Trading options is not an easy job strictly from the point of view of the number of choices available. There are many expiries and many strikes for a given option type Call or Put. This makes Option Trading more interesting than difficult.

To make the most of the choice we need to do a matching exercise of our objective from the trade with the characteristics of the option. Let us look at few such aspects of Option Buying trade and try to make a better strike selection.

Basis of the selection is confidence in the View.

First thing that comes to mind while taking a trade is how confident are we about the view on the stock/index. In a normal Cash or Futures market, the confidence level might have given a simple answer, yes or no for taking the trade.

With Options we can translate the high or low confidence in the strike selection. Let us look at few examples to make this a simple case.

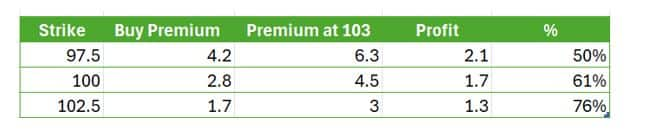

A stock trading at 100 has 3 Call strike prices 97.5 @ 4.2, 100 @2.8, 102.5 @ 1.7. For taking advantage of the Option’s very characteristics one can just stick to the strike that is closest to the current market price. So, the normal selection is 100. If the price were to move to 103 in 2 days, the option would go up to 4.5

If one is a little less confident, the same view can be traded with a slightly higher strike in our case 102.5. This will make the cost of Option a bit cheaper, but it comes at a cost. Now the same move of 103 in 2 days can take this Option to 3.

On the other hand, if the view on the stock is very confident then we can go down to lower strike (little more expensive) and buy 98.5 Call. Here the gains to 103 can bring the Call premium to 6.3

So, this is the result..

As can be seen the highest absolute profit is in 97.5 Call of 2.1 but it is the lowest percentage profit of the 3. At the time of buying option no one considers the premium as it is very small portion of the stock price. So, in that race the 97.5 Call wins if we are most confident.

However, the Returns on Investment is higher in the 102.5 (cheaper option). This makes it bit difficult to choose but at this point I must introduce a characteristic of options, 102.5 option could be more attractive if the time taken is more than expected when compared to 102.5 option.

100 Call has best of both worlds. I personally have been using more of 97.5 options when it is very few days left for the expiry. So far as the confidence is concerned, I will add one more perspective.

If we are super confident of the view and it is not too close to expiry, one can also try to buy not one but two 102.5 Calls. Lower investment than 97.5 and higher profits if we go right.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.