Notable highs are most of the time too stubborn to be broken easily. The same situation is upon us with Nifty. Many weeks of consolidation do not seem to be enough for the index to carry the momentum forward beyond recent highs.

Situations like this are frustrating due to 2 problems.

1. The move back into the range could create repetitive stop losses

2. At times, the struggle is not in pullbacks from the top but a small consolidation at the top.

Now the first problem has a simple solution. Futures may have a problem with trading the breakouts, considering we are buying at the top and there is a lot to lose. However, with Options, there is no such problem.

A slightly higher strike Call option would be inexpensive for us to trade over and over again. This will not pinch us either because of the very attractive risk-reward ratio. If the breakout were to materialize, the higher strike Call would have a bigger move percentage-wise than the lower strikes.

However, this still is not the best solution because of the consolidation. The 2nd problem is a premium killer. This will not let the small premium option get an easy exit, but it will push it towards a slow death.

That brings us to a solution of a Spread. Option spread is defined as a trade that involves buying and selling of 2 options simultaneously of the same symbol and same option type, and in our case, of the same expiry.

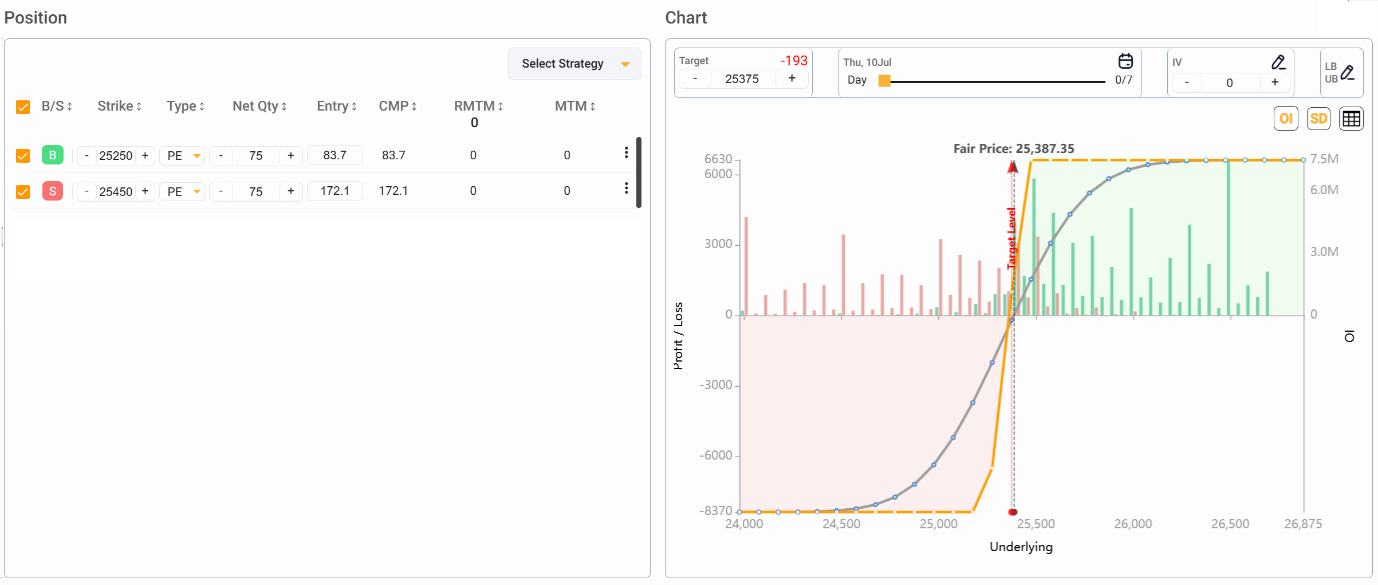

The trade that we are contemplating is a Bull Put Spread.

Bull Put Spread involves selling and buying of Puts of the same expiry, where the Sell Put is of a Higher Strike and the Buy Put is of a Lower Strike.

What to Trade?

Strike selection is simple. Take a Sell position in one step higher strike (compared to the current market price of stock/index) Put option, and a Buy position in a lower than market price strike Put Option with at least a 2-3 step difference. For example, if I sell a Put Option for Nifty, I would be buying another Put option with a strike that is 200 points lower than the Put sold.

For example, Future Price is 25387. Let us have a strategy in place. We Sell 25450 Put and Buy 25250 Put. Let us see the Pay-off here.

Now 1 out of 3 things can happen.

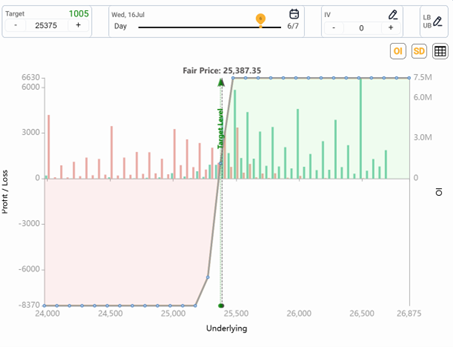

1. If the time passes by and the index remains at the same level.

As we can see the passing of 6 days can have a positive impact on the premiums since we have sold an expensive option. There is a profit of 1000.

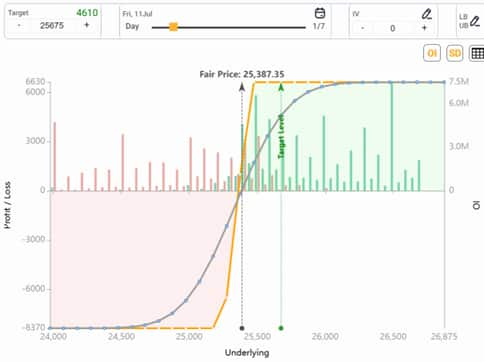

2. Index Runs away to 25700 (300 points Rally)

Here the view goes right so the money is bound to be made. We can see the profit of 4610. At the target of 25675.

3. It does not work out, and index does not sustain. Stops out at 25300.

We tend to lose 1655. Considering the potential profit over 2.5X of the loss, it still is not a bad deal, considering we are making money for both no movement and favourable movement.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.