Cash-strapped edtech Byju’s has rolled out a new policy linking sales staff’s salaries to the revenue they generate every week, as it struggles to cover payroll amid shortage of funds.

This comes after the embattled company resorted to paying only a part of the salaries for February and March, after weeks of delay.

According to an internal document that Moneycontrol has viewed, Byju’s will now directly pay a percentage of the weekly revenue generated by each sales staff at the end of the seven-day period.

The company said the new policy is applicable to the Inside Sales (IS) and Byju’s Exam Prep (BEP) team, which largely focus on generating revenue for Byju’s. The policy, which was introduced within the company on April 24, will be applicable for a period of four weeks till May 21.

“Starting immediately, 50 percent of the upfront weekly collection will be directly disbursed to our sales associates every week for the next four weeks. For instance, if an associate successfully collects Rs 50,000 in revenue generated from orders between April 24th and April 30th, they will receive Rs 25,000 on May 1st,” said the document, a copy of which Moneycontrol has reviewed.

Byju’s said that the base salaries for sales team associates will be “suspended temporarily” during this period. “Since the base salary has been suspended, you will not receive any payout or salaries for the given period (when the associate fails to do any revenue in a given week),” Byju’s added.

Byju's did not immediately respond to Moneycontrol's queries.

The company’s efforts come in an attempt to retain and motivate sales staff to bring in new enrollments during the peak sales quarter April, May and June, for test prep companies.

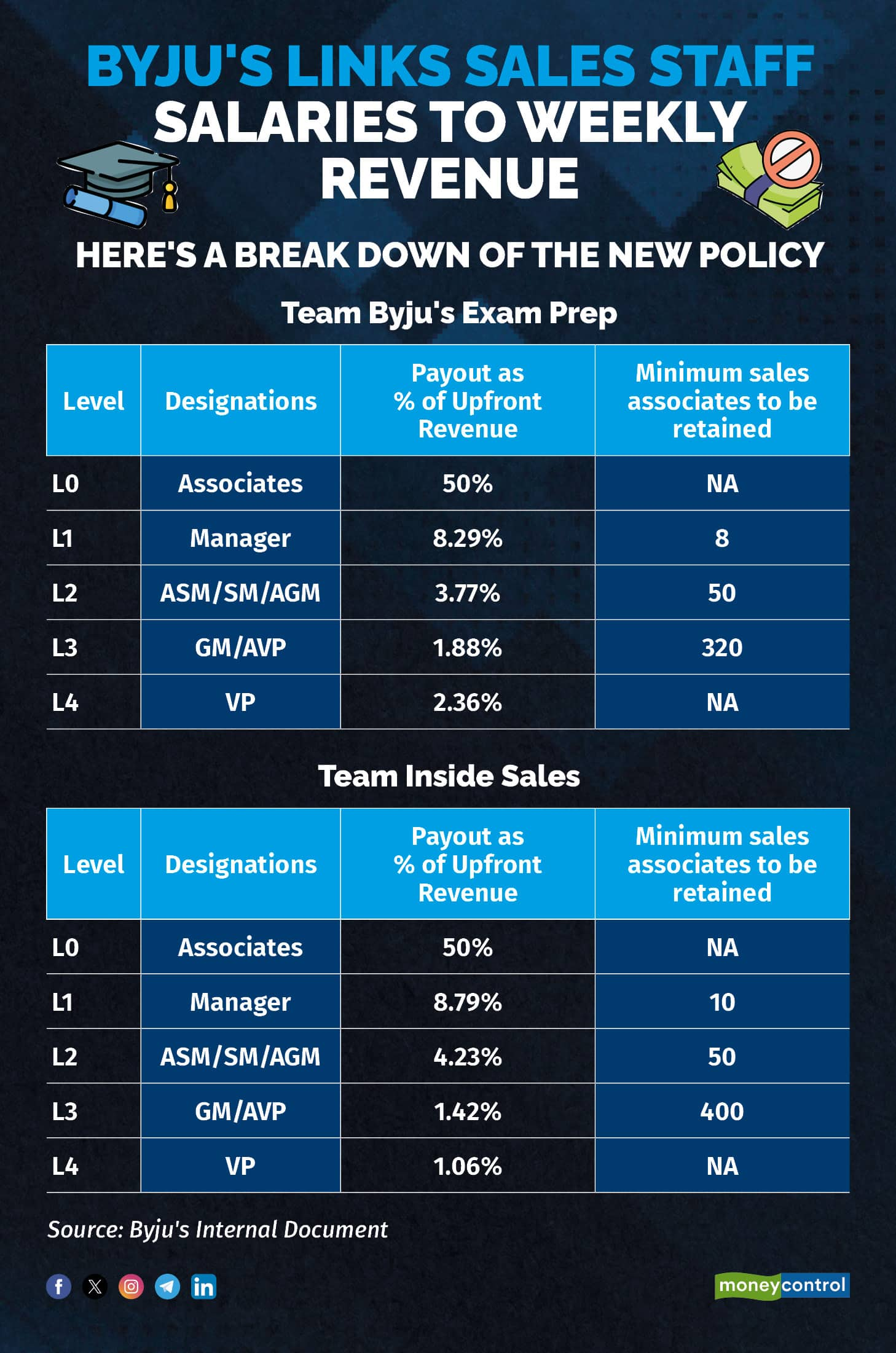

According to Byju’s, the percentage of payout will vary depending upon three factors - revenue generated by each employee, their designation and the number of sales associates working in their team. In case, employees in the managerial level fail to retain a specified number of sales associates in the team, it can result in reduced payout, Byju’s said.

Take a look at the payout percentages determined by Byju’s according to designations and expected retention of sales associates per manager.

Breakdown of the new revenue-linked salary policy for Byju's sales staff

Breakdown of the new revenue-linked salary policy for Byju's sales staff

This comes even as Byju’s is reportedly witnessing resignations in high numbers on the back of salary delays and operational challenges.

“This strategic initiative ensures that our sales team experiences timely payouts even during periods of operational adjustments and system optimisations. It reflects our proactive approach to maintaining financial stability for our team members while we enhance and refine our ecosystem,” the company added in the document.

To be sure, the amount paid on the weekly basis will be adjusted against employees’ pending salaries. “This feature ensures that our sales associates receive their rightful earnings promptly, thereby enhancing financial security and stability,” the document added.

Byju’s mountain of troubles

The development comes as Byju's is facing an acute shortage of funds with Byju Raveendran, the founder and CEO of the company taking on more personal debt to make monthly payroll.

Meanwhile, the funds raised from the recently concluded rights issue is tied up in an escrow account as per orders from NCLT, till the disposal of the above mentioned case. At least seven vendors have also sued Byju's at NCLT to recover their dues.

The company has also initiated layoffs on phone calls, letting go about 100 to 500 employees without putting them on a performance improvement plan (PIP) or having them serve a notice period. Byju's has laid off over 10,000 employees in the last 12 months as it battled a double blow of drying venture capital funding and slowing demand for online learning services. Since then, its investor board members have left too, citing differences with Raveendran.

The company has tried to fix some of the problems since then. Its early investor Ranjan Pai ploughed in the capital, it set up an advisory council with veterans such as Mohandas Pai and Rajnish Kumar and elevated Arjun Mohan as CEO. In the latest development, however, Mohan decided to step down from the position. It is also in talks to divest assets such as Great Learning and Epic.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.