Samsung Electronics Co. said it would maintain capital spending this year at about the same level as last year, after profit tumbled on a sharp drop in chip demand.

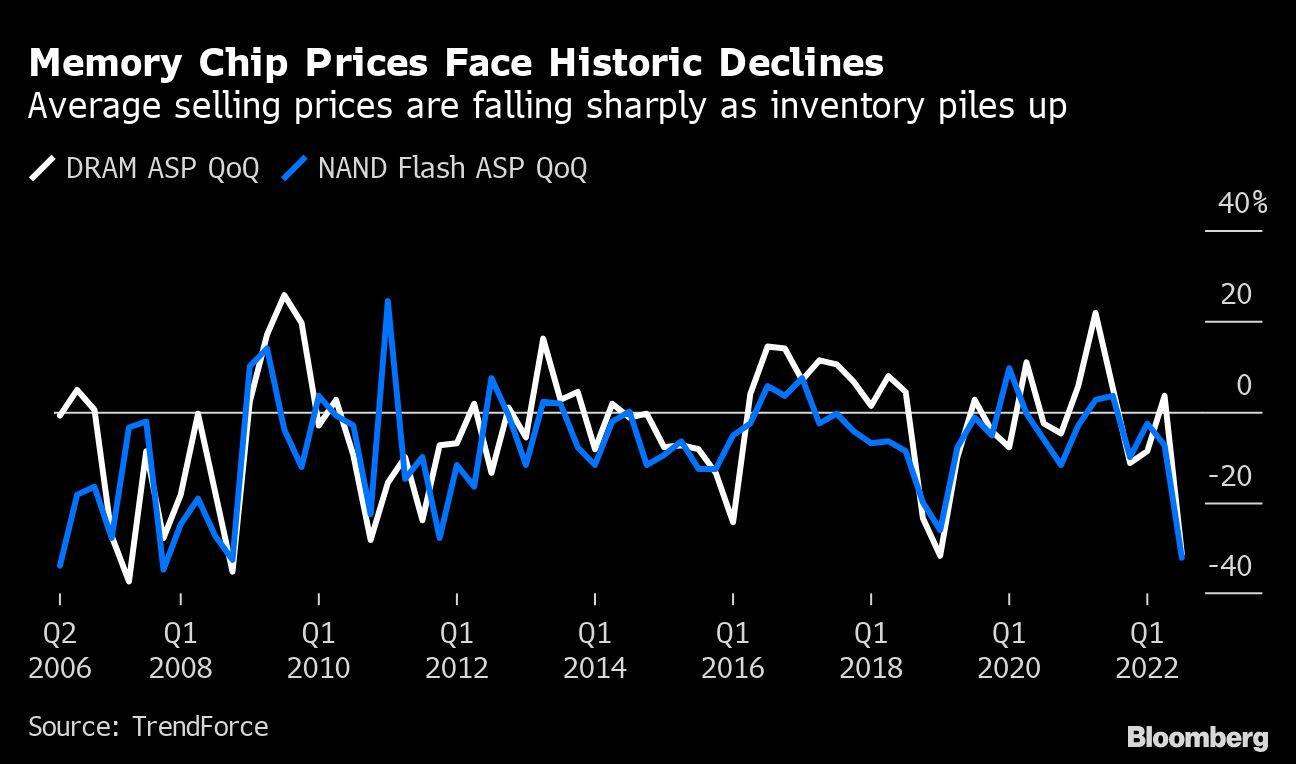

South Korea’s largest company has been struggling with a historic slump in the price of memory, as consumers cut back on purchases of gadgets amid soaring interest rates and inflation. Inventory has piled up, forcing double-digit price slides that are deepening losses.

Uncertainty in the global economy is weighing on corporate and consumer sentiment, the company said, warning that it expected recovery in chips to begin only in the second half of the year, while smartphone demand would likely contract in 2023. But despite pressure on the world’s largest memory chipmaker to slow down spending on new capacity, the company said it would keep its pace of spending.

“In memory, we will continue to invest in the mid- to long-term to prepare for future demand,” Jaejune Kim, executive vice president in charge of the company’s memory division said at an earnings call Tuesday.

Shares of Samsung fell as much as 3% on the news.

“The business environment deteriorated significantly in the fourth quarter due to weak demand amid a global economic slowdown,” the company said in a release, adding that in the semiconductor business, it expects factory usage rates to fall and earnings to decline in the first quarter.

The world’s largest memory chipmaker, which supplies displays and semiconductors used in Apple Inc.’s iPhones, said it sees “possible recovery on mobile demand in the second half” as customers seek gadgets with more storage. The Galaxy device maker said smartphone market demand will likely contract in 2023, dragged down by the mass-market phones.

Profit at Samsung’s key chip segment plunged 97% to 270 billion won ($220 million) in the three months ended December, as customers continued to work through piles of inventories. Operating profit fell 69% to 4.3 trillion won in the biggest drop in over a decade in line with the company’s preliminary results earlier this month.

Net income more than doubled to 23.5 trillion won, thanks to a one-time item from a local tax law change that won’t mean a refund.

Shares fell as much as 1.4% in early morning trade after the announcement. Fellow South Korean memory maker SK Hynix Inc. fell 1.1%.

The industry is suffering from a sharp drop in semiconductor demand due to the war in Ukraine, historic inflation and restrictions on chip exports to China, right on the heels of one of the industry’s biggest capacity ramp-ups to meet pandemic demand.

Memory pricing will likely continue to decline during the first half of 2023, Goldman Sachs analyst Giuni Lee said in a note to investors ahead of Tuesday’s announcement. “We expect the company to be in red for both DRAM and NAND starting in the first quarter of 2023.”

Samsung, which spent 20.2 trillion won in capital expenditures in the last quarter, is under pressure to lower output and hold off on capacity ramp-ups.

US memory maker Micron Technology Inc. has said it will cut spending for new plants and equipment as well as slash output. Hynix has also scaled back investments and output, while Japan’s Kioxia Holdings Corp. has said it was cutting output by 30%. Kioxia, which makes NAND, is in merger talks with US production partner Western Digital Corp., Bloomberg News reported.

Samsung’s earnings come after grim forecasts from other corners of the tech sector. Intel Corp. said it is bracing for one of its worst quarters in history, while Microsoft Corp. has said it’s cutting its workforce by 10,000, even as its profit beat analyst estimates.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.