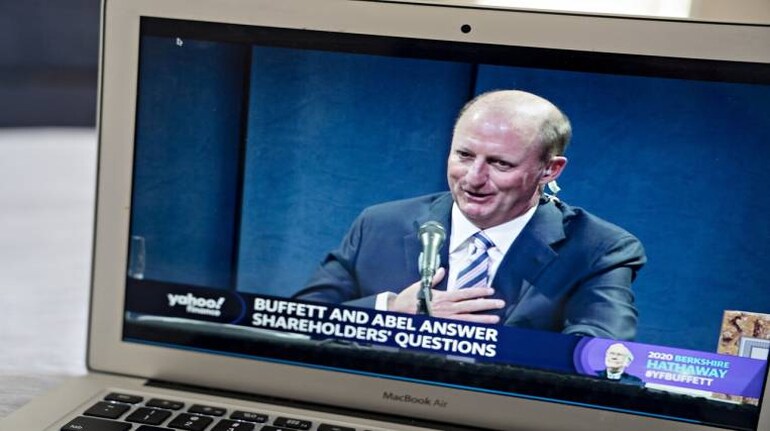

Greg Abel, who is in line to eventually succeed Warren Buffett as chief executive officer of Berkshire Hathaway Inc., has been building his stake in the conglomerate he expects to oversee one day.

Abel acquired about $68 million of stock late last month, according to filings Monday. The Class A shares closed at $413,300 Monday in New York.

The purchases may begin to address a concern raised by shareholders: Abel, who oversees Berkshire’s non-insurance businesses, hasn’t been a major holder of the stock, unlike the company’s long-time leader. The heightened ownership stake increases his skin in the game more than a year after being officially named as the most likely successor to replace the 92-year-old Buffett when he steps down.

The share purchases significantly ramp up Abel’s stake in Berkshire. He owned five Class A shares and more than 2,000 Class B shares as of March 2, according to a proxy filing released earlier this year.

Abel, who previously ran the company’s sprawling energy empire, received an influx of funds when the energy business bought back his small ownership stake for $870 million in June. The move stoked speculation he might seek to redeploy some of those funds back into the company he’s slated to run.

Abel is among the most well-compensated executives at Berkshire, earning more than $19 million in total compensation in 2021 from the conglomerate, according to its most recent proxy filing. That’s equivalent to earnings by his peer Ajit Jain, who oversees the insurance operation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.