The road to financial literacy is a long one. For those of us trying to manage finances, information from various sources - online, on the news and from trusted confidants - can feel insufficient and overwhelming by turns. This doesn't just apply to investment advice, or when it comes to major financial decisions. It can even apply to understanding basic documents like our credit card/savings/loan statements, various forms, updates on our investments, our credit reports, etc. Sometimes, it's really hard to work out what's being said in the financial section of our newspapers.

When it comes to our credit reports though, there's a simpler way. If you've seen your credit report by any of the 4 credit bureaus that operate in India, chances are that you don't understand it: a long, complicated report with numbers galore and jargon in every sentence. It's a daunting document. Which is troubling, because so much depends on your credit score today!

Managing one's credit score and building it up to a healthy level is super important today. If you want to buy a house, or start a business, or study abroad, or even just get a credit card, you'll need a strong credit score! This was the reason behind the creation of the OneScore App. OneScore was founded by bankers who saw firsthand how this gap in understanding was hurting people.

There is a stark disparity in India's credit active population and the segment which actually monitors their Credit Report and Score on a regular basis. Infact, most young people don't know what a credit score is, and of those who do, a very small segment knows how and where to check their credit scores. OneScore is trying to bridge this gap through education, awareness, and finally, through the ease of checking and understanding their credit scores through the OneScore App. The aim: simplify credit scores, so people can take the right steps towards a stronger financial future.

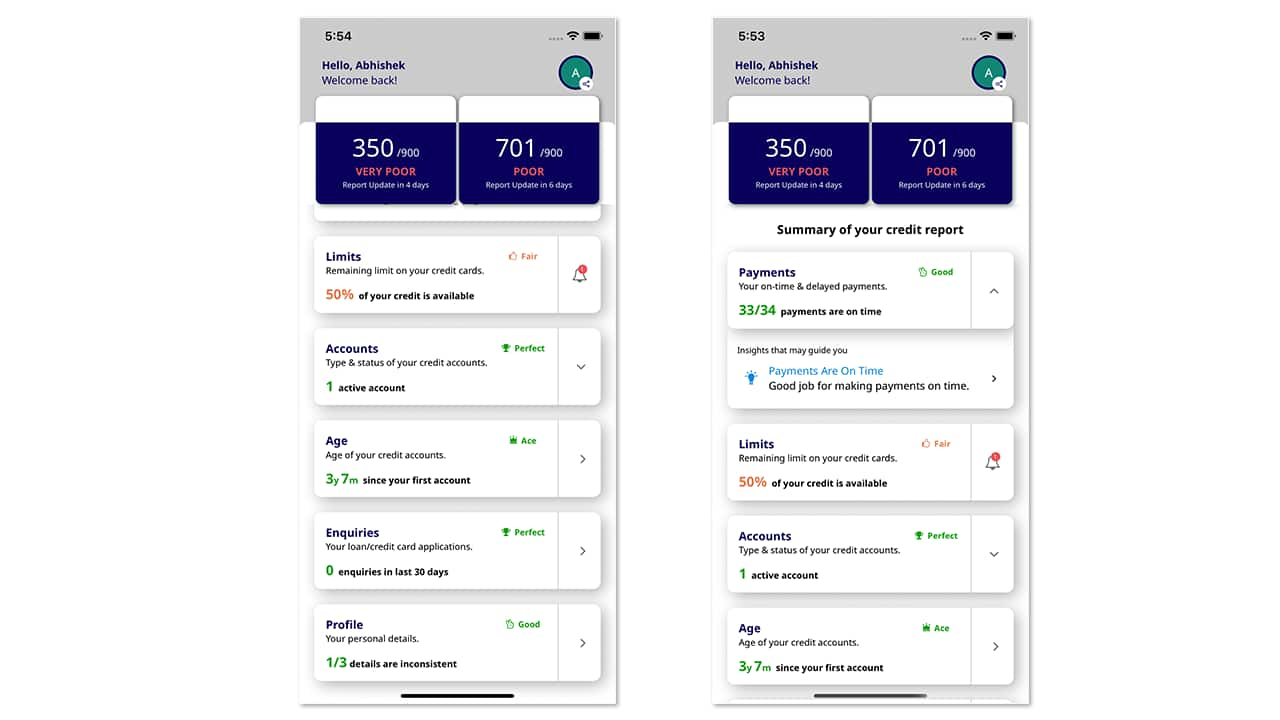

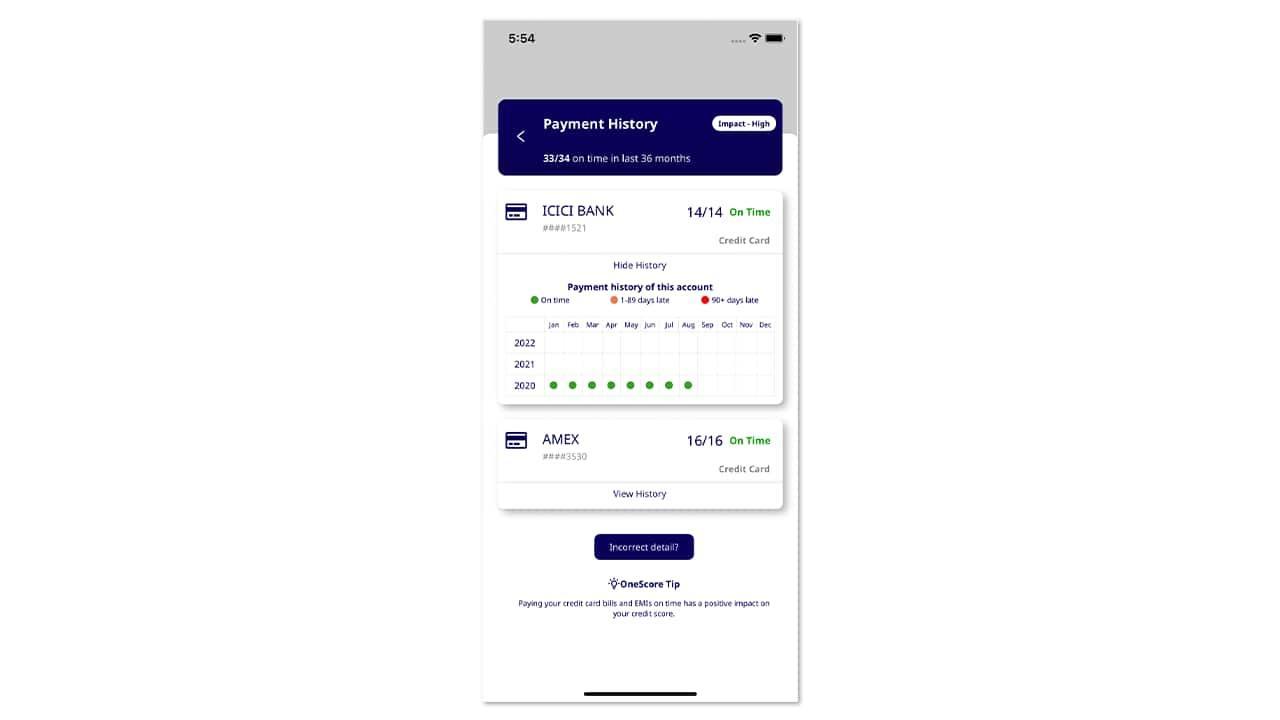

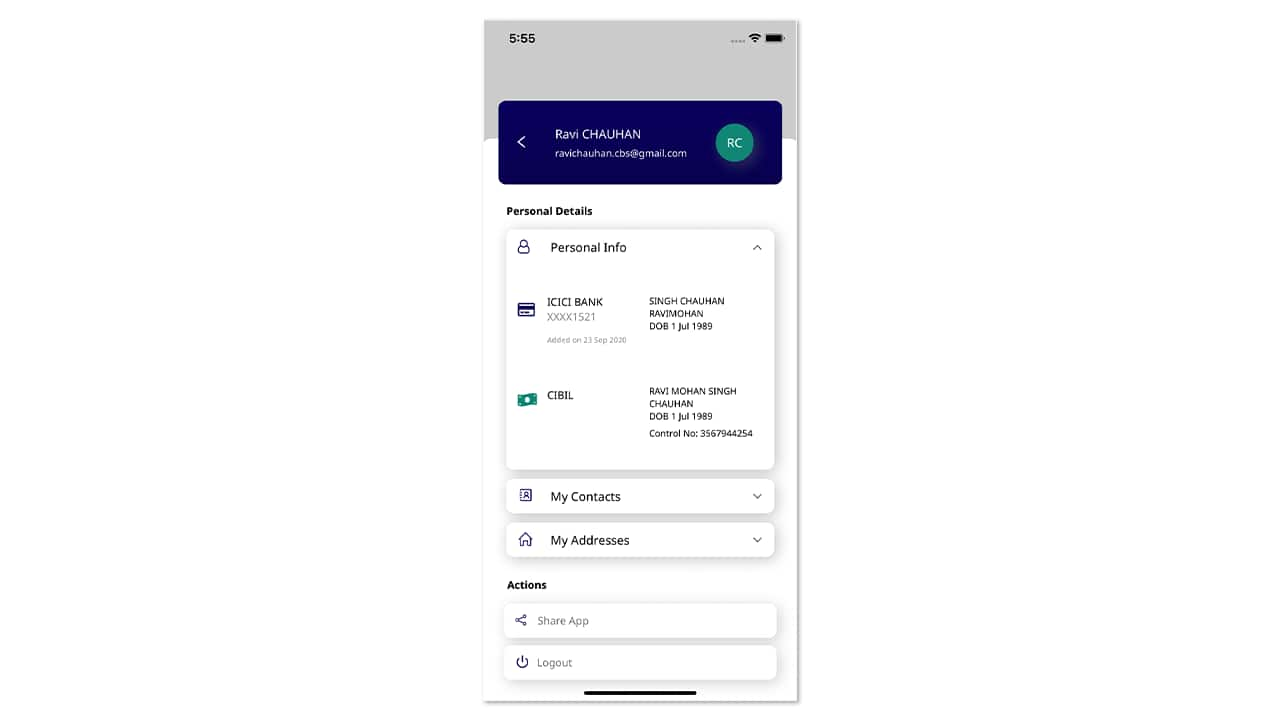

The OneScore App breaks down the credit report into a simple language (no jargon in sight!), easy to understand 6 part summary:

OneScore recommends checking credit scores each month, so you can learn what's working and what isn't and how to fix it. In fact, features like "Find Out Why" help you understand why your credit score moved up or down from the previous month, and AI powered personalized recommendations take the guesswork out of the actions you need to take, to improve your credit score.

So if you haven't already, download the OneScore App (It's free!), and get started on your journey to a stronger financial future.

For more articles, information and tips, visit our page #ScoreDekhaKya.

Moneycontrol journalists were not involved in the creation of the article.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!