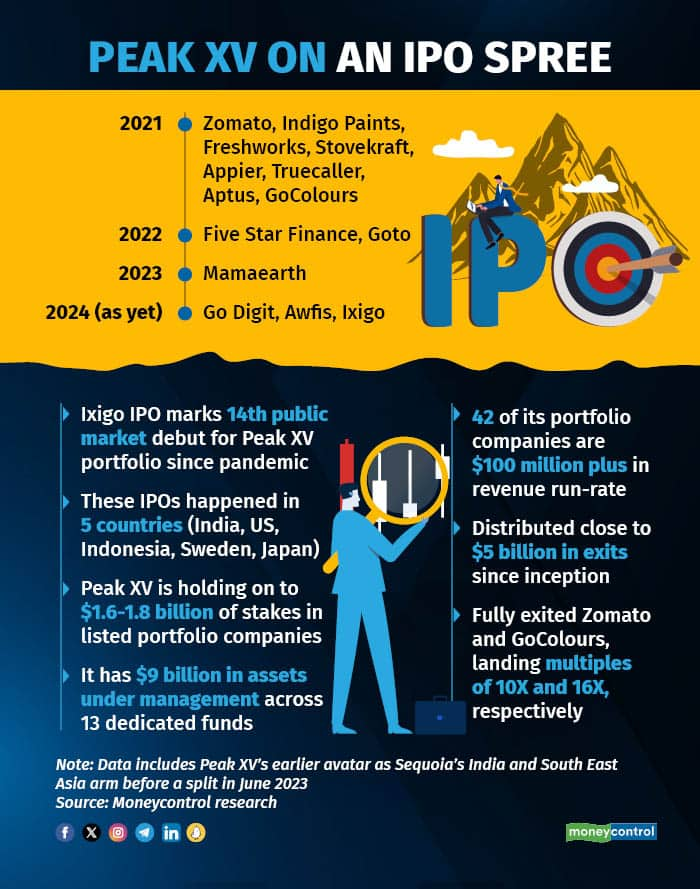

The initial public offering (IPO) of travel aggregator Ixigo marks the 14th public market debut of venture capital (VC) firm Peak XV’s portfolio companies since the Covid-19 pandemic, and the third this year after the stock market listings of co-working space provider Awfis and insurance company Go Digit.

According to sources, Peak XV’s cumulative shareholding in portfolio companies that are now listed publicly — such as Truecaller, Freshworks, Mamaearth, and Five Star Finance, among others — is currently worth $1.6-1.8 billion.

Since the erstwhile India and Southeast Asia arm of storied VC firm Sequoia Capital broke up with the parent last year and rebranded itself as Peak XV, it has fully exited its positions in food delivery company Zomato and womenswear brand GoColours, landing multiples of 10X and 16X, respectively, for these investments.

In all, the VC firm has seen 23 IPOs in its portfolio since inception (including in its earlier avatar) which is the highest number for any venture capital firm in the region and has already distributed close to $5 billion in exits to its investors, said people aware of the matter.

Peak XV did not offer any comments for the story.

It held 59 million shares in Ixigo, which were acquired at an average price of Rs 11.32 apiece, as per the company’s IPO prospectus. The VC firm is selling 13 million shares via the offer — booking a gain of around 8X on the transaction, given the travel aggregator’s pricing of the issue at Rs 88-93 per share.

Also, the tech investor sold 6.6 million shares in the Awfis IPO for Rs 253 crore at Rs 383 apiece — which was almost 3X its average cost of buying the stake at Rs 134.8 apiece. According to data from BSE, Peak XV — listed as a promoter of Awfis — still holds about 7.7 million shares in the company that are worth about Rs 353 crore.

However, the VC firm didn’t sell any shares in the IPO of Go Digit. At the time of the issue, Peak XV held 9 million shares in the company which were acquired at the price of Rs 328 apiece. Go Digit shares were trading at Rs 342 apiece at the time of publishing.

Peak XV told its limited partners (LPs) in March that its portfolio includes 42 companies with over $100 million plus in run-rate revenue, 20 companies with $200 million plus in revenue, more than 65 companies with over $50 million plus in revenue, and over 100 companies with $20 million plus in revenue.

It has $9 billion in assets under management across 13 dedicated funds and has invested in over 400 companies to date.

In March this year, Peak XV told investors it will launch a perpetual fund which will 'create a culture of high accountability and alignment with LPs'.

Sources said at the time that this permanent capital vehicle will have the Peak XV team's own capital and not raise any cash from LPs. The vehicle could invest in Peak XV's own future funds, other venture funds or even deploy capital in other assets in the future.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.