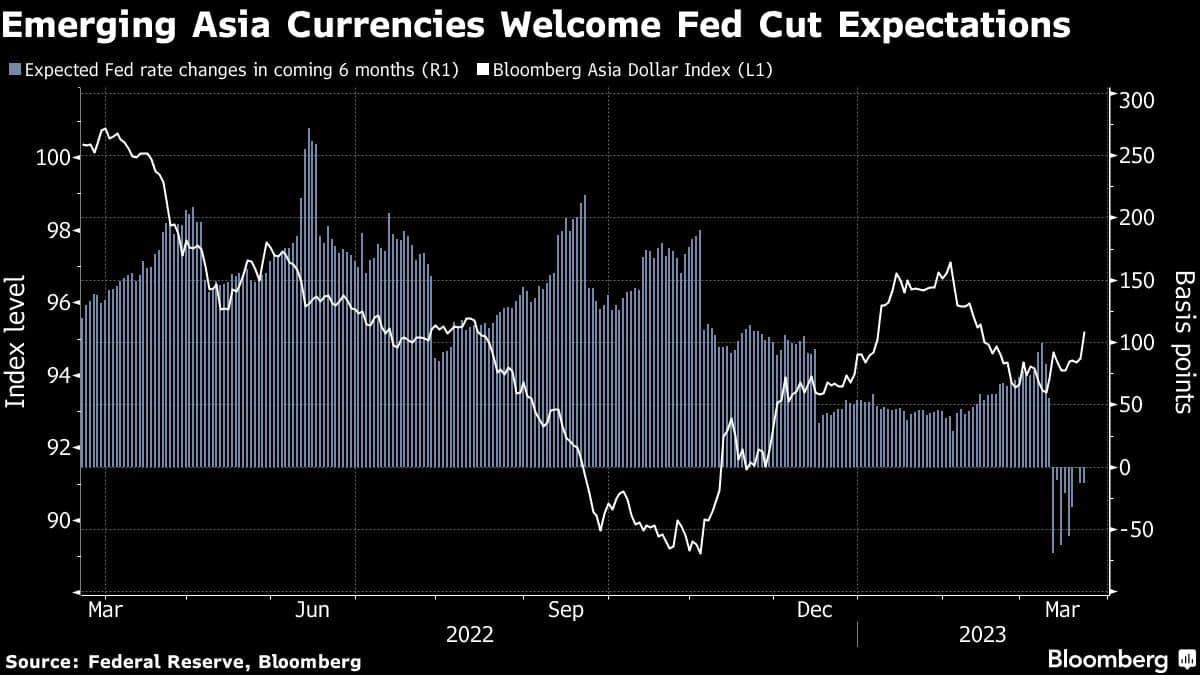

A slump in the dollar after the Federal Reserve’s latest interest-rate hike will be a breath of fresh air for emerging-market policymakers as it puts a floor under their currencies and eases their efforts to control inflation.

The greenback weakened across the board Thursday, resuming a downtrend that started in earnest six months ago, and allowing the South Korean won, for example, to soar more than 2% to a one-month high. Such moves should make imports cheaper, helping to moderate price pressures.

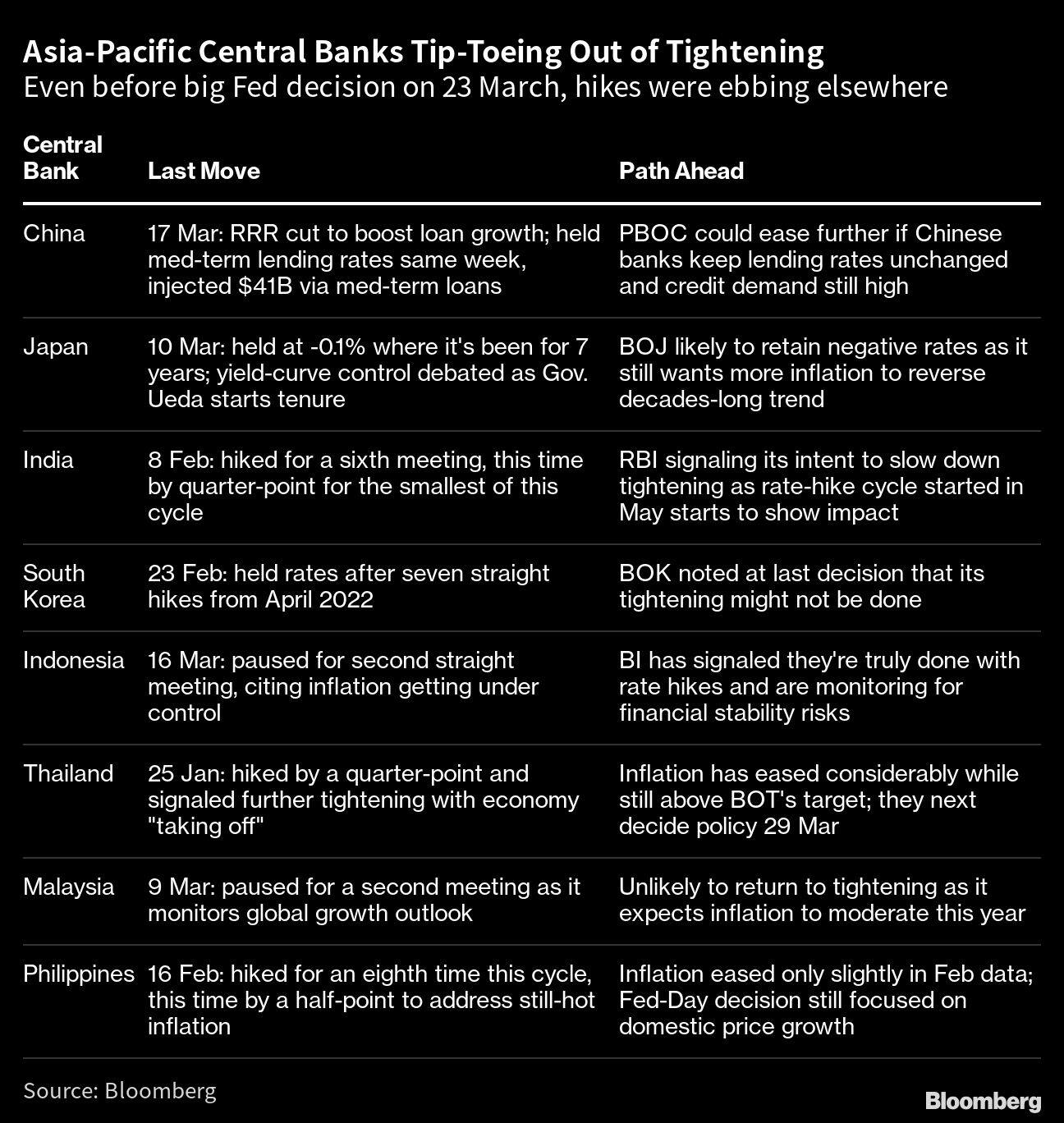

Heading into the Fed decision, central banks across emerging Asia were already poised to slow their tightening cycles. Pulling off that task without undermining local currencies looks considerably easier with investors selling the dollar and betting a US banking crisis will see Fed rates peak out.

“The dovish hike from the Fed saw the dollar weaken, as markets view this as potentially the end of the tightening cycle,” said Khoon Goh, head of Asia research at Australia & New Zealand Banking Group. “Asian currencies are stronger as markets see the stresses with US regional banks as specific to the US.”

Swaps traders see Thailand and South Africa as the only emerging economies where key rates will be higher in six months’ time, each by just a quarter of a point. That’s down from four that were seen hiking at the start of this year.

The Philippines central bank, set to decide on policy later Thursday from Manila, is a rare one across Asia that may continue to tighten, given price pressures that remain at uncomfortably high levels. The peso has been the strongest among the most-active currencies across the region this year.

For other emerging Asia economies, the fresh dollar weakness makes a bigger difference. South Korea held rates last month but signaled further hikes were on the table even amid concern that the economy was starting to sag. In Indonesia, which paused last week for a second straight meeting, a bet on currency stability in the fragile external environment looks set to pay off.

Further relief of currency pressures is a bonus for the region, which was already the big February winner in capital flows data. It drew in almost $12 billion for the best of any region, according to figures compiled by the Washington-based Institute of International Finance.

Policymakers from the US and Europe have sought to provide reassurances that the banking turmoil that erupted over the past two weeks can be contained. Fed Chair Jay Powell was the latest to maintain that tools are in place to handle any further dramas in the sector, and European Central Bank chief Christine Lagarde repeated Wednesday that officials can manage financial volatility without interrupting their inflation fight.

But US Treasuries rallied and equities sank in the wake of Powell’s remarks — including an assertion that rate cuts remained outside of the Fed’s base case for this year — while the dollar weakened for a sixth day, returning to its broad donward trajectory from a peak in September.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.