 crore.

Paytm’s KMPs include Chief Executive Officer (CEO) Vijay Shekhar Sharma and Chief Financial Officer (CFO) Madhur Deora. Unlike other new-age firms, the company didn’t disclose the expenses on account of each individual KMP in its related party transaction filings.

Meanwhile, its fintech peer Policybazaar revealed that it incurred expenses of Rs 121 crore towards the remuneration (including ESOPs) of Co-Founder and CEO Yashish Dahiya, Rs 53 crore for Co-Founder and Vice-Chairman Alok Bansal, Rs 21 crore for Group President Sarbvir Singh, and Rs 6 crore for Group CFO Mandeep Mehta.

However, these top four Policybazaar bosses made Rs 201 crore cumulatively in FY24 — down 42 percent from Rs 345 crore in FY23.

The situation is not too different for Zomato. Of the company’s total ESOP expenses of Rs 515 crore in FY24, its Founder and CEO Deepinder Goyal was responsible for Rs 117 crore and CFO Akshant Goyal for Rs 52 crore. The duo accounted for 33 percent of the company’s ESOP expenses in the last fiscal and 74 percent in FY23.

While Zomato’s quick commerce acquisition Blinkit has become a key driver of the company’s growth, its management has said previously in its earnings calls that its ESOP costs will rise due to such grants made to Blinkit’s leadership team.

However, neither Blinkit boss Albinder Dhindsa or any other top executive of the quick commerce company have been designated as KMPs of Zomato. This means that the publicly listed company is not required to reveal the remunerations of Blinkit’s top brass.

In this regard, logistics unicorn Delhivery has been more open as it has designated seven executives of its top deck as KMPs, and shared the company’s spends on their remuneration in related party transaction filings. But it has not revealed the break up of the remuneration in terms of ESOP expenses and cash.

Delhivery Co-Founder and CEO Sahil Barua's compensation cost the company Rs 66 crore in FY24, while the number was Rs 50 crore for its Co-Founder and Chief Technology Officer (CTO) Kapil Bharati, and Rs 4.7 crore for Co-Founder and Head of New Ventures, Suraj Saharan.

The Gurugram-based company also compensated its non-founder bosses very well — Chief Business Officer (CBO) Sandeep Barasia made Rs 17 crore, CFO Amit Agarwal took home Rs 14.6 crore, Chief Operating Officer (COO) Ajith Pai made Rs 8.5 crore, and Chief People Officer (CPO) Pooja Gupta Rs 4.5 crore.

These seven top Delhivery employees cumulatively earned Rs 165 crore in FY24, or 11 percent of the company’s total spend on employee benefits , which was Rs 1,437 crore.

Promoter-controlled companies have a different storyThe main reason for most of the new age companies’ large remunerations is big ESOP packages granted to founders. These firms changed their company structures from promoter-operated to professional manager-operated before their public market debuts, which enabled them to grant ESOPs to founders, as regulations prohibit such pay to promoters.

The impact is visible when one looks at the top deck’s remuneration in promoter-controlled new-age companies like Nykaa, Nazara, and Mamaearth.

Nykaa founder Falguni Nayar's remuneration was Rs 8.7 crore in FY24, whereas her children, Executive Directors Anchit and Adwaita Nayar, each took home Rs 4.3 crore. Mamaearth Co-Founders Varun and Ghazal Alagh received Rs 3.5 crore and Rs 1.8 crore, respectively.

In case of gaming company Nazara, Founder and CEO Nitish Mittersain got Rs 3.9 crore in FY24, CFO Rakesh Shah took home Rs 86 lakh, and Managing Director Vikash Mittersain received Rs 76 lakh as compensation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.