A nervous start to the week had a positive surprise packed in it after all. After a dip the successive gaining session towards the end of the week erased the early losses and added over 2 percent gains on the charts for Nifty for this week.

Bank Nifty, on the other hand, was not very strong, the genesis of which would be later found in the Open Interest (OI) activity. Nonetheless, the move midweek in fact for Bank Nifty was better than Nifty as the index outperformed Nifty by a margin but the lack of sustainability in the next two sessions left Bank Nifty with little over a percent gain for the week.

On the open interest front, Nifty futures did keep the momentum but the reasons behind it were not very constructive as there were short covering bouts behind the scene that kept the Nifty higher. Despite a tiny amount of longs later in the week, Nifty futures ended up losing OI for the week, which can very well be attributed to short covering.

On the Bank Nifty front, the story was a little different as the dips invited a round of shorts in the early part of week. Despite the recovery which never got covered. As a result, by the end of the week Bank Nifty futures ended up gaining 19 percent in OI but half of it was contributed by shorts and half longs.

Stock futures were rather well placed this week. Being the first week of the expiry the force of unwinding remained fairly low. Also, the highest OI activity in terms of the number of stocks was longs, followed by shorts. While unwinding was subdued, we still could see 20 percent of stocks dropping OI due to short covering.

Slicing the stock futures data further, most of the sectors this week aggregated to long with a few averaging for actions other than price up and OI up. Auto was the biggest surprise this week with all stocks adding long except Ashok Leyland, same was the case with Capital Goods led by BEL, BHEL and Siemens. Oil continues to do well with leadership in Reliance Industries. Mood spoiler was PSU Banks as apart from SBI all added shorts.

Coming down to sentiments, the risk index India VIX broke down into a lower territory for recent times. The sustained gains in Nifty and lower size of swings seems to be helping. Lowering realized volatility could be one of the biggest reasons for the drop as they match the pre-pandemic levels. This along with falling risk premium brought down the India VIX by 3 more points, its lowest level since early March.

The Open Interest Put Call Ratio was not so lucky as the sentiment led force of Call writers pushed the ratio to its lowest level since mid-May early this week. There was a definite come back in OIPCR as well however the ratio subsided in the last session despite the uplift in Nifty.

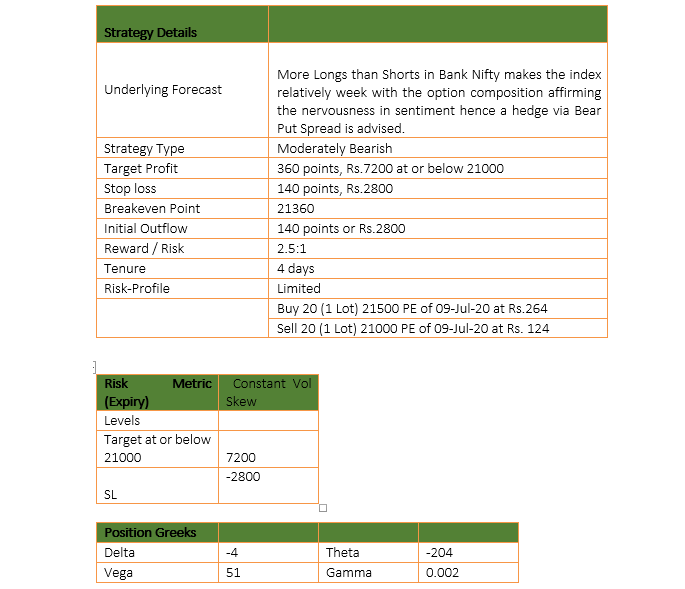

Finally, Mixed Built-up in Bank Nifty futures OI keeps the directional conviction low for Bank Nifty particularly. Lack of encouraging OI activity in Pvt. Banks and shorts in PSUs spoils the mood after a long run led by long built-up. OIPCR for Bank Nifty for the week remains in both Monthly as well as weekly expiries. More Longs than Shorts in Bank Nifty makes the index relatively weak with the option composition affirming the nervousness in sentiment hence a hedge via Bear Put Spread is advised.

Bear Put spread is a moderately bearish strategy. The strategy is built by Buying a Put close to the current market price of the underlying and Selling the same expiry Put but of a strike lower than the Put bought. The sold Put strike would limit the profit but fund the put buying. Profits are limited to difference between strikes minus the net premium paid.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.